The high-low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. By focusing on these extremes, the high-low method helps determine the variable cost per unit and the total fixed cost. This provides insight into how expenses fluctuate with production. The high-low method is useful for both businesses and investors who are seeking a quick estimate of cost behavior without delving into more detailed financial data.

Are you looking to build a financial plan? Consider working with a financial advisor as you put together long-term investment goals.

What Is the High-Low Method?

The high-low method is a cost-estimation method that identifies the variable and fixed costs within a company by using only the highest and lowest points of activity. Activity levels may be based on number of products manufactured, number of guests served or a similar metric. This method calculates variable cost per unit based on these extremes, then applies it to determine the total fixed costs.

By analyzing high and low data points, the high-low method creates a cost model that can help predict expenses at different levels of production. However, it assumes a linear relationship between activity levels and costs. This makes it most reliable in stable environments with minimal cost fluctuations.

3 Steps for Using the High-Low Method

To calculate costs using the high-low method, here are the steps to follow:

1. Determine the Variable Cost Component:

The formula for variable cost per unit is:

Variable Cost = (Highest Activity Cost – Lowest Activity Cost) ÷ (Highest Activity Units – Lowest Activity Units)

Here, the highest and lowest activity units refer to the periods with maximum and minimum activity levels, respectively. Use the number of products shipped, customers served or similar unit measure rather than costs to identify the highest activity levels. This period may be a month, a quarter or other span of time.

2. Calculate the Fixed Cost Component:

Once the variable cost is calculated, use this value to find the fixed cost with the following formulas:

Fixed Cost = Highest Activity Cost – (Variable Cost × Highest Activity Units)

Fixed Cost = Lowest Activity Cost – (Variable Cost × Lowest Activity Units)

3. Calculate the Total Cost Using the High-Low Cost Formula:

Finally, use the calculated variable and fixed costs to determine the total cost at a specific activity level:

Total Cost = Fixed Cost + (Variable Cost × Units of Activity)

Putting the High-Low Method into Practice

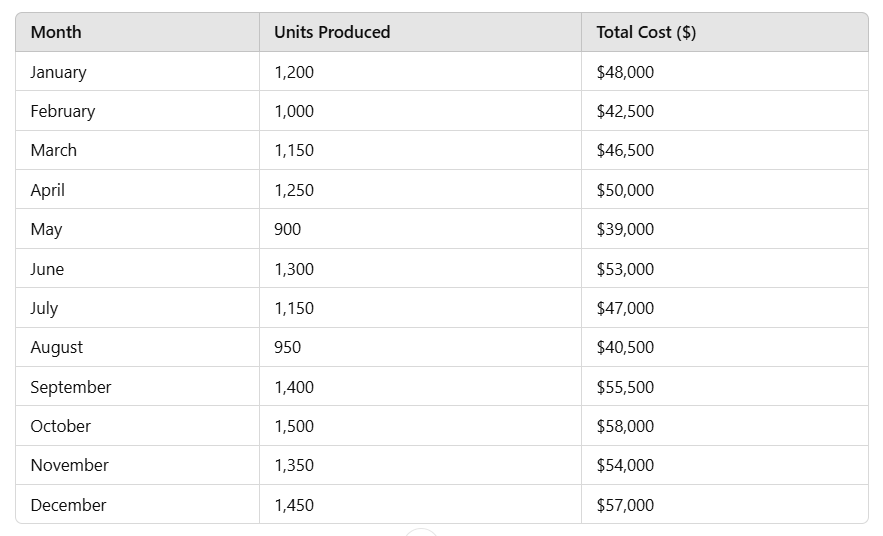

As an example of using the high-low method, assume a company that tracks the number and cost of products it makes every month wants to understand their cost variance throughout the fiscal year. Here’s a monthly breakdown:

For this example, the highest activity occurs in October with 1,500 units produced, costing this hypothetical company $58,000. The lowest activity is in May with 900 units produced, costing them $39,000.

1. Calculate Variable Cost per Unit

Using the high-low formula for variable cost:

Variable Cost = ($58,000 – $39,000) ÷ (1,500 – 900)

Variable Cost = $19,000 ÷ 600

Variable Cost = $31.67 per unit

2. Calculate Fixed Costs

Choose either the high or low point to solve for fixed costs. Let’s assume the company wants to start by using the high point:

Fixed Cost = $58,000 – ($31.67 × 1,500)

Fixed Cost = $58,000 – $47,505

Fixed Cost = $10,495

Now let’s flip it and assume the company wants to use the low point:

Fixed Cost = $39,000 – ($31.67 × 900)

Fixed Cost = $39,000 – $28,503

Fixed Cost = $10,497

The fixed costs are nearly identical for both high and low points. This indicates that the high-low method has been performed correctly. It shouldn’t matter whether you use the high or low points, as the relative difference between each metric is matched within itself.

3. Construct the Total Cost Equation

Using the calculated fixed and variable costs for the high point and an estimated production of 2,000 units, the total cost equation becomes:

Total Cost = $10,495 + ($31.67 × 2,000)

Total Cost = $10,495 + $63,340

Total Cost = $73,835

A similar calculation can suggest likely costs for other production levels. Once the variable cost figure is known, it’s only necessary to multiply it by the projected production figure and add fixed costs.

What We Can Learn From the High-Low Method

The high-low method helps companies estimate costs quickly and can empower them to predict future expenses for different production levels. This method is especially useful for companies with seasonal production fluctuations, as it helps to set cost baselines and identify how fixed and variable costs impact overall spending.

Limitations and Other Considerations

While practical, the high-low method has some limitations. It relies only on the highest and lowest extremes and overlooks other activity levels. This can lead to inaccuracies if these extremes are not typical of regular operations.

Additionally, the high-low method assumes a linear relationship between costs and activity, which may not hold in all business scenarios. For companies with fluctuating or irregular costs, alternative cost estimation methods may offer a more accurate picture of expenses.

Common Uses for the High-Low Method

The high-low method is particularly beneficial for small business owners, financial analysts and accountants who need a quick and simple way to estimate fixed and variable costs. It’s especially useful when detailed cost data is limited, allowing for rapid approximations of cost behavior to inform budgeting and decision-making processes.

In personal or business budgeting, the high-low method can separate fixed costs, like base fees, from variable costs, such as usage-based expenses. For example, individuals can analyze utility bills to see which portion remains constant and which changes with consumption. Small businesses can use it to understand delivery or production costs and plan more effectively.

This method can also support decision-making by revealing how costs might change in different scenarios. For investors, it provides insight into a company’s cost structure, helping them assess efficiency and growth potential. By applying the high-low method, readers can gain a clearer understanding of cost behavior and use it to plan or evaluate opportunities.

Frequently Asked Questions

What Are the Advantages of Using the High-Low Method?

The primary advantage of the high-low method is its simplicity. It requires only the highest and lowest activity levels and their corresponding costs to estimate variable and fixed cost components.

How Does the High-Low Method Compare to Regression Analysis?

Regression analysis considers all available data points to provide a more precise estimation of cost behavior, capturing variations and trends that the high-low method might overlook. However, regression analysis is more complex and requires statistical software or advanced calculations, whereas the high-low method offers a quicker alternative, albeit at the cost of some degree of accuracy.

Bottom Line

The high-low method is a useful tool for estimating fixed and variable costs, helping businesses predict how expenses change with activity levels. While it’s not without limitations, it provides a quick and accessible way to analyze cost behavior. For investors and business owners, the high-low method can support better cost control, financial planning and investment decisions.

Tips for Financial Planning

- A financial advisor can help you mitigate risk for your portfolio. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- To get a handle on your take-home pay after accounting for withholding and taxes, use SmartAsset’s federal paycheck calculator.

Photo credit: ©iStock.com/fizkes, ©iStock.com/Miljan Živković, ©iStock.com/MangoStar_Studio