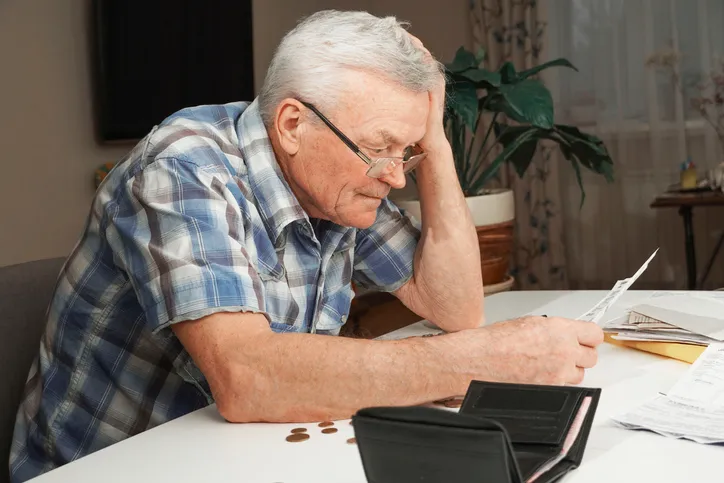

Debt can seriously risk your retirement, and it’s on the rise.

When it comes time to retire, one of the best first steps is to control your finances. Cut down on bills and household spending so that you can maximize the value of your retirement income. Ideally, this means you’ll have that much more left over for luxuries and growth-oriented investing. But it also frees you up for defensive finance as well, letting you make the most of your savings at need.

Debt can undermine all of that. It increases your monthly bills and, thanks to interest, grows over time. And, as researchers from Boston College recently found, it is a growing problem. Here’s what you should know.

A financial advisor can help you get out of debt and plan for a sustainable retirement. Talk to a financial advisor today.

Retiree Debt Is Real, and Growing

Debt in retirement is a complicated issue, as discussed in a recent publication by Boston College’s Anqi Chen, Siyan Liu and Alicia Munnell.

Retiree debt is growing and has been since the mid-90’s. Today about 60% of Americans over 65 owe money. But while this is an arresting figure, the authors are quick to point out that it doesn’t really give us much useful information. “Debt,” as measured by the Federal Reserve, includes virtually all forms of borrowing. This includes red flags, such as unpaid student loans and overleveraged credit cards, and potentially healthy debt, such as low-interest mortgages and managed rewards cards. In a recent SmartAsset study, it was uncovered that even the ultra wealthy carry debt.

But the scope of debt among retiree households is real and growing. The number of retired households carrying debt of some sort has approximately doubled in the last 30 years. Most of this growth has come from new mortgages. The scope of this borrowing is new, but the question is not really how many people owe.

It’s how many people are in trouble.

Retirement Debt Isn’t Always Bad

As Boston College’s researchers write, debt does not always mean “financial fragility.” Instead, the implications of this trend depend on kind and amount of debt. The authors broke down borrowers into two basic categories, high- and low-risk households, based on the type and amount of loans that they hold.

Some forms of debt can be harmless or even benign. A low-rate mortgage, for example, can be financially wise. It may cost less than the rent on an equivalent property and will almost certainly grow less quickly. Over the long run, this can both cost less money out of pocket and build value in the underlying property.

Or a simple credit card, if properly managed, can hover somewhere between harmless and modestly valuable depending on rewards and use. Although, that said, in general credit cards can enable dangerous borrowing. In fact, they make up one of the four specific profiles of high-risk households.

The real problem, the paper found, is less the number of retirees carrying debt. It’s that most of the recent growth has come among high-risk households, ones that carry a lot of unsecured debt and/or which have high borrowing relative to their assets.

A financial advisor can help you manage debt.

The Wrong Debt Can Harm Your Retirement

That’s the problem, researchers have found, because unmanageable debt can seriously harm your finances. In 2020, a paper published by the Urban Institute’s Barbara Butricia and the CBO’s Nadia Karamcheva found that households with high debt often restructure their retirement plans. More indebted older adults, they wrote, “are more likely to work, less likely to be retired and on average expect to work longer than those with less debt.”

It does not end with work. Indebted households also claim Social Security benefits earlier, reducing their lifetime income in order to make current payments. Debt also erodes the value of working longer, since households cannot save that extra income. And, they found, bankruptcies among retirement-age households have more than doubled.

To Manage Your Retirement, Manage Debt

The takeaway here is not “no borrowing.” Instead, plan smart. Don’t necessarily cut up your credit cards, but spend carefully. Don’t avoid new mortgages or home renovations, but consider how you’ll budget for those payments.

Pay close attention to new borrowing in your 50’s and early 60’s. These are the loans that will likely stay with you into your actual retirement years, so you don’t want to get stuck with something unsustainable. And if at all possible, pay off your old debts before you leave work.

It will make retirement much more relaxing.

Talk to a financial advisor if you have questions about your debt or retirement plans.

Bottom Line

Three in every five retirement-age Americans hold some kind of household debt. This isn’t necessarily a problem, since financial fragility depends heavily on the nature of that debt, but it’s an important red flag to watch out for in your own retirement plans.

Debt Management Tips

- A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- One of the most important issues when it comes to long-term saving is, when should you pay off debt vs. putting money in savings? It’s a particularly difficult issue for younger adults, who often must choose between paying off hefty student loans and putting money aside for retirement, so make sure to think the issue through.

Photo credit: ©iStock.com/Irene Puzankova