While it’s never ideal to remove a tenant from a property, certain situations, such as nonpayment of rent, lease violations or property damage, may leave you with no choice. Figuring out who pays legal fees for eviction can be complex and expensive for landlords because the cost of eviction includes not only legal fees but also lost rent and property turnover costs. Landlords must also prepare for additional expenses, such as property damage, though some of these may qualify for rental property tax deductions.

If you want to create or build out your real estate portfolio, a financial advisor could work with you to evaluate investment options and manage them.

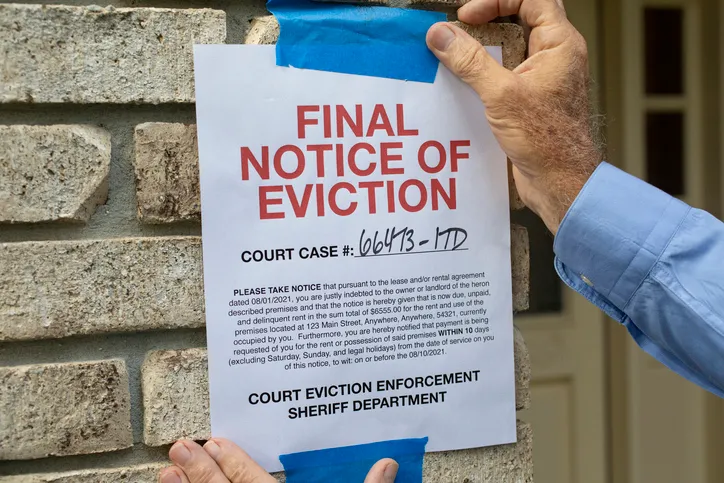

Understanding the Eviction Process

Eviction is a legal process that allows a landlord to remove a tenant from their property. This step is typically taken when a tenant fails to uphold their lease agreement, such as not paying rent, damaging the property or engaging in illegal activities on the premises.

Before you can file for eviction, you must typically provide the tenant with a formal notice, giving them a chance to rectify the situation, which can include paying overdue rent or resolving lease violations.

If the tenant fails to comply, you can file an eviction lawsuit in court, which initiates the formal legal process. A judge will hear both sides, and if you prevail, the tenant will be legally ordered to vacate the property. In some cases, the sheriff may need to intervene if the tenant refuses to leave.

How long the eviction process takes depends on local laws and the tenant’s response, and can range from a few weeks to several months

Common Eviction Costs for Landlords

Common eviction costs for landlords can include legal fees, court filing fees and expenses for repairing or cleaning the property after a tenant leaves. Here’s a breakdown of five common costs that you may encounter.

Court Costs

Landlords typically need to file an eviction case with the local court, which requires paying filing fees. These court costs can range from $50 to $500, depending on the jurisdiction. Additionally, if the tenant disputes the eviction, legal representation may be required, which can add thousands of dollars to the total cost in attorney fees.

Sheriff and Locksmith Fees

Once the eviction is granted by the court, a sheriff may be required to enforce the eviction order and physically remove the tenant. The cost for a sheriff’s involvement can range from $50 to $400, depending on the location. In some cases, landlords may also need to hire a locksmith to change the locks once the tenant has been evicted, which can cost an additional $100 to $200.

Property Damages

Evicted tenants may leave behind property damage, especially if they were unhappy about the eviction. The cost of repairs can vary greatly, depending on the extent of the damage. Minor repairs might only cost a few hundred dollars but significant damage such as broken appliances or damaged flooring could cost thousands if you’re not covered by landlord insurance.

Property Turnover

Once a tenant is evicted, the property must be prepared for the next tenant. This can involve cleaning, painting and repairing any damages. On average, property turnover costs can range from $1,000 to $5,000, depending on the size of the property and the extent of the required work.

Lost Rent

During the eviction process, landlords often lose out on rent payments, as the tenant either cannot or will not pay rent. Eviction cases can take several weeks or months to resolve, leading to significant income loss.

How to Minimize Eviction Costs

To minimize eviction costs, landlords should screen tenants carefully, use clear lease agreements and address issues promptly to avoid legal disputes. Here are four common tips:

- Choose tenants carefully. By checking credit scores, rental histories, and background information, tenant screening can reduce the likelihood of renting to problematic tenants who may require eviction down the road.

- Draft a detailed lease. Clearly outline tenant responsibilities and consequences for nonpayment or rule violations. This expedites evictions and provides legal protection if a dispute arises.

- Offer “cash for keys”. Asking tenants to leave voluntarily in exchange for a small payment can save landlords from paying court fees, legal representation and other eviction expenses.

- Get some help. Hire a property manager to handle rent collection, maintenance and tenant relations. This proactive step can help prevent issues from escalating into eviction.

Who Pays Legal Fees for Eviction?

During the eviction process, both parties are responsible for paying their own legal fees until the court reaches a decision. Who pays legal fees after the resolution will depend on the court’s ruling, which can be influenced by physical evidence, lease terms and local fair housing laws that protect tenant rights.

For landlords, if the court rules in their favor, they may recover some or all of their legal fees from the tenant. However, if the tenant wins, the landlord may be required to cover the tenant’s legal fees as well.

Keeping thorough documentation and evidence can support the landlord’s case and influence the court’s decision on fee recovery. Understanding local laws is also essential for landlords to prepare for potential costs associated with the eviction process.

Bottom Line

Evictions are usually a last resort for landlords, but they come with significant financial costs. Court fees, lost rent, property turnover, and damages can add up quickly. By learning about the eviction process and using strategies like screening tenants and creating clear lease agreements, landlords can protect their investments and reduce losses.

Tips for Real Estate Investing

- A financial advisor could help you identify real estate investment opportunities and manage risks. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you want to know how much your investment could grow over time, SmartAsset’s investment calculator could help you get an estimate.

Photo credit: ©iStock.com/KLH49, ©iStock.com/designer491, ©iStock.com/andresr