As one of the four largest banks in the U.S., Bank of America has a long history in the financial sector. In addition to mortgage loans, the company offers retail banking, credit cards, consumer, investment and corporate banking, investment services, small business banking and auto loans. Headquartered in Charlotte, North Carolina, the corporation has more than 213,000 employees, 3,700 retail financial centers and serves the U.S. as well as another 35 other countries.

Bank of America offers all the major home loan types - fixed-rate, variable rate, FHA, VA - as well as a low-income and low down payment option called the Affordable Loan Solution® mortgage.

Today's Rates

| Product | Today | Last Week | Change |

|---|---|---|---|

| 30 year fixed | 5.50% | 5.66% | -0.16 |

| 15 year fixed | 4.75% | 5.04% | -0.30 |

| 5/1 ARM | 5.12% | 5.27% | -0.15 |

| 30 yr fixed mtg refi | 5.82% | 5.89% | -0.07 |

| 15 yr fixed mtg refi | 4.75% | 5.03% | -0.28 |

| 7/1 ARM refi | 5.18% | 5.30% | -0.13 |

| 15 yr jumbo fixed mtg refi | 3.06% | 3.10% | -0.04 |

National Mortgage Rates

Regions Served by Bank of America

Does Bank of America Operate in My Area?

Bank of America has home loan specialists at many of its retail banking locations across the U.S. The company originates loans in all 50 states.

What Kind of Mortgage Can I Get With Bank of America?

Bank of America offers a variety of home loan options:

Fixed-rate mortgage: These home loans are the most common as they are straightforward and dependable, and you’re protected from possible increases in your monthly payments. Because the loan has a set interest rate that doesn’t change over the life of the loan, your principal and interest payments stay the same. Bank of America’s most popular fixed-rate loans have 15-year, 20-year or 30-year terms.

Adjustable-rate mortgage (ARM): This mortgage has an interest rate that may fluctuate depending on changes in a financial index that your mortgage is tied to. It typically starts with an initial interest rate that’s lower than a fixed-rate mortgage but once your introductory period has ended, the rate can change. Your monthly payment may increase or decrease when that happens. The loan’s terms will dictate how many times the interest rate can change, as well as the highest level it can reach.

FHA loan: This is a Federal Housing Administration-insured loan which may be a good option if you have limited income and funds for a down payment or a lower credit score.

VA loans: If you are a current or former member of the U.S. military or National Guard (or the current or surviving spouse of one), you may be eligible for this government-insured mortgage. VA loans have little or no down payment required.

Jumbo loan: If you need to take out a loan that is bigger than the conforming loan limit in a particular county then you will have what is known as a jumbo loan. In most of the U.S. the conforming loan limit is less than $832,750, but in some pricey areas it goes up to $1,249,125. This means that you can take out a loan up to that amount in those areas and it will still be considered a “conforming loan.” If you’re considering a jumbo loan for your mortgage, be aware that they usually come with higher interest rates.

Affordable Loan Solution® mortgage: In 2016, Bank of America launched the Affordable Loan Solution mortgage for low-income buyers. Bank of America partnered with Self-Help Ventures Fund and Freddie Mac for the program that lets buyers pay as little as 3% in down payments on single-family homes. You can’t own additional property if you have this loan and you are subject to maximum income limits and loan amount limits. Like a FHA loan, mortgage insurance premiums are required as well as upfront mortgage insurance premiums. Those premiums are added to your monthly mortgage payment. This loan program is available for fixed-rate mortgages with 25-year or 30-year terms.

Refinance: Bank of America offers refinance loans. Loan options include fixed-rate, ARM, FHA, VA and cash-out refinance loans.

What Can You Do Online With Bank of America?

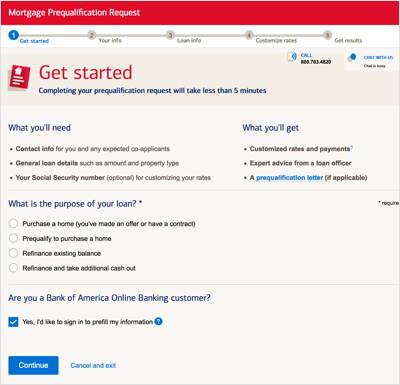

One of the first things you’ll see when you pull up Bank of America’s website is the option to “prequalify now” or to call a mortgage representative. According to the information on the application, completing the prequalification application can take as little as five minutes. If you’re already a Bank of America customer, you have the option to sign in to get your information automatically filled out. Once you complete the application, you’ll get a prequalification letter, customized rates and payments and a phone call with a loan office who will provide advice.

Other online features include live rate charts that display current mortgage rates, APR, point and payment amount for 30-year fixed-rate loans, 15-year fixed-rate loans and 5/1 ARM variable loans. You also have the option to get custom rate by filling out purchase price, down payment and zip code.

Bank of America’s website is comprehensive. There are videos, mortgage FAQs, home buying information resources such as articles and guides, tools and calculators and multiple ways to contact the company. You can live chat with a customer service representative, schedule and in-person appointment or arrange to get a call from a mortgage representative.

There’s also a real estate center, where you can search for homes or find your estimated home value on a current property.

When you’re ready to apply for a loan, you can do that online, as well. You’ll use the “Home Loan Navigator®,” an online portal, to sign and submit documents and track your home loan. While Bank of America’s general site is mobile-friendly (and there’s an app!), the Home Loan Navigator® portal is easiest used on desktop.

Would You Qualify for a Mortgage From Bank of America?

Similar to many large banks that offer FHA loans, the lowest FICO credit score that's generally accepted is 600. This isn’t a hard and fast rule, as more than your credit score is considered during the process, but that’s the general rule of thumb. Conventional mortgages will usually require at least a 620 FICO score.

In addition to credit score, you’ll need a solid work history, or proof of income as a freelancer or small business owner. Down payment savings are another consideration. You want to aim for 20% of the home purchase price. For example, if you’re buying a $250,000 home, ideally, you’d have $50,000 for the down payment. Obviously this isn’t an option for every lender.

FHA loans have lower down payment requirements and Bank of America’s Affordable Loan Solution® requires just 3%. With both those options, however, you’ll pay a monthly insurance premium (MIP) and upfront insurance premium (UFMIP). This means a higher monthly payment. If you’re apply for a conventional loan with less than 20% down payment, you’ll have to get private mortgage insurance (PMI). Like MIP, PMI is added to your monthly mortgage payment.

Your lender will also consider your debt-to-income ratio (DTI). DTI helps a lender determine if you can afford the projected monthly mortgage payments. In general, you want to aim for 36% or less. Bank of America doesn’t stand behind a specific limit, but if you have more than around 44%, most lenders won’t consider you for a loan.

Calculate your DTI by totaling your monthly debt payments. This includes student loans, credit card payments, auto loans, child support and so on. Divide your monthly debt liabilities by your pre-tax monthly income and multiple by 100 to find your percentage.

What’s the Process for Getting a Mortgage With Bank of America?

To apply for a Bank of America mortgage, you can call, find a retail location or start an application online. The first step is prequalification and should take you about 30 minutes or so. You’ll need your contact info, home price and property type (such as single home, condo or duplex) and your Social Security number.

For the actual application, you’ll need a number of financial documents, W-2s (for the last two years), pay stubs (for the last 30 days), federal tax returns and employment history for the past two years, bank and asset statements for the last two months. Self-employed homebuyers will need a quarter or year-to-date profit and loss statement. VA loan applicants will need a certificate of eligibility, found on the VA’s website. The purchase and sales agreement for the home you’re buying is required as well.

With Bank of America’s Home Loan Navigator®, you’ll be able to submit and sign all documents online if you choose. The online portal allows you to track your mortgage process each step of the way.

Before the loan closes, the bank will arrange a home appraisal in order to verify the property’s estimated market value. If everything checks out, and your home inspection is fine, you’ll need to secure homeowners insurance as one of the final steps. Many people use an escrow account to pay for property taxes and homeowners insurance, which means the payment will be included in your monthly mortgage payment.

How Bank of America Stacks Up

Large banks come with both advantages and disadvantages. On the plus side, you’ll find a wide variety of loan options, a fluid online experience and plenty of in-person locations to sit down with a mortgage consultant. However, you may not get a truly personalized experience due to Bank of America’s corporate size. It’s one of the largest mortgage providers in the U.S., and that comes with various customer service hiccups.

Overall, Bank of America’s mortgage division is similar to the ones at Wells Fargo and U.S. Bank. If you’re already a Bank of America customer, you might find it a quick and simple process to apply for a mortgage. All your accounts are in one place, and you’re an established customer. However, if you want an online-only experience or want to find the absolute best loan rates, it’s worth checking out a smaller, online-based lenders such as Better Mortgage.

The internet has made so many lenders available at the click of a button. You’re no longer limited to finding a lender within driving distance. That means you should feel free to shop around for the best possible lender for your needs.

Tips for Finding a Mortgage

- There can seem to be an endless sea of loan options when you're mortgage hunting, but there is one thing to look for if you find two similar lenders. While interest rates are flat, annual percentage rates (APRs) include outside charges, like closing costs and other fees. So if one lender has a larger difference between their interest rates and APRs than another, you may want to choose the one with presumably lower fees.

- A financial advisor can help you choose a mortgage that fits into your financial plan. SmartAsset free tool matches you with vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.