Compound interest can help your investments to grow exponentially over time. Unlike simple interest, which is calculated solely on the principal amount, compound interest accrues on both the initial principal and the interest that’s accumulated over previous periods. This process of earning “interest on interest” leads to significantly larger returns, particularly when investments are held over extended periods of time. Understanding the compounded interest formula can help you estimate the future value of an investment, as well as a loan.

A financial advisor can help you create an investment portfolio that takes advantage of compound interest.

What Is Compound Interest

Compound interest is the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. This method of calculation allows investments to grow at a faster rate compared to simple interest, which is computed only on the principal amount.

Compound Interest Formula

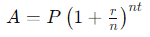

The compound interest formula is:

In this formula:

- A is the future value of the investment or loan, including the interest.

- P is the principal investment amount (either the initial deposit or the loan amount).

- r is the annual interest rate (in decimal format).

- n is the number of times interest is compounded per year.

- t is the time the money is invested or borrowed for (in years).

How to Calculate Compound Interest

To calculate compound interest, do the following:

- Identify the principal amount (P).

- Determine the annual interest rate (r) and convert it to a decimal format.

- Find out how often the interest is compounded per year (n).

- Decide the total number of years the money will be invested or borrowed (t).

- Plug these values into the compound interest formula.

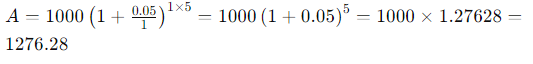

For example, if you invest $1,000 at an annual interest rate of 5%, compounded annually for 5 years, your calculation would look like this:

This means that after 5 years, your investment would grow to $1,276.28.

Benefits of Compound Interest in Investing

Whether you’re planning for retirement, saving for education, or aiming to grow your portfolio, understanding the benefits of compound interest can help you make more-informed investment decisions. Here are four general benefits to keep in mind:

- Accelerated growth: One of the key benefits of compound interest is its ability to accelerate investment growth. By earning interest on both the principal and the accumulated interest, your investment grows at an increasing rate over time.

- Maximizing returns: Compound interest maximizes the returns on your investments by continually reinvesting earned interest. This means that even small, regular contributions to an investment account can grow substantially over time.

- Long-term wealth building: For long-term investments, compound interest is particularly advantageous. The longer the investment period, the more pronounced the compounding effect. This makes it an ideal strategy for retirement planning, education savings, and other long-term financial goals.

- Inflation hedge: Investments that benefit from compound interest can also serve as a hedge against inflation. As the investment grows, it can help preserve and increase the purchasing power of your money over time, offsetting the eroding effects of inflation.

Frequently Asked Questions About Compound Interest

What Is Compound Interest?

Compound interest is the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. This allows investments to grow at a faster rate compared to simple interest.

How Is Compound Interest Different From Simple Interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and the accumulated interest. This results in compound interest growing investments more quickly over time.

How Often Is Interest Typically Compounded?

Interest can be compounded on various schedules, including annually, semi-annually, quarterly, monthly, or daily. The frequency of compounding can significantly impact the growth of the investment.

Bottom Line

Compound interest allows you to earn interest on both the original principal of a loan or investment and the interest that has been added over time. By reinvesting earned interest and allowing your investments to grow exponentially over time, you can achieve your long-term financial goals more efficiently. Whether you’re saving for retirement, education, or simply building wealth, compound interest can make a substantial difference in the success of your retirement and investment portfolios.

Tips for Utilizing Compound Interest

- If you’re looking to take advantage of compound interest in your investment portfolio, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- A high-yield savings account is one option for setting aside money to earn compound interest. However, you might also consider opening a money market account or a certificate of deposit account instead. With money market accounts, you can earn interest on balances, but you may have check-writing privileges or debit card access to your savings. CD accounts allow you to set aside money and earn interest for a set time period. Once your CD matures, you can withdraw your principal and the interest earned. Similar to high-yield savings accounts, an online bank may be the best option for opening money market or CD accounts.

Photo credit: ©iStock.com/insta_photos, ©iStock.com/BongkarnThanyakij, ©iStock.com/JLco – Julia Amaral