Saving is an important part of any budget. The ability to put money away is indicative both of an ability to cover necessary expenses and of an ability to plan for the future. Stashing your cash can protect you from unexpected misfortune, increase your net worth through compound interest, and let you work towards financial goals like college, retirement, becoming a homeowner, or a killer vacation. Unfortunately, your ability to save can be a product of your environment as well as your financial wherewithal.

Find out now: How much house can I afford?

Check the potential savings in your (or any) county using this interactive map. Zoom into your state and scroll your mouse over any county to see how it ranks for savings potential.

Many of life’s costs such as taxes, home value, health care, food and energy vary depending on where you live. In order to identify the places where homeowners have the greatest opportunity to save, SmartAsset sought to compare some of these localized costs with typical incomes for 3,111 US counties. For each of these counties we were able to arrive at the potential for savings for someone living on a median household income would have after covering typical essential costs (or necessities).

Methodology

In order to determine the savings potential for residents, we started with the median household income for each county, and then subtracted the basic expenses. These costs included food, healthcare, vehicle insurance, gasoline, electrical energy, income taxes, property taxes and median yearly mortgage payments. The number left is what we are calling potential savings. We ranked the counties by potential savings to determine the counties where someone making the median income for that county would be able to save the most and least money.

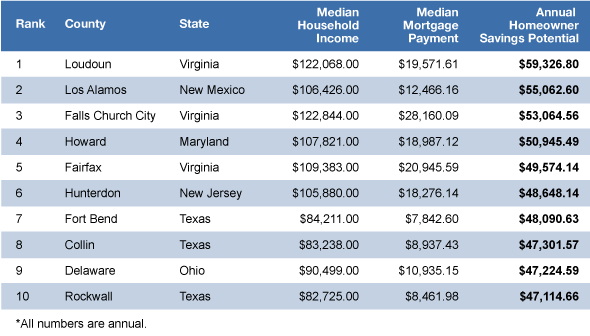

The Top Ten Places for Potential Savings

These are the counties that our study shows give you the best chance to save money:

1. Loudoun County, Virginia

Loudoun County came out on top as the best place for homeowners to save money. Loudoun County’s median income of $122,068 is the highest median income of all jurisdictions in the United States with a population of 65,000 or greater. After incorporating food, healthcare, travel, tax, and mortgage costs, the typical resident of Loudon County has the potential to save $59,326.80.

This highly suburbanized county is a part of the Washington D.C. metro area and is home (along with Fairfax county) to Washington Dulles Airport. In addition to the airport, Loudon County has 22 wineries which produce many internationally recognized wines as well as an equine industry that generates an estimated revenue of $78 million. Leesburg is the county seat.

2. Los Alamos County, New Mexico

Los Alamos County, New Mexico is a small county of just over 17,950 people as of the last Census. The county is most well known as the home to Los Alamos National Laboratory which was founded to undertake the Manhattan Project.

During the Manhattan Project, Los Alamos was administered exclusively by the federal government, but has since been returned to equal status of other New Mexico Counties. Today, Los Alamos is a great place to save as it allows its residents to generate a great deal of income, with a household median of $106,426, and find affordable housing, with effective mortgage payments of just above $1,000 per month.

3. Falls Church County, Virginia

Falls Church County, Virginia is an independent city with county level governance status. This tiny city of just 12,332 is home to some big business. Several Fortune 500 companies including Computer Sciences Corporation, General Dynamics and Northrup Grumman have headquarters addressed there.

Falls Church lays claim to the lowest level of poverty of any independent city or county in the United States. Despite its high effective monthly mortgage and yearly state income tax payments of $2,346 and $6,067 respectively, Falls Church can be a great place to save because the median household earns $122,844.

4. Howard County, Maryland

Howard County, Maryland or “HoCo” sits between Baltimore and Washington, D.C. The county gets its name from Colonel John Eager Howard, an officer in the “Maryland Line” of the Continental Army in the Revolutionary War. He eventually became the fifth governor of Maryland.

Today, Howard County consistently ranks among the counties with the highest quality of life and best schools in America. With its high income and savings potential of $50,945.33, Howard County also rates as our 4th best county for saving.

5. Fairfax County, Virginia

Another DC suburban county makes our list. Loudoun’s southern neighbor, Fairfax County is also a great place to save. Fairfax is home to many US intelligence agencies such as the CIA and the National Counter Terrorism Center.

Fairfax County has a strong economy based on federal government jobs and local private employers, such as Volkswagen Group of America, Hilton Worldwide and Northrup Grumman, that provide its residents with the second highest median income in the U.S. After covering basic necessities, Fairfax County residents have an effective savings potential of $49,574

6. Hunterdon County, New Jersey

Hunterdon County has many of the wealthiest of New Jersey’s countless New York City bedroom communities, allowing its households to generate a median income of $105,880. Hunterdon County is able to overcome one of the highest effective yearly property tax payments of $4,196.06 and an effective monthly mortgage payment of $1,530 to become the 6th best county for homeowner savings potential.

7. Fort Bend County, Texas

Fort Bend County was founded in 1837 and is named for a blockhouse fort that rested at a bend of the Brazos River. In this suburban county near Houston, residents enjoy a high median income , inexpensive homes and the absence of state income taxes. As a result, the typical Fort Bend resident has a savings potential of $48,090.

8. Collin County, Texas

Like many Texas counties, Collin County began as a series of small farming communities that exploded with growth as rails connected them to major cities. Though the Great Depression caused many of these farms to die out, dairy farming remains a significant part of Collin’s economy. Beginning in the 1980s, Dallas’ northward expansion triggered massive growth and suburbanization in Collin, which today includes part of the city of Dallas itself.

9. Delaware County, Ohio

Delaware County, Ohio was formed in 1808 from Franklin County Ohio and is named after the Delaware Native American tribe. It was most notably home to Rutherford B. Hayes, the 19th president of the United States. The Central Ohio county holds many suburbs of Columbus. Delaware County households benefit from a high median income of $90,499 and affordable effective mortgage payments of $911 per month.

10. Rockwall County, Texas

Rockwall County is named for a subterranean wall-like rock formation that runs throughout the county. While folk tales romanticize that the wall was built by prehistoric natives, scientists have determined that it is a natural formation.

Rockwall is the smallest county in Texas, sitting just to the northeast of Dallas. But with a median household income of more than $82,000 and an effective monthly mortgage payment of just $705, it can be a great place for homeowners to generate big savings.

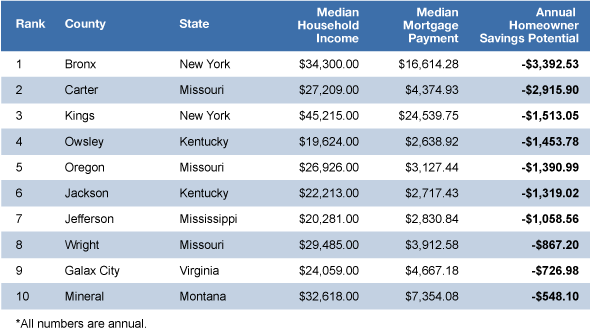

The Bottom Ten Places for Potential Savings

Our study shows that living in these counties gives you the worst chance to save money as a homeowner:

1. Bronx County, New York

With origins as a rural area of small farms supplying New York City, the Bronx grew into a railroad suburb in the late 1800’s. In the early part of the 20th century Bronx County was a center of manufacturing, particularly of pianos. After World War I the Bronx underwent rapid growth as extensions of the New York City Subway brought thousands of immigrants looking to settle there.

Today the Bronx measures as such a bad place to save as a homeowner simply because the county household earning the median income of $34,000 would have trouble finding an affordable home. As a result of this disparity, Bronx residents have a savings potential of -$3,392. It is important to note that this does not mean that Bronx residents lose $3,392 every year, but that the median Bronx earner would likely not be able to afford the mortgage for the median priced home, along with other necessities.

2. Carter County, Missouri

Carter County, Missouri is home to just over 6,000 people in the foothills of the Ozark Mountains in the southeastern part of the state. The county saw periods of success, first by producing lumber and then iron. But in 1921, with the absence of wartime demand for pig iron, the county’s major iron company closed down. Carter’s economy has been reeling ever since.

Today, despite the fact that its median household earns just of $27,000 per year Carter has an effective state income tax payment of just under $5,400 and an effective property tax payment of nearly $2,000. With only $20,000 in post-tax income it can be extremely difficult to save.

3. Kings County, New York

Kings County whose boundaries coincide with those of Brooklyn has always had an independent spirit. It was an independent incorporated city as per the New York State constitution until January 1898 when Brooklyn was combined with other cities to form what we know today as the City of New York.

Despite its incorporation into Greater New York City, Brooklyn has maintained its independent spirit with its own sports and culture. However, its job market is heavily driven by Manhattan with roughly 44% of its employed population working there. Despite significantly lower property taxes, Kings County residents are nearly as ill-equipped for saving as their neighbors in the Bronx as Brooklyn’s median annual income of $45,215 is not well suited for its effective monthly mortgage payments of $2,044.

4. Owsley County, Kentucky

Owsley County is a bad place to save simply because the state of its economy makes it incredibly difficult to earn money. Deep mines in thin coal seams and logging once provided many jobs for Owsley residents, but both of these resources have diminished greatly and, while there are some jobs created by farming and surface coal mining, according to a 2012 study by the Bureau of Economic Analysis, 53.07% of personal income in Owsley County came from government benefits.

Owsley has the second highest rate of child poverty of any county in the U.S. and over 52% of its residents were dependent on SNAP benefits in 2012. With a median income of just $19,624 it is little wonder Owsley County households have an effective savings potential of -$1907.

5. Oregon County, Missouri

Oregon County, Missouri is located in southern Missouri. It was organized in February 1845 and named after the (then) Oregon Territory in the northwest. Oregon County is home to a large portion of the Mark Twain National Forest and is a destination for hiking, backpacking, fishing and canoeing along the Ozark Trail. Oregon County, like Carter County, suffers from low income and high taxes. Households here earn a median yearly income of $26,926 and pay an effective annual property tax rate $1,315 and an effective yearly state income tax of $5,415.

6. Jackson County, Kentucky

Jackson County is about 60 miles southeast of Lexington. In February 2014, unemployment in the county climbed above 20%. Jackson is also one of the most unhealthy counties in Kentucky, with an estimated 32% of its adults missing 6 or more teeth because of tooth decay or gum disease. While Jackson County may be a dentist’s paradise, its far from one for savers as the median household leaves an effective savings potential of -$1,319.

7. Jefferson County, Mississippi

Jefferson County sits in southwestern Mississippi along the Louisiana border. Jefferson suffers from an unemployment rate well above the national and Mississippi state averages. As of June 2014 Jefferson had a 16% unemployment rate. As a result, it is one of the poorest counties in the country with the lowest median income in Mississippi at just over $20,000 per household.

8. Wright County, Missouri

Wright County was formed on January 29, 1841 and named in honor of Silas Wright, a prominent New York Democrat. Ironically, today Wright County is one of the most strongly Republican Counties in the US with Republicans holding every elected position in the county and taking the county in each of the last ten presidential elections. East of the city of Springfield in southern Missouri, Wright County is also one of the poorest county’s in Missouri with a median household income of $29,485.

9. Galax City County, Virginia

A hotbed of bluegrass, early country and American Folk Music, Galax has been claimed, the ‘World Capital of Old Time Mountain Music.’ The city in southwestern Virginia is home to many annual music events and festivals including the Galax Old Fiddler’s Convention and the Galax Leaf & String Festival.

Like Falls Church in Virginia, Galax is an independent city with county level jurisdiction. Originally, the city’s independent status allowed it to excel in comparison to its neighbors, but recent hard times have led Galax City to close all but one of the furniture factories that were traditionally its economic staples.

10. Mineral County, Montana

Mineral County is located on the western border of Montana. Around 87% of the land in Mineral County is public forest land, with the majority under management of Lolo National Forest. Mineral County gets its name from its high concentration of minerals and many unpatented mining claims. Natural resources have historically supported the Mineral County economy, with its private land providing some opportunities for farming. Despite these opportunities Mineral County residents may be having trouble finding opportunities to save as their household savings potential measures in at -$548.10.

What Neighborhood is the Best Fit For Me?

More on the Methodology

To derive our savings potential data we began with median household income for each county from the US Census Bureau’s income survey and sought to subtract the cost of basic necessities. We applied yearly food, gasoline, vehicle insurance, public transportation and healthcare costs from the Bureau of Labor Statistics Consumer Expenditure survey for the appropriate US region.

Next we found average monthly costs of electricity from the Energy Information Administration for the state the county is located in. In order to determine monthly mortgage payments we used American Community Survey data on median home value and our own mortgage rates for each county. We applied tax foundation data to Census Bureau median household income in order to calculate the proper state and federal income tax payment for the median household in each county. We determined median property tax payment by applying Census Bureau data on property taxes to our own data on median home value.

Photo Credit:© iStock.com/Justin Horrocks, flickr