If you’re in the process of buying a home, you may have heard the term “deed of trust.” Depending on what state you live in, this may have come up more frequently than it would in other places. But what exactly is a deed of trust? Is it the same as a mortgage? Here’s what you need to know.

A financial advisor can walk you through the homebuying process and how it will impact your financial plan.

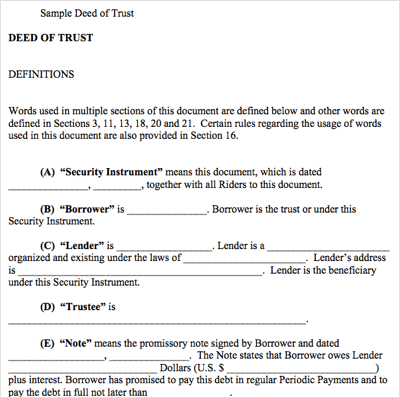

What Is a Deed of Trust?

A deed of trust is a document that pledges real property to secure a loan. In plain terms, when you sign paperwork for the home you’re buying, you sign a document that’s considered a promissory note. This note promises that you’ll pay what you owe for the property.

Many people use mortgage and deed of trust interchangeably, but they aren’t the same. With a deed of trust, there are three parties: the trustor (the borrower), the beneficiary (the lender) and the trustee (an independent third party). With a mortgage, there are two parties: the mortgagor and the mortgagee.

While this difference doesn’t change anything with your monthly mortgage payments, closing costs or other fees, it matters for foreclosures. The states that commonly use deeds of trust generally have much faster foreclosure timelines. This can be attributed to the power of sale clause.

What Is the Power of Sale Clause?

Most deeds of trust include a power of sale provision. This clause outlines how the lender can foreclose on the property if the borrower stops paying the mortgage, also known as defaulting on a home loan. This is where the trustee comes into play: The trustee is usually responsible for selling the property at a foreclosure sale. In most cases, the trustee is a title company, but it can differ across states.

Power of sale provisions allow lenders to foreclose without involving the local courthouse. That’s why deeds of trusts usually go hand-in-hand with non-judicial foreclosures. This type of foreclosure is usually much faster than a judicial foreclosure on a mortgage. Judicial foreclosure, in some cases, requires the lender to file a lawsuit. Most states that have this process have extremely long foreclosures due to the backlog and overwhelmed court systems.

With a power of sale clause, lenders avoid having to involve the state court system. This doesn’t mean you’ll lose your house overnight after a missed payment, but it generally means a much quicker timeline from first notice to the sale of the home. That said, each state that allows deeds of trust has different procedures; it’s not standard across lenders. This means timelines and notification protocol will differ depending on where the property is located.

States that allow power of sale foreclosures include: Alabama, Alaska, Arizona, Arkansas, California, Colorado, the District of Columbia, Georgia, Hawaii, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Washington, West Virginia and Wyoming.

What Is Non-Judicial Foreclosure?

If you’re facing foreclosure in a non-judicial foreclosure state, the process can take just a handful of months. While you generally can request free foreclosure counseling or monetary assistance through state agencies, it’s not guaranteed that you’ll save your house. If you want to fight a foreclosure formally, you’ll need to file a lawsuit, which can take not only time, but also money for filing and attorney fees.

While this type of foreclosure is thought of as beneficial for lenders, as it’s a faster process, there is a possible advantage for borrowers. States that allow power of sale foreclosures usually prohibit deficiency judgments against the lender. This means if your house is sold at a cost below what you owe for the home, the lender can’t sue you for the remainder.

If you’re facing a foreclosure, here are three common tips to deal with one:

- It may be worth checking out refinance rates. You might be able to lower your monthly payments with a lower interest rate. It’s a proactive choice if you aren’t behind your mortgage yet but are struggling to make payments.

- If foreclosure’s looming on the horizon, you might consider filing for bankruptcy to save your home.

- Another option to consider is a short sale. This option could help you avoid foreclosure and total credit score ruin. Despite the name, it’s a lengthy and complicated transaction. You’ll want to discuss the option with your lender and financial institution.

Bottom Line

A deed of trust makes it easier for a lender to foreclose on your house. The lack of judicial process involvement means less red tape, which means a quicker foreclosure. While you can’t exactly request a mortgage in lieu of a deed of trust if you’re buying property in a location that uses the latter, at the very least you’ll know what you’re signing.

Tips for Buying a Home

- A financial advisor can also help you create a financial plan for your homebuying needs. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re planning to buy a home, SmartAsset’s mortgage comparison tool can help you compare mortgage rates from top lenders for your needs.

Photo credit: ©iStock.com/Peopleimages, National Consumer Law Center, ©iStock.com/Johnny Greig