Often when we think about the finances of older Americans, a couple of words come to mind: investments and retirement. Student debt among older Americans is a less typical conversation. However, about 6% of Americans ages 50 and older carry an average of $45,641 in student debt in addition to potential other debt. That’s $333.2 billion dollars spread across 7.3 million people ages 50 and older, according to Federal Student Aid, an office of the U.S. Department of Education.

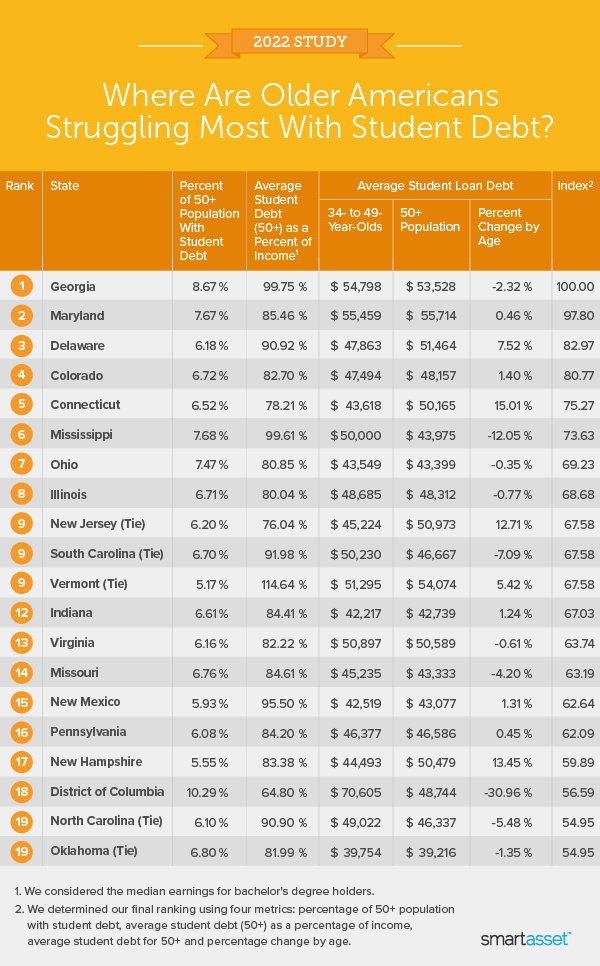

In this study, SmartAsset investigated where older Americans are struggling with student debt most, comparing the 50 states and District of Columbia. We considered four metrics to calculate our ranking: percentage of the 50+ population with student debt, average student debt for the 50+ population (as a gross figure and compared to income), and percentage change in debt by age. For more information on our data sources and how we put all the information together to create the final rankings, read our Data and Methodology section below.

Key Findings

- In 17 states, older residents carry more student debt on average than those ages 34 to 49. Connecticut ranks worst for the metric, percentage change in average student loan debt by age. Average student debt among residents ages 50 and older is 15% higher than the average student debt for 35- to 49-year-olds.

- Southern states dominate the top 11 when it comes to student debt struggles for older Americans. Overall, residents in Southern states account for 35% of total U.S. student debt for the 50 and older population. Followed by the Midwestern states (19.0%), Western states (17.8%) and finally Northeastern states (16.2%).

1. Georgia

Topping the list in our study, Georgia ranks highest in student debt struggles for its 50 and older population. On average, older Americans have $53,528 in student debt, which ranks third-highest. When compared to the 50+ population, Georgia ranks second-highest – behind the District of Columbia – for the percentage of older residents with student debt (8.7%).

2. Maryland

Maryland ranks worst in average amount of student loan debt for the 50 and older population ($55,714). It also ranks fourth-highest in the percentage of their age group that have student debt (7.7%). With tax season upon us, residents of Maryland can look forward to additional tax credits for student debt this year.

3. Delaware

Delaware may rank second to last in terms of size, but it places third-highest in our list of where older Americans struggle most with student debt. Older Americans hold an average of $51,464 in student debt and when compared to income, that’s 90.9% of a year’s take-home. Average student debt among the 50+ population in Delaware is 8% higher than debt held by residents ages 34 to 49.

4. Colorado

The first state in the top 11 with an average student debt below $50,000 is Colorado. Average student debt for the 50+ population is $48,157 and there are 127.5 thousand borrowers in this age group. The average student debt for older Colorado residents as a percentage of income is 82.7%. The COVID-19 pandemic has stressed the finances of many but when it comes to student debt: Colorado residents reduced the delinquency rates of student debt payments by 36%.

5. Connecticut

Home to one of the most prestigious Ivy League schools, this Northeastern state ranks fifth-highest for older Americans struggling with student debt. On average, residents of Connecticut ages 50 and older have over $6,000 more student debt than residents ages 35 to 49. Ranking eighth, the average amount of student debt for the 50 and older population is $50,165.

6. Mississippi

Mississippi ranks third-worst for the percentage of the 50+ population with student debt (7.7%) and average student debt as a percentage of median earnings (99.6%). Average student debt for residents ages 50+ is $43,975 and the median income for a bachelor’s degree holder in Mississippi is $44,148. But when you compare the 50+ average debt held by the age group 35 to 49, there is a 12% decrease. This shows that older Mississippi residents generally have less student loan debt when compared with younger age groups in the state.

7. Ohio

More than 7% of the 50+ population in Ohio have student debt, the fifth-highest rate in our study. Older Americans in this state also have an average of $43,399 in student debt. Ranking eighth-highest for the percentage of total outstanding student debt for the 50 and older age group in the U.S., Ohio contributes 3.7% of it, which equates to $14.2 billion.

8. Illinois

Illinois is our eighth-ranking state. Older residents in this Midwestern state carry about the same student debt as 35- to 49-year-olds. On average, 50 and older student debt is $48,312 and 6.7% of this population has student debt in Illinois.

9. New Jersey (Tie)

This Northeastern state joins Connecticut in the top 11, but ties for ninth with two other states. New Jersey also ranks fifth-highest for the average amount of student debt ($50,973) for the 50 and older population. That debt amount is 12% higher than the 35 to 49 year old age group and New Jersey ranks third-highest for that metric.

9. South Carolina (Tie)

In South Carolina, residents ages 50 and older typically have less debt than younger groups. When specifically compared with those ages 35 to 49, there is a 7% decrease in the amount of student debt held by the 50 and older population. However, South Carolina still ranks poorly when comparing average student debt for the 50+ population to income. We found that this figure amounts to almost 92% – the 10th-highest rate in our study.

9. Vermont (Tie)

Of the states at the top of the ranking, Vermont is the sole state where average student debt as a percentage of median income exceeds 100%. With the average student debt for those ages 50 and older at $54,074 and the median earnings for a bachelor’s degree holder at $47,170, that equates to 114.6%. Vermont also ranks second for average student debt and seventh for percentage change in debt amount between 35- to 49-year-olds years old and those 50 and older.

Data and Methodology

To find where older Americans are struggling most with student debt, SmartAsset looked at data on all 50 states and the District of Columbia. SmartAsset compared places across the following four metrics:

- Percentage of the 50+ population with student debt. This is the number of borrowers ages 50 and older divided by the state’s 50 and older population. Data comes from Federal Student Aid, an office of the U.S. Department of Education, and the Census Bureau’s 1-year 2019 American Community Survey.

- Average student debt (50+ population) as a percentage of income. This is average student debt for the 50 and older population divided by median earnings for bachelor’s degree holders. Data comes from Federal Student Aid, an office of the U.S. Department of Education, and the Census Bureau’s 1-year 2019 American Community Survey.

- Average student debt (50+ population). This is the outstanding debt amount in each state divided by the number of borrowers. Data comes from Federal Student Aid, an office of the U.S. Department of Education.

- Percentage change in student debt by age. This is the change between the average amount of student debt held by 35- to 49-year-olds and individuals 50 and older. Data comes from Federal Student Aid, an office of the U.S. Department of Education.

We ranked each state in all four metrics. We then found each state’s average ranking, giving a double weighting to the percentage of the 50+ population with student debt. Using this average ranking we created our final score. The state with the highest average ranking received a score of 100, ranking as the state where older Americans struggle the most with student debt. The state with the lowest average ranking placed as the state where older Americans struggle least with student debt.

Tips for Managing Student Debt

- Manage your budget. For some, student loan payments can cost more than a car payment or take away from what you can put away in savings, but you can gain financial control with budgeting. Our budget calculator can give you a clear picture of your current spending but also visualize the next six months and show you where cutting back on excess expenses can maximize your savings.

- Consider refinancing. Another way to directly tackle this debt is to change the terms of your loan(s) by refinancing. If you refinance all your student loans it is possible to get access to lower rates or to extend the life of the loan to lower monthly costs.

- Work with a professional. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com.

Photo credit: © iStock/designer491