Student loan relief has finally gotten the green light, and it couldn’t come at a better time. The federal student loan repayment pause will be lifted in December 2022, with payments resuming in January 2023.

Making good on his campaign promise, President Biden has received approval to move forward with targeted student loan debt relief, allowing relief for more than 40 million borrowers and a complete cancellation for about 20 million borrowers. Savings will range from $10,000 to $20,000 in total forgiveness, depending on eligibility.

For money-minded individuals looking to make smart cash decisions, this benefit presents the question: “What should I do with all these savings?” Here’s our guide.

If you need more of a hands-on approach for your finances, a financial advisor can help you create a financial plan to manage your money.

2022 Student Loan Relief Summary

One of President Biden’s biggest promises in 2020 was to combat the looming trillion-dollar student loan debt crisis. Many Americans have long struggled with student loan debt, taking on large amounts to finance their post-high school education.

The goals laid out by the Biden-Harris administration will overhaul higher education costs. These will include:

- Cutting undergraduate loan payments in half: This will lower the average annual payment by over $1,000.

- Repairing the Public Service Loan Forgiveness (PSLF) program: This will allow borrowers who work in nonprofits, the military, or branches of government to receive credit toward loan forgiveness through the PSLF program.

- Safeguarding future college attendees with college cost reduction: This proposal includes doubling the maximum Pell grant and offering free community college.

And it all starts with the Department of Education providing debt cancellation for both Pell Grant and non-Pell Grant recipients.

How Much You Could Save

The relief structure is simple. There are two tiers of forgiveness: Pell Grant recipients and non-Pell Grant Recipients. A Pell Grant is a sum of money provided by the government to low-income students. Unlike a loan, the Pell Grant does not have to be repaid. If you received a Pell Grant, it will be listed on your FAFSA award letter.

Pell-Grant recipients are eligible to receive up to $20,000 in debt cancellation. Non-Pell Grant recipients are eligible to receive up to $10,000 in debt cancellation. This will not apply to the top 5% of incomes. Individuals are only eligible if their income is less than $125,000 or $250,000 for married couples.

Where to Apply Your Student Loan Savings

Now that you’ve been briefed on the student loan relief plan and the savings you are eligible for, let’s talk about where to apply those savings: outstanding debt and retirement.

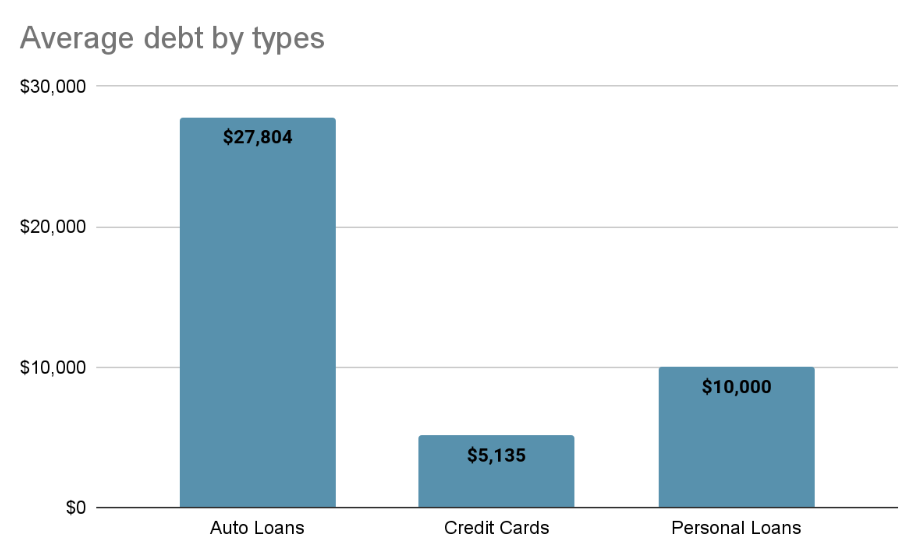

Outstanding debt: The average debt per American household is laughably high. Even when you take out the student loan debt, Americans are still taking on liability with automobiles, personal loans and credit cards.

Putting the newfound student loan savings towards other debt relief efforts is a smart move. By eliminating your debt you could see a raise in your take-home income that could be put towards an emergency fund, general savings or retirement.

Below is a chart based on a 2021 study reflecting the average debt by type.

Retirement: The other option is playing catch-up with retirement savings. With significant student loan debt and the high cost of homes, Millennials and Gen Zs are either postponing their saving for retirement or are not saving enough. While it may look like retirement is far off for a twenty-something, what they are truly missing is the concept of compounding interest that will mean the difference in thousands of dollars when retirement rolls around. To know if you are on track with your savings use a retirement calculator to see how much you’ll need.

If you haven’t been contributing to retirement or you are not contributing at the rate necessary, taking the excess savings from the student loan relief can help you bridge the gap.

By the Numbers: Your Potential Savings

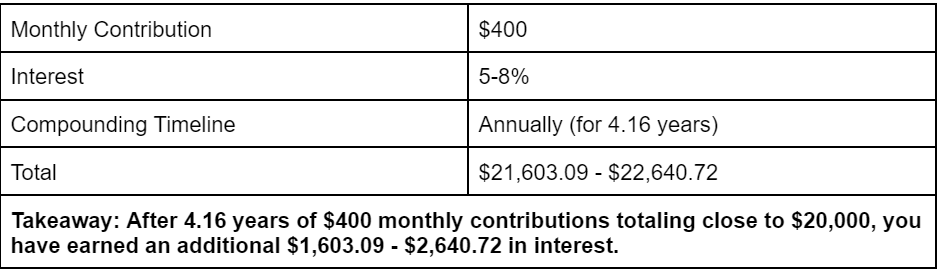

The average American had a student loan payment of about $400 prior to the payment pause according to the Federal Reserve. That’s an average of $4,800 annually. If you receive $20,000 in savings, that $4,800 is a little over four years’ worth of contributions. Assuming you’re 30 years old with plans to retire at 65, let’s see how that will translate over 35 years if you chose to contribute to retirement savings with an average return of 5-8% and annual compounding interest.

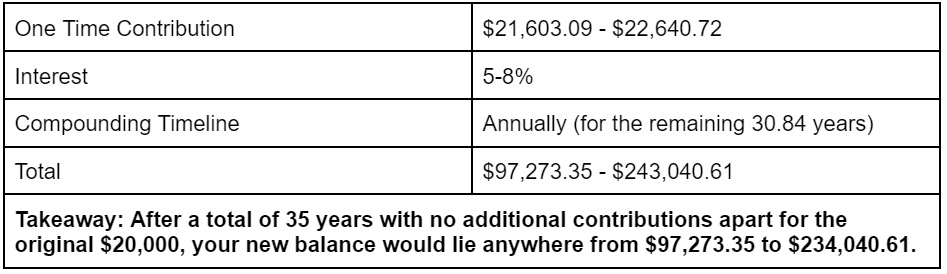

Now, let’s look at the table below to see what that sum alone will look like if it’s allowed to continue to sit and grow in a 401(k) account for the remainder of your working years until you reach the age of 65.

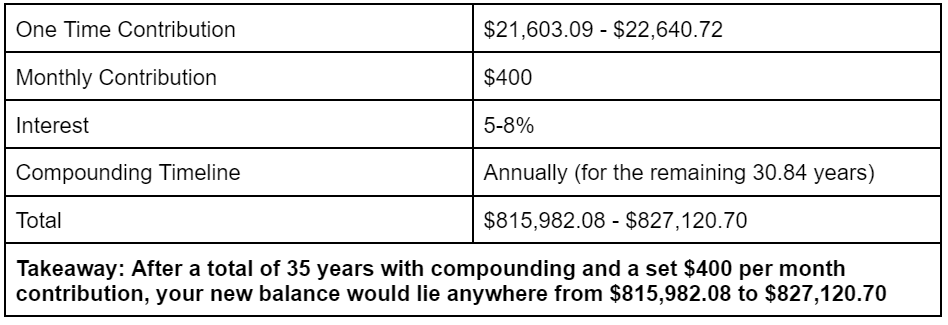

If you were wise and chose to continue contributing the same $400 per month for the remaining 30.84 years until you hit age 65 here is what your total retirement nest egg would look like.

Bottom Line

If you have student loans and make under $125,000 annually ($250,000 for married couples) you will be receiving a $10,000 to $20,000 reduction in student loan debt. What you do with the savings is up to you but with Social Security insolvency on the horizon, beefing up your retirement savings can be a smart option to retire comfortably.

Tips on Retirement

- The decision about when to retire is one of the most important and challenging many of us will make. A financial advisor can help you decide on a timeframe, as well as create a plan for the future. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Use our free retirement calculator to gauge your progress toward the retirement goals you have set for yourself.

Photo credit: ©iStock.com/PeopleImages