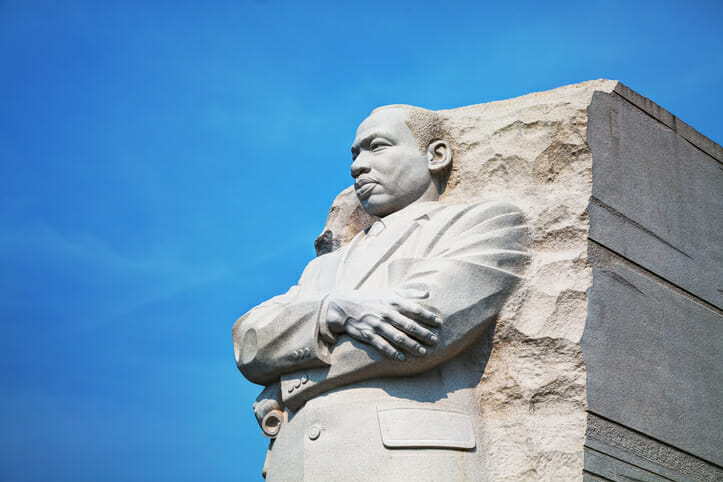

While Dr. Martin Luther King Jr. is best known for his pioneering fight for civil rights and racial equality, he also promoted valuable practical wisdom about how to handle your money. Financial planning firm Facet has collected five of his top priorities that bear on personal finance and individual development. You can read about them below.

Consider working with a financial advisor to ensure that your financial priorities and practices are being followed in the most advantageous way.

1. Live Modestly

King, who was an ordained Baptist minister, based his civil rights work on his theology. One product of that religious orientation was a warning against materialism.

“Money in its proper place is a worthwhile and necessary instrument for a well rounded life; but when it is projected to the status of a god it becomes a power that corrupts and an instrument of exploitation,” he said in 1953. “Man is more than a dog to be satisfied with a few economic bones.”

One way to ensure that your spending stays within appropriate boundaries is to use SmartAsset’s free budget calculator.

2. Persevere

Never stop pressing on, King said. Despite multiple attempts on his life, financial setbacks, illegal arrests and incarcerations, slander and defamation of character, the civil rights icon refused to back off.

In his Founder’s Day address at Spelman College on April 10, 1960, entitled “Keep Moving from This Mountain,” King concluded his challenge to the students and faculty with these words: “If you can’t fly, run; if you can’t run, walk; if you can’t walk, crawl; but by all means keep moving.”

Thinking long-term and staying afloat during set-backs is important as you strive to achieve your lofty goals, financial and otherwise.

3. Invest in Yourself

King stressed the importance of both intellectual and moral development.

The function of education, therefore, is to teach one to think intensively and to think critically. But education which stops with efficiency may prove the greatest menace to society,” he wrote in the campus literary journal of Morehouse College. “The most dangerous criminal may be the man gifted with reason, but with no morals.”

On the financial side of things, following this advice means boosting your financial literacy, boning up on your personal finance fundamentals, investing strategically and potentially mining wisdom from a financial advisor.

4. Give Generously

Every month, King donated to charity. And when he won the Nobel Peace Prize in 1964 he donated it all to the civil rights movement. In inflation-adjusted terms the amount of the prize, $54,600, would be equivalent in today’s dollars to nearly $500,000.

One way to emulate King’s example would be to make a qualified charitable distribution (QCD) from an IRA. Such a move could be better than making a tax-deductible contribution since you won’t get credit for a charitable donation if you don’t itemize your deductions.

5. Build with Intention

Making a difference requires a plan, a blueprint, he said on Oct. 26, 1967, during a speech at Barratt Junior High School in Philadelphia. “Whenever a building is constructed, you usually have an architect who draws a blueprint. And that blueprint serves as the pattern, as the guide, as the model, for those who are to build the building. And a building is not well erected without a good, sound and solid blueprint.”

In your financial life, you can’t just blindly set off on a course. You have to implement a strategic financial plan, potentially with the help of a financial advisor.

The Bottom Line

In the space of his 39 years, King made permanent changes in the U.S. The most well-known of his initiatives concern civil rights. But his sermons, writings, lectures and his own example exemplified a comprehensive agenda for human flourishing, including how to handle personal finance and lifestyle issues. He warned against materialism and advocated investing in yourself, persevering, giving generously and building with intention.

Tips on Finances

- A financial advisor can help you apply King’s advice on handling money. If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Determine how your money will grow over time with this free investment calculator from SmartAsset.

Photo credit: ©iStock.com/AndreyKrav, @iStock.com/Michael Vi, ©iStock.com/krblokhin