With inflation in 2022 reaching a 40-year high, many taxpayers might wonder if they will have to pay more in Medicare premiums for 2023. Your Medicare premium will not increase because of inflation. But it has been going up steadily over decades to pay for the higher costs of health care. On September 27, however, the Centers for Medicare and Medicaid Services (CMS) announced a slight decrease for 2023. Let’s break down how Medicare premiums are calculated and how much you will have to pay.

A financial advisor can help you create a financial plan for your health care needs in retirement.

How Much Will Medicare Premiums Cost in 2023?

For 2023, the CMS announced that the standard monthly premium for Medicare Part B will cost $164.90, which is down from $170.10 in 2022. That is $5.20 less per month and $62.40 less per year. The annual deductible for all beneficiaries also decreased from $233 in 2022 to $226 in 2023, which is $7 less per month and $84 less per year.

This adjustment follows the largest one-year increase in the organization’s history, when it raised the standard monthly premium for Medicare Part B by 14.5%, which is a jump from $148.50 in 2021 to $170.10 in 2022. The annual deductible also went up from $203 in 2021 to $233 in 2022.

As we stated earlier, Medicare premiums do not go up because of inflation, but they have gone up consistently to cover for the rising costs of health care. And even with inflation rocketing to a four-decade high this year, the premium for 2023 will be slightly lower.

The CMS says that the largest one-year increase issued for 2022 was “based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly premium increase during the COVID-19 pandemic.”

For reference, monthly premiums for Medicare Part B are mandated by law to “equal 25% of the estimated total Part B costs for enrollees age 65 and over.”

Who Can Get Medicare and How Is the Premium Calculated?

Medicare is generally available to U.S. citizens and documented residents over the age of 65. Those with a disability, end-stage renal disease or amyotrophic lateral sclerosis (more commonly known as Lou Gehrig’s disease) can also qualify under age 65.

Your Medicare premium is based on your modified adjusted gross income (MAGI), which includes your adjusted gross income (AGI), as well as any non-taxable Social Security benefits and tax-exempt interest. Social Security tends to rely on your tax returns to set your Medicare cost for the year.

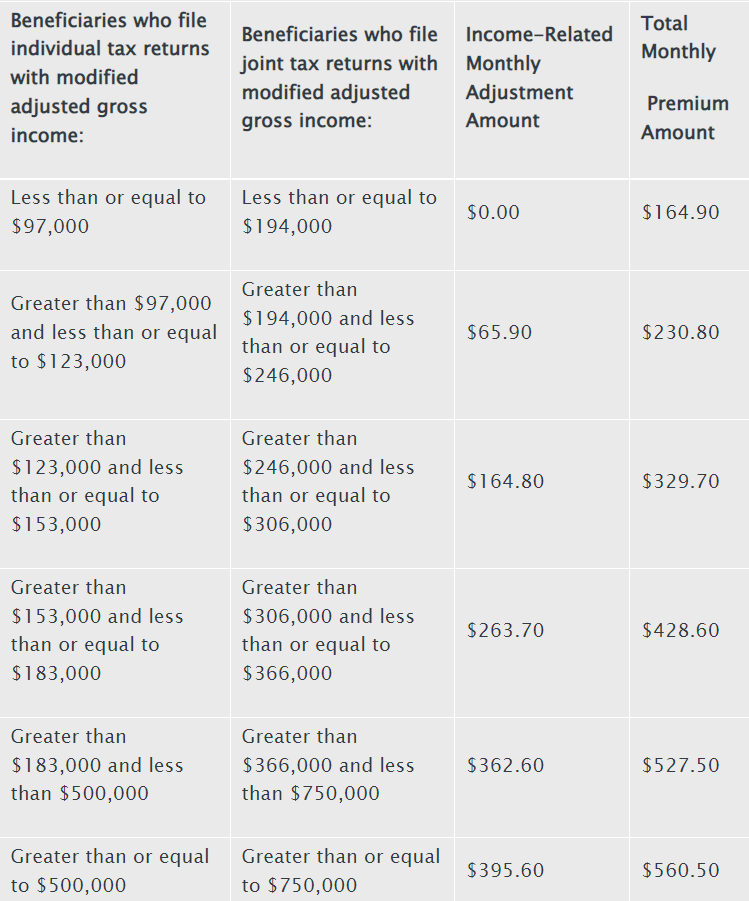

Taxpayers with higher income will have to pay an additional premium amount for Medicare Part B and Medicare prescription coverage, which is called an income-related monthly adjusted amount (IRMAA).

The income-related monthly adjustment amount (IRMAA) is a sliding scale created by the Social Security Administration to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher a beneficiary’s MAGI is, the higher the premium will be.

The table from CMS.gov below shows how much you can expect to pay for Medicare Part B as a high-income beneficiary with full Part B coverage in 2023:

How High-Income Taxpayers Can Reduce IRMAA

If you are a high-income taxpayer, here are five common ways you can minimize IRMAA:

Appeal to life-changing events. Revisit your income and determine whether it has dropped during that time. If this is the case, you can appeal the IRMAA decision by filing Social Security Form SSA-44 and providing proof that you experienced a life-changing event. This can include work stoppage, work reduction, married, retiring, divorce, job loss or your spouse passing away.

Convert to a Roth IRA. One common way to avoid the high-income threshold is to move your money from a 401(k) or traditional IRA to a Roth IRA. Additionally, Roth IRA withdrawals aren’t taxable and if you can convert your pretax assets to a Roth IRA before age 72, you won’t have to make required minimum distributions (RMDs).

Minimize capital gains. Every time you sell an asset for profit, you will have to pay capital gains. One strategy to avoid getting taxed on additional income that will push you above the high-tax threshold is to use tax-loss harvesting, which allows you to use investment losses to lower your taxes.

Make a qualified charitable contribution. If you are at least 70 1/2 years old, you are eligible to make qualified charitable contributions (QCD), which allows you to withdraw funds from an IRA and donate them directly to a qualified charity. This will help you stay beneath the high-income threshold.

Consider filing jointly or separately. Before tax season begins, talk with your spouse about making possible changes to your filing status. Depending on whether you file separately or jointly, you may be able to strategize in a way to stay underneath the high-income threshold.

Bottom Line

Rising inflation can be costly for everyone. But even in a year when inflation hit a four-decade high, Medicare premiums for 2023 will be slightly lower than in 2022. While inflation does not determine directly how much you will pay for a premium, premiums have gone up consistently in the past few years to cover the rising costs of health care. For 2023, high-income taxpayers will have to pay a standard monthly premium for Medicare Part B of $164.90, which is down from $170.10 in 2022.

Retirement Planning Tips

- A financial advisor can help you create a financial plan for your health care needs and goals in retirement. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- It’s important to remember that Medicare coverage isn’t available until you turn age 65. If you plan on retiring early at 55 or even 45, then you’ll need to decide what to do about health insurance until you’re Medicare-eligible. You may be able to continue with your former employer’s coverage through COBRA, but there’s a timeline for how long you can do that. So when you make your retirement budget, think about where health insurance and health care fit in.

Photo credit: ©iStock/Khanchit Khirisutchalual, ©iStock/shapecharge, CMS.gov, ©iStock/tumsasedgars