Retirement is a big milestone for many, and planning for retirement can constitute a large financial goal that takes years to reach. In fact, data from the Federal Reserve indicates that the majority of Americans only have a median of $87,000 saved for retirement, which is far less than most experts recommend.

Investment giant T. Rowe Price has released an updated guide for retirement savers based on income level. Another well-known investment firm Fidelity Investments also has its own retirement savings guide, only with different numbers. So what do you do when the advice conflicts? Which benchmark guide should you follow?

A financial advisor could help you plan for retirement and select investments that align with your financial goals. Speak to a qualified advisor today.

T. Rowe Price Estimates Retirement Savings By Income Group

Planning for retirement can be intimidating, whether you’ve just begun working or you’re already approaching retirement. Given the power of compounding interest, saving as much as possible early on allows you to save even more over time. Yet with so many competing priorities in the present, sometimes retirement saving becomes less important and you may find yourself wondering if you’ve fallen behind.

T. Rowe Price calculates that the amount of money needed by age 65 depends heavily on your income. Thought Leadership Director Roger Young says that “higher earners will get a smaller portion of their income in retirement from Social Security, [so] they generally need more assets in relation to their income.”

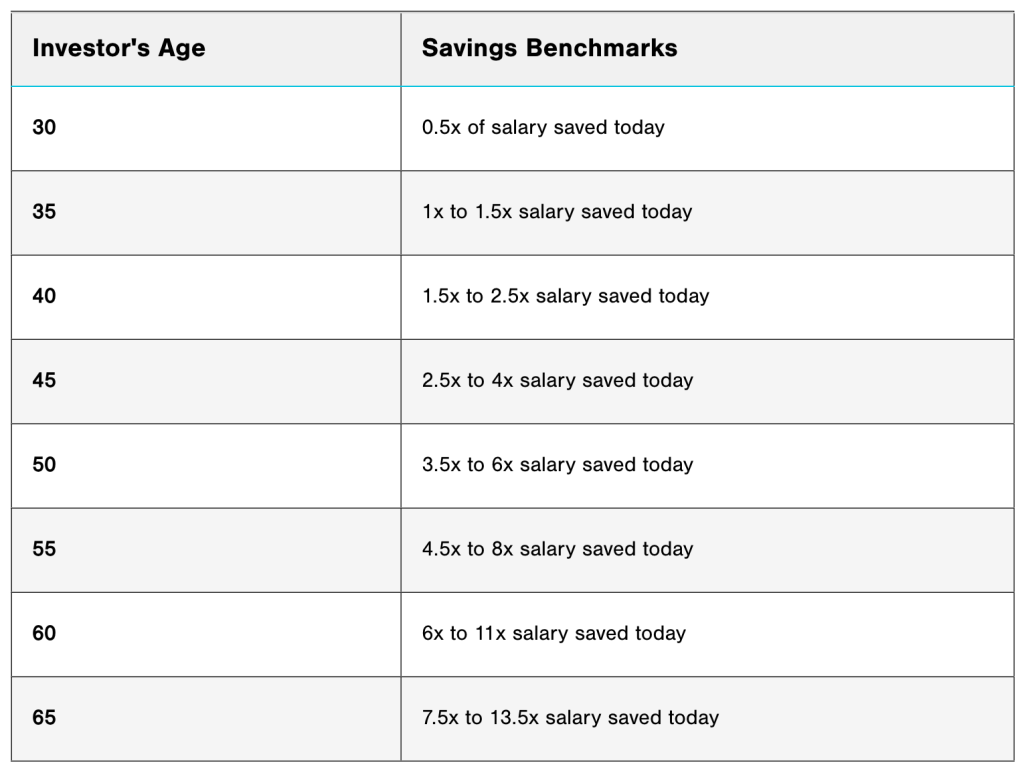

As a result, most people looking to retire around age 65 should aim to save between seven and 13.5 times their pre-retirement gross income. The chart below shows how that breaks down by age group:

However, the range widens significantly as savers approach retirement. A married couple with two earners making $100,000 gross a year should have approximately five and a half times their income saved for retirement by age 55, whereas a couple making $250,000 a year should save six and a half times their income by the same age. According to T. Rowe Price, this multiple factors in estimated government benefits that varies depending on income.

On the other hand, Fidelity recommends saving more at a younger age and catching up less as savers age. At age 30, the company advises earners to have one times their salary saved, two times by age 35, four times by 45 and reach seven times their salary by age 55. Fidelity assumes a relatively low real wage growth, at only 1.5% per year, so front-loading retirement savings would allow retirement savers to earn more through compounding returns.

How Retirement Savers Can Take Advantage

For the average American, T. Rowe Price recommends saving between four and a half and eight times your salary by age 55, whereas Fidelity says you should save seven times. Both rely on different assumptions that impact their retirement savings calculations.

T. Rowe Price assumes that, early on in a career, younger earners tend to save 6% of their paychecks for retirement, ramping up by 1% per year until they reach 15%. Fidelity assumes you’ll save 15% right from the start. The appropriate amount for you will depend on your level of disposable income and how much you can reasonably expect to save.

In fact, Federal Reserve data indicates that the average individual in the age 55-64 cohort has saved approximately $537,560 for retirement. However, the median savings for that age group is only $185,000. So while retirement savings goals are important for the future, some workers simply can’t afford to put away so much of their income.

If you’ve begun saving late or you’ve had to tap your retirement savings for unexpected expenses, it might even seem like seven times your salary is an unattainable goal. The 2020 Economic Well-Being of U.S. Households Survey found that 42% of non-retirees laid off in 2019 had no self-directed retirement savings, but it’s never too late to work on your financial goals.

Both T. Rowe Price and Fidelity find that 15% of income per year (including any employer contribution matches) is an ideal savings level for many people. Higher earners who will likely receive less in Social Security benefits should aim beyond 15%. A financial advisor could help you formulate a plan to reach your retirement goals faster if you need help.

Bottom Line

Investment firms T. Rowe Price and Fidelity Investments have released updated retirement savings benchmarks by income level. While both companies estimate that the average American should save seven times the annual salary by age 55, the actual amount saved will depend heavily on income and savings patterns. In general, experts recommend that retirement savers aim to save 15% of income per year over their working years in order to save enough for a comfortable retirement.

Retirement Planning Tips

- Not sure what investments or strategies will set you up for a smooth retirement? For a solid, long-term financial plan, consider speaking with a qualified financial advisor. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Use SmartAsset’s free retirement calculator to get a good first estimate of how much money you’ll need to retire.

Photo credit: ©iStock.com/whyframestudio, ©T.Rowe Price, ©iStock.com/tagstock1