Taking out a mortgage is a big decision, especially if it’s for a secondary property. You’ll have to take into account factors like property taxes, timely mortgage payments and other housing costs. However, if you’re ready for another investment, you might find yourself wondering where to look next. That’s why SmartAsset uncovered the most popular markets in the country for mortgages on secondary properties.

To find the hottest secondary home markets in the U.S., we compared data for 400 metro areas across two metrics: number of mortgages for secondary residences and total number of mortgages approved in 2018. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s third study on the hottest secondary home markets in the country. Check out the 2019 version here.

Key Findings

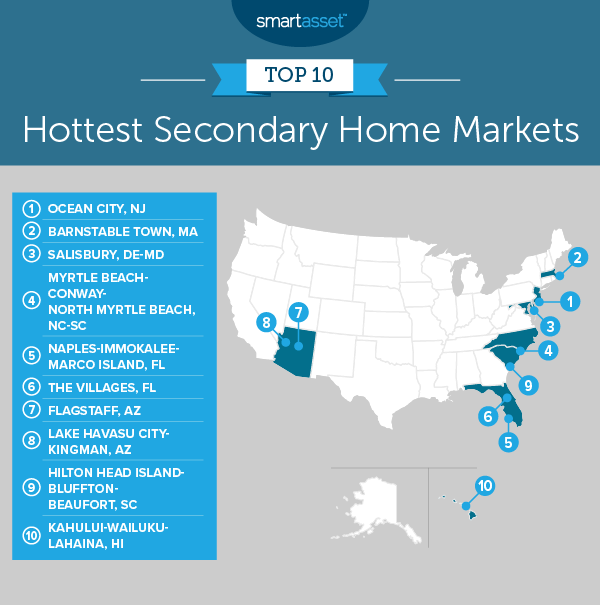

- Ocean City is a one-of-a-kind secondary home market. Not only does Ocean City, New Jersey take the No. 1 spot in our study for the third year in a row, but it is also the only metro area we analyzed where secondary homes comprise a majority of recent home purchases. Almost 70% of all approved mortgages there are for secondary residences. No other metro area in the study cracks 40% for this metric. In fact, mortgages for second homes make up less than 10% of the total new mortgages in 361 of the 400 metro areas in the study.

- Consistency among some of the top 10. Five of the metro areas that appear in this year’s top 10 were also in the top 10 of our 2019 and 2018 studies. The following secondary housing markets have been consistently strong in recent years: Ocean City, NJ; Barnstable Town, MA; Salisbury, DE-MD; Myrtle Beach-Conway-North Myrtle Beach, NC-SC and Kahului-Wailuku-Lahaina, HI.

- The Midwest fares poorly. The top 10 of this study consists of metro areas in the Northeast, South and West, according to Census regional divisions. The first Midwestern metro area to appear in this year’s rankings is Niles-Benton Harbor, MI at No. 31. Furthermore, 17 of the bottom 25 places in our study are located in the Midwest.

1. Ocean City, NJ

Ocean City, New Jersey takes the top spot in our study for the third year in a row. According to 2018 data from the Consumer Finance Protection Bureau (CFPB) Home Mortgage Disclosure Act (HDMA) database, of the total 3,074 mortgages approved in Ocean City in 2018, 2,139 of them – or 69.58% – were for non-primary residences.

2. Barnstable Town, MA

Even though the Barnstable Town, Massachusetts metro area comes in at No. 2 on our list of the top 10 secondary home markets in the country, the percentage of approved mortgages that are for secondary residences is almost half of what it is in Ocean City, New Jersey. In Barnstable Town, 2,767 mortgages for primary residences were approved during 2018 while 1,683 mortgages were approved that year for secondary residences. This means that 37.8% of the total number of approved mortgages in that market were for second homes.

If you’re looking to start or move your family to a new town, you might want to consider somewhere in the Barnstable Town metro area, as it’s one of the best places for children.

3. Salisbury, DE-MD

The Salisbury, Delaware-Maryland metro area ranks third in our study of the hottest secondary home markets in the U.S. Approximately 37.3% of approved 2018 mortgages in this area were mortgages for secondary residences. The total number of approved mortgages in the Salisbury area was 8,265, and of those, 3,086 were for secondary residences.

4. Myrtle Beach-Conway-North Myrtle Beach, NC-SC

The Myrtle Beach metro area has a relatively substantial market for secondary homes that prospective buyers might use for vacation and recreation. The home might even be a valuable asset for their estate planning purposes down the line. The metro area also has the highest number of total approved mortgages and mortgages for secondary residences compared to all metro areas in our top 10. According to 2018 data from the CFPB Home Mortgage Disclosure Act database, of the 13,072 total approved mortgages in this area in 2018, about 3,769 – or 28.9% – were secondary homes.

5. Naples-Immokalee-Marco Island, FL

In the Naples, Florida metro area, almost 28% of the total 2018 approved mortgages were secondary homes. According to the data, about 6,680 mortgages were approved in the area, and about 1,870 of those mortgages were second homes for their buyers. Even if you already own a home, it will be crucial for you to gather the right preapproval documents before you take the plunge and invest in a second.

6. The Villages, FL

Just shy of 60 miles northwest of Orlando, Florida, the Villages metro area takes the No. 6 across all 400 metro areas for which we considered data. Of the total 2,996 approved mortgages in the metro area, 822 of them – roughly 27.4% – are for secondary homes. For potential homeowners who are still weighing the costs of investing in a second property, it might be worth taking a look at our How Much House Can I Afford? calculator.

7. Flagstaff, AZ

About 75 miles south of the Grand Canyon, Flagstaff, Arizona comes in seventh of 400 total metro areas we considered in our study on the hottest secondary home markets in America. According to data from the CFPB Home Mortgage Disclosure Act database, 1,991 total mortgages were approved in 2018 in the area. Of those, 1,462 of them were mortgages for primary residences, while 529 of them were mortgages for secondary residences. This means that approximately 26.6% of the homes bought in the Flagstaff metro area during 2018 are for secondary residences. What’s more, the typical Arizona homeowner saves nearly $700 in property taxes compared to the national average.

8. Lake Havasu City-Kingman, AZ

The second of two Arizona metro areas in the top 10, Lake Havasu City-Kingman takes the No. 8 spot. Even though it has a higher number of total approved mortgages than the other Arizona metro area on our list – Flagstaff – the percentage of mortgages that comprise its secondary home market is lower than the percentage of these mortgages in Flagstaff. In the Lake Havasu metro area, 3,958 total approved mortgages were approved in 2018, and 956, or approximately 24.2%, were mortgages for secondary residences.

9. Hilton Head Island-Bluffton-Beaufort, SC

The Hilton Head Island-Bluffton-Beaufort, South Carolina metro area takes the No. 9 spot across all 400 metro areas we considered in our study on the hottest secondary home markets in the country. According to 2018 data from the CFPB Home Mortgage Disclosure Act Database, 1,223 – or approximately 24.1% – of the total 5,068 approved mortgages in 2018 were for second homes.

10. Kahului-Wailuku-Lahaina, HI

Rounding out the top 10 hottest secondary home markets in America is the Kahului-Wailuku-Lahaina, Hawaii metro area, located on Maui. In 2018, 1,647 mortgages were approved in the Kahului metro area. Of that total, 1,269 were for primary residences, and 378 – or almost 23% – were for secondary homes. For those considering investing in the Kahului area, the help of a local financial advisor can guide you toward the next best step.

Data and Methodology

To find the hottest secondary home markets in the U.S., we looked at data for 400 metro areas across the following two metrics:

- Number of mortgages approved for secondary residences in 2018.

- Total number of mortgages approved in 2018.

We divided the number of mortgages approved for secondary residences by the total number of mortgages approved for each metro area. The metro area with the highest number of non-primary residence mortgages as a percentage of all approved mortgages ranked highest. The place with the lowest percentage ranked lowest.

Data for both metrics comes from the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act Database.

Tips for Investing in the Housing Market

- Pay attention to taxes. Real estate taxes can comprise a substantial amount of homeownership costs, especially depending on where your property is located. Be smart about your payments in order to avoid being burdened by housing costs. Get an accurate calculation of your property taxes by using our comprehensive property tax calculator.

- Get in the weeds of estate planning early. Including your properties in the inventory of your assets is only one small step involved in planning your estate. Start preparing your estate documents now to ensure that your beneficiaries receive everything that you leave for them without a hitch.

- Feel at home in your finances. Financial planning, especially with multiple investments in the picture, isn’t easy, and it’s a good idea to ask for help. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in just five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/SolStock