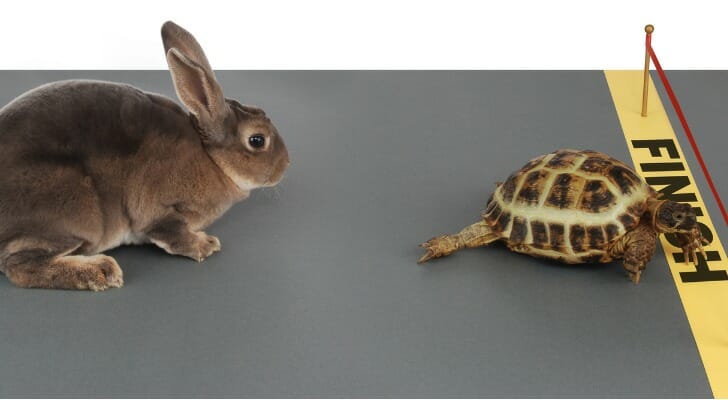

Trading stocks and investing in other securities can help with building a well-rounded portfolio. While the two sound similar, there’s a difference in trading and investing when it comes to the speed and reliability of reaching your financial goals. If you’re unsure whether you’re a trader or an investor, or what the distinction even means, here’s a closer look at what each one means and how it can affect your finances. Work with a financial advisor to make sure your investment strategy and tactics reflects your orientation as an investor or a trader.

Trading stocks and investing in other securities can help with building a well-rounded portfolio. While the two sound similar, there’s a difference in trading and investing when it comes to the speed and reliability of reaching your financial goals. If you’re unsure whether you’re a trader or an investor, or what the distinction even means, here’s a closer look at what each one means and how it can affect your finances. Work with a financial advisor to make sure your investment strategy and tactics reflects your orientation as an investor or a trader.

What Is Trading and What Do Traders Do?

Trading refers to buying and selling stocks and other securities with a short-term result in mind. An active day trader, for example, may spend their days studying market trends to find buying and selling opportunities that can turn the biggest profit.

Someone who trades stocks doesn’t purchase them with the intention to buy and hold them for the long term. Instead, they’re buying securities for the purpose of selling them in the near future, ideally at a profit.

Stock traders may rely on technical analysis indicators to tell them which way a security or the market as a whole is moving. For example, they may use trends and momentum to decide when to buy a particular security or when to sell it.

While traders can hold securities for longer periods of time, including months or even years, it’s not uncommon for them to focus on much shorter holding periods. For instance, they may hold a security for two to three days at most, though some may only hold equities for two to three hours before trading it away.

Regardless of how they fine-tune their strategies, traders are primarily concerned with turning profits in the short term. They focus more on what a stock is likely to do next, versus where it may be headed a decade or two down the line.

What Is Investing and What Do Investors Do?

Investing money also means putting it into the market the same as trading does. But the difference between a trader and an investor is usually the mindset that prompts decision-making.

Again, a trader may be intent on raking in profits in the short term. An investor, on the other hand, may select stocks and other investments with a long-term outlook in mind. For example, a value investor studies the market to find stocks that are selling at a discount to the underlying value of the company. They purchase them and hold onto them in the belief that the market will recognize the actual value of these securities.

It may take a very long time, but they can eventually sell their shares for much more than what they paid for them. The goal is to produce long-term returns to build wealth rather than making quick profits.

Does Investing Get You to Your Goal Faster Than Trading?

Whether it makes sense to focus on trading or investing ultimately depends on your investment style, risk tolerance and goals. If you’re interested in generating immediate returns and you’re comfortable taking more risks then you could be suited to trading stocks rather than investing. On the other hand, if you have a lower risk tolerance or you prefer to focus more on the big picture rather than the short-term, you may lean toward investing instead.

Whether it makes sense to focus on trading or investing ultimately depends on your investment style, risk tolerance and goals. If you’re interested in generating immediate returns and you’re comfortable taking more risks then you could be suited to trading stocks rather than investing. On the other hand, if you have a lower risk tolerance or you prefer to focus more on the big picture rather than the short-term, you may lean toward investing instead.

When discussing trading vs. investing, one isn’t necessarily better than the other. When approached with the right strategy and knowledge, either one could help you to achieve your goals. It’s also important to remember that you don’t have to commit to just one or the other.

For example, you could invest in value stocks or mutual funds for the long-term while still day trading stocks or exchange-traded funds (ETFs) for short-term gains. Whether this makes sense for you depends on how much time and effort you’re willing and able to put into managing a portfolio, as trading is more active whereas investing can be largely passive.

Trading vs. Investing: How to Get Started

Whether you plan to trade, invest or do a little of both, opening an online brokerage account is the first step. With a brokerage account, you can actively trade shares of stock, ETFs or other securities. Or you can purchase stocks, ETFs, mutual funds, bonds and other investments that you’d like to hold for the long term. When choosing a brokerage account, there are a few things to consider, including:

- Commission fees and costs to trade stocks or ETFs

- Minimum account opening requirements

- ETF and mutual fund expense ratios

- Account types offered

- Investment analysis and research tools

- Online and mobile user experience

If you’re a beginning trader, then you may be fine with a basic online brokerage account that charges minimal fees. But if you’re a more experienced trader then you may want to consider a brokerage that offers advanced trading tools that rely on technical indicators.

As a trader, it’s also important to set some guidelines on when to buy or sell and what threshold you’re not comfortable exceeding when it comes to losses. You should also be aware of how buying and selling can affect your taxes when it involves paying short- or long-term capital gains tax.

When choosing securities to invest in, consider your personal preferences and risk tolerance. If you’re trading, for example, consider whether you want to focus on a particular sector or what kind of target return you’re aiming for. If you’re investing for the long-term, think about what types of investments can offer the best diversification to help you manage risk while generating returns.

Also, think about your eventual exit point. For instance, if you’re heavily invested in stocks now will you start to sell those off once you’re 10 years away from retirement, five years away? Will you plan to continue to hold a mix of riskier and more conservative investments as you begin to draw on your portfolio for income?

The Bottom Line

Whether it makes sense to choose trading vs. investing is a personal choice. What matters most is understanding how they compare and what each one is designed to help you do. Once you’re clear on what makes trading stocks different from investing in the market, you can better decide which path to pursue. Talking these things over with a financial advisor can help you create a plan for investing long-term. And even a day trader can benefit from getting professional investment advice from time to time.

Whether it makes sense to choose trading vs. investing is a personal choice. What matters most is understanding how they compare and what each one is designed to help you do. Once you’re clear on what makes trading stocks different from investing in the market, you can better decide which path to pursue. Talking these things over with a financial advisor can help you create a plan for investing long-term. And even a day trader can benefit from getting professional investment advice from time to time.

Tips for Investing

- Consider talking to a financial advisor about how and where to trade or invest, based on your needs and goals. If you don’t have a financial advisor yet, finding one doesn’t have to be complicated. SmartAsset’s financial advisor matching tool makes it easy to connect with professional advisors in your local area. It takes just a few minutes to get your personalized advisor recommendations. If you’re ready, get started now.

- Whether you see yourself as an investor or a trader, an investment calculator can help you figure out how to meet your goals. It can show you how your initial investment, frequency of contributions and risk tolerance can all affect how your money grows.

Photo credit: ©iStock.com/Image Source, ©iStock.com/jgroup, ©iStock.com/Leoba