As 2020 mortgage rates in the U.S. reached historic lows, housing sales increased throughout the year. Freddie Mac data shows that the 30-year fixed mortgage rate, excluding fees and points, fell to less than 3% in July 2020 for the first time ever. Amid those plunging mortgage rates, in November 2020, new and existing home sales were 20.8% and 25.8% higher, respectively, than in the previous year, according to Census Bureau and National Association of Realtors data.

The coincidence of low mortgage rates and increased home buying raises the question: To what extent have low mortgage rates caused the uptick in home purchases? It is difficult to ascertain an answer and evaluate the degree of causation. What is undeniably clear, however, is that mortgage rates have a huge effect on the total cost of buying a home. In this study, SmartAsset shows why home loan interest rates are so important. Specifically, we explain how mortgages amortize and map the changing composition of monthly mortgage payments for loans with different interest rates. For details on our data sources and how we put all the information together to create our findings, check out the Data and Methodology section below.

Key Findings

- Generally, interest adds up to more than 50% of the home loan. The most popular home loan product in the U.S. is the 30-year fixed-rate mortgage. Even for homeowners who lock in a low rate of 3%, interest payments will amount to nearly 52% of the original home loan. For a 30-year fixed-rate mortgage with an interest rate of 4% – a more typical figure once fees and closing costs are included – total interest is 71.87% of the home loan.

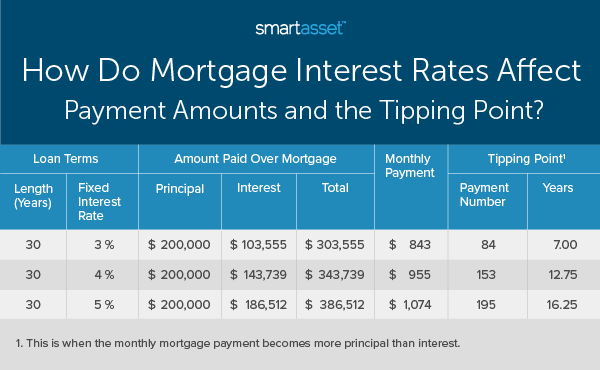

- Homeowners with a lower interest rate reach the tipping point faster. Prospective homebuyers may be surprised to learn that most of their early mortgage payments go towards interest and not the principal loan balance. The point at which you pay more in principal than interest is considered the tipping point. Homeowners with a 30-year fixed-rate mortgage and an interest rate of 4% will reach the tipping point on the 153rd loan payment (at 12 years and nine months). Supposing the interest rate is 3% or 5%, homeowners will pay more towards principal than interest on the 84th payment (at seven years) and 195th payment (at 16 years and three months), respectively.

How Do Home Loans Amortize?

Monthly mortgage payments consist primarily of two components: principal and interest. Principal is the loan amount borrowed, and interest is the additional money that is owed to the lender for borrowing that amount. For example, if you take out a $200,000 mortgage, your beginning principal balance is $200,000. Because of interest, the amount you will owe in total will be higher. So if a homeowner with a $200,000 mortgage takes on a 30-year fixed-rate mortgage with a 4% interest rate, he or she would pay about $343,700 in total over the loan’s life. The $143,700 in interest payments equals almost 72% of the $200,000 principal.

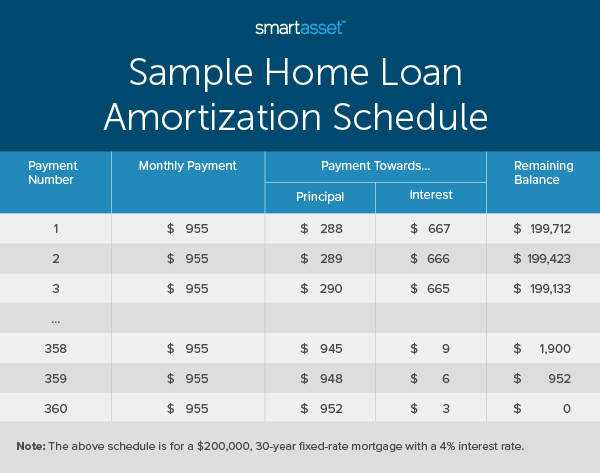

The process of paying off your mortgage is known as amortization. Fixed-rate mortgages have the same monthly mortgage payment of the life of the loan, though the amount you pay in principal and interest changes because interest payments are calculated based on the outstanding balance of the mortgage. Thus, the proportion of each monthly payment shifts from primarily interest to primarily principal over the course of the loan. A breakdown of the loan amortization schedule for a 30-year fixed-rate mortgage of $200,000 with a 4% annual interest rate is shown below.

Seen above, almost 70% of the first several monthly mortgage payments goes towards interest. By contrast, interest accounts for less than $10 for all three of the last monthly payments. The dramatic shift from paying almost $700 in interest monthly at the beginning of the mortgage to paying less than $150 in interest during the last 50 monthly loan payments shows the significant change in mortgage payment composition.

When Do You Pay More in Principal Than Interest?

For loans with the same term length, the tipping point on a fixed-rate mortgage (i.e. the point at which the monthly payment becomes more principal than interest) is a function of the loan’s interest rate alone. That is, the overarching loan amount is relevant insofar as it determines the amount of each month’s payment that goes to principal and interest, but it does not affect when payments toward principal outweigh payments towards interest.

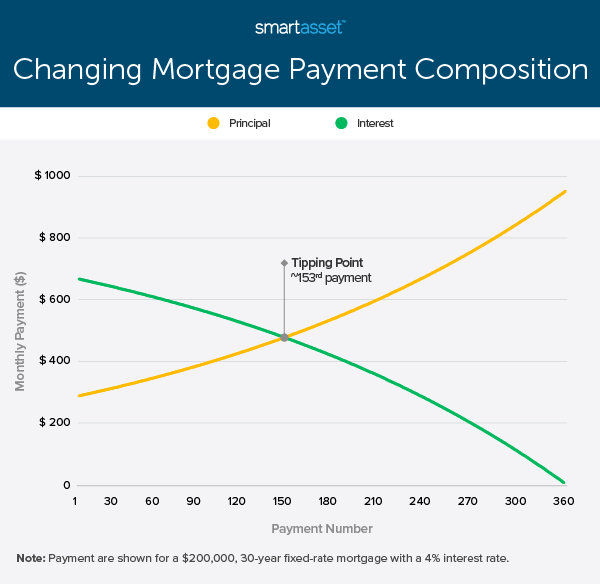

In the example above, the tipping point is about 13 years; only on the 153rd payment will more of the monthly payment go toward the principal than interest. We can see how the composition of mortgage payments changes over time for a $200,000 30-year fixed-rate mortgage with a 4% interest rate in the chart below.

In general, homeowners with a higher interest rate will pay more in interest than principal for a longer time than those with lower interest rates. We can consider the same $200,000 30-year fixed-rate mortgage with both a higher and lower interest rate. Given the varying interest rates, the monthly mortgage payments for a $200,000 30-year fixed-rate mortgage with a 3% and 5% interest rate are $843 and $1,074, respectively. In addition, the difference in tipping points is about nine years. The table below compares a $200,000 fixed-rate mortgage with interest rates of 3%, 4% and 5%.

Getting to the Tipping Point Faster

There are two primary ways homeowners can accelerate or adjust their mortgages to reach their break-even month (i.e. the month when they begin to pay more in principal than in interest) faster. These strategies are mortgage prepayment and refinancing.

Mortgage prepayment is the process of paying off your mortgage ahead of schedule so that you can save money on the loan’s interest. Homeowners may either increase their monthly payment or send additional checks throughout the year. Though mortgage prepayment does not change the interest rate, it shortens the loan term and in turn decreases the total interest incurred. Keep in mind that when considering this cost-saving measure, you should avoid common mistakes: Make sure your lender does not charge a prepayment penalty and that the additional prepayments go toward the principal balance, not interest.

Refinancing is the process of updating mortgage terms. In doing so, homeowners can either change the length of the loan or get a better interest rate. Both a shorter loan term and lower interest rate can decrease the expected tipping point. However, like mortgage prepayment, refinancing occasionally comes with a catch, as there are some fees that homeowners will have to incur during the process.

Other Factors to Consider

We primarily considered the 30-year fixed-rate mortgage in the above examples because 30-year fixed-rate mortgages account for almost 90% of the home purchase market, according to Freddie Mac. However, some homebuyers opt for shorter mortgage terms or an adjustable-rate mortgage (ARM).

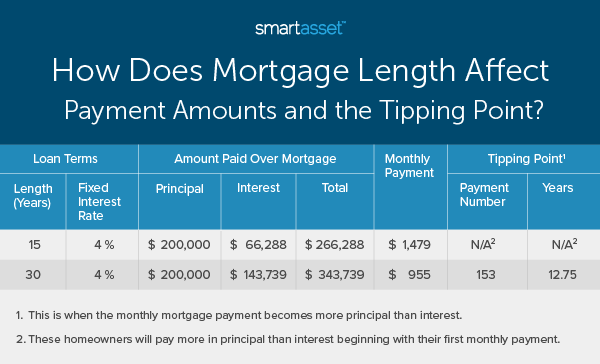

The second-most popular fixed-rate mortgage has a term of 15 years. The 15-year fixed-rate mortgage is structurally similar to the 30-year fixed-rate mortgage, though the shorter term length means that monthly payments will be higher while the overall cost of the loan is lower. This is because interest is lower. With the shorter term and higher monthly payments, homeowners with a 15-year fixed-rate mortgage pay more in principal than interest beginning with their first monthly payment. The table below compares a $200,000 15- and 30-year fixed-rate mortgage, each with a 4% interest rate.

Another available mortgage option is an ARM. Unlike a 15- or 30-year fixed-rate mortgage, an ARM has a variable interest rate. With an ARM, most homeowners commit to a low interest rate for a given term, after which the interest rate becomes adjustable for the rest of the loan’s life. This means that homeowners with an ARM carry the risk that interest rates will rise, but also stand to gain if rates fall.

Given the adjustable interest rate, homeowners with an ARM generally have a variable tipping point. If interest rates fall, the tipping point may be shorter than one expects at the beginning of the mortgage. In the reverse scenario, if interest rates increase, payments toward interest may be higher than payments toward the principal for a longer period of time.

Data and Methodology

Research for this study comes from Freddie Mac and HSH. The quoted Freddie Mac mortgage rates exclude average fees and points. The total upfront cost of the mortgage will include lender fees as well as closing costs. For that reason, we considered 4% as the baseline mortgage rate throughout the study. To map the changing composition of mortgage payments, we create loan amortization schedules for the varying scenarios discussed.

Tips for Making Smart Home-Buying Decisions

- Seek out trusted advice. Thinking about buying a home or refinancing? The right financial advisor can help you create a financial plan for your home buying needs. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Buy or rent? Even if you have the savings to buy a home, be sure the switch makes sense. If you are coming to a city and plan to stay for the long haul, buying may be the better option for you. On the other hand, if your stop in a new city will be a short one, you’ll likely want to rent. SmartAsset’s rent or buy calculator can help you see the cost differential between renting and buying.

- Find the best mortgage rate. Our study shows the benefit of looking around at mortgage rates before you commit to a home purchase. Locking in a 30-year mortgage with a 3% interest rate rather than a 4% rate can save you 11.69% over the lifetime of the loan. SmartAsset’s mortgage comparison tool can help you compare rates from top lenders and find the best one for you.

Questions about our study? Contact us at press@smartasset.com.

Photo Credit: © iStock/akaplummer