If you’re thinking about moving to the Palmetto State, it’s important to know what the cost of living is there. The state has a high income tax and a high sales tax, though property taxes are very low. The state is also a solid spot for housing costs, with median home prices and rental costs coming in below the national median.

If you are planning to move to another state, a financial advisor can help you create a financial plan for your goals.

Housing Costs in South Carolina

Homes in South Carolina are fairly affordable. To be specific, according to NeighborhoodScout, the median home value in the state resides at just $246,720. That’s one of the lowest numbers in the U.S.

When you look at home values by city, these numbers start to fluctuate quite a bit. For example, Charleston’s median home value is a much higher $487,078. In Mount Pleasant, the median home value skyrockets to $693,858. An interesting note about Mount Pleasant: Almost three-quarters of its residents own their home.

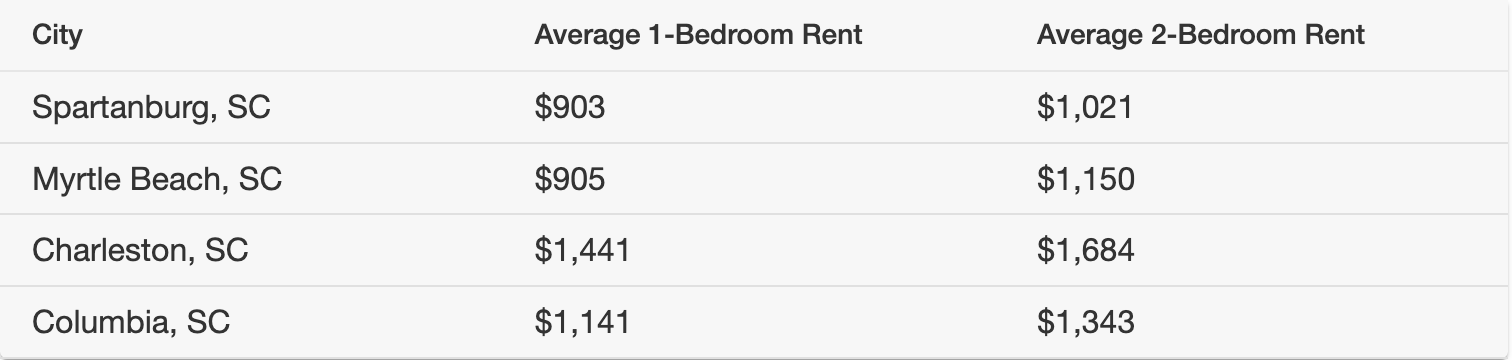

If you’re just not ready to drop the money on a down payment for a home, renting is a viable choice in South Carolina. According to Apartment List’s 2022 data, the average rent for a one-bedroom apartment in Charleston is $1,441 per month, while a two-bedroom in Myrtle Beach is $1,150.

Utilities

Whether you rent or buy, you’ll likely have to pay an energy bill, though some renters have that covered. According U.S. Energy Information Administration (EIA) data from 2021, the average monthly bill in South Carolina is $138.65.

According to 2022 reports from Numbeo.com, the average monthly utility bill for a 915 square-foot apartment in Columbia is $162.37. That includes electricity, heating, water and garbage. In Greenville, the price jumps to $166.81.

Food

The Missouri Economic Research and Information Center did a study in 2022 that incorporates grocery prices into cost of living data. South Carolina ranks at a 101.0 index, which is a bit higher than the 100 national average index. As a reference, the highest state is Hawaii at 150.3 and the lowest is Mississippi at 92.6.

Taxes

South Carolina’s income tax system is a progressive one. Its top marginal tax rate is 7%, which starts at incomes over $16,040. South Carolina residents who make $3,200 or less in annual income won’t pay any state income taxes.

Here’s some good news for homeowners: South Carolina has low property taxes. In fact, the state’s average effective property tax rate is the fifth-lowest in the country at 0.55%.

If you plan to retire in South Carolina, the state does not tax Social Security retirement benefits. Plus, there’s a $15,000 deduction for seniors receiving any other type of retirement income.

Miscellaneous Cost of Living Facts

There’s more to life than just the necessities. Popular extra expenses in South Carolina are headlined by beach house vacation rentals. According to the Myrtle Beach Area Convention and Visitors Bureau, beach home rentals start at $500 per week, but can go as as high as $3,500 per week depending on the size, location and features of the house. Rates in the off-season are substantially lower than summer rates.

If you’re a nature-lover, be sure to take advantage of what South Carolina has to offer. Admission to Huntington Beach State Park is only $5. Caesars Head State Park is even more of a bargain, at $2.

Love zoos? You can visit the Greenville Zoo for just $9.75 or the Riverbanks Zoo and Gardens in Columbia for $16.95.

Tips for Managing Your Finances

- Transporting your entire life to a new state can have implications for your finances, so it may be a good idea to find a financial advisor in South Carolina. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re new to an area, it can be tough to figure the best banking options available to you. To get you started, here are five local banks to select from: Anderson Brothers Bank, GrandSouth Bank, Southern First Bank, The Conway National Bank and Arthur State Bank.

Photo credit: ©iStock.com/Thomas Arbour, ©Apartment List, ©iStock.com/Susanne Neumann