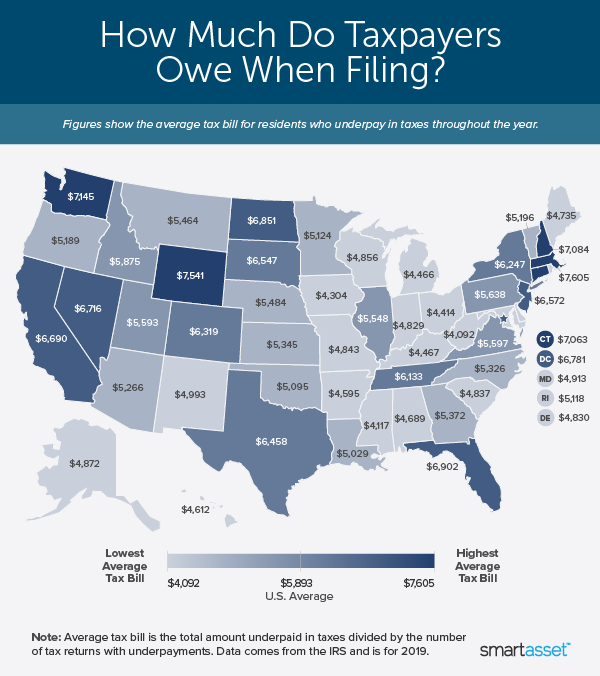

Is tax season a time when you look forward to an eventual refund or dread a looming tax bill that could cost you thousands of dollars? Taxpayers who owed the IRS money when they filed their 2019 federal tax return faced an average tax bill of $5,893. That’s $272 more than one year earlier when those who underpaid their taxes during the year ended up owing $5,621.

However, when you take a closer look at the data, you notice that the average tax bill varies significantly from state to state. With tax season on the horizon, we compared the size of the average tax bill in each state and ranked them from highest to lowest.

To compile our rankings, we analyzed IRS data for all 50 states and the District of Columbia across two metrics from 2019 (the latest year available): the number of tax returns with underpayments and the total amount underpaid in taxes. For details on our data sources and how we put all the information together to create our final rankings, you can read more in the Data and Methodology section below.

This is SmartAsset’s fourth study on the states with the largest tax bills. Check out the 2021 version here.

Key Findings

- Massachusetts has the highest average tax bill, while West Virginia has the lowest. Massachusetts taxpayers who underpaid on their taxes in 2019 owed an average of $7,605, the most of any state. Meanwhile, taxpayers in West Virginia who owed money to the IRS had an average tax bill of just $4,092, nearly 86% less than those in the Bay State.

- Some states push the national average higher. Thirty-five states had average tax bills less than the national average of $5,893 in 2019. But 15 states and the District of Columbia had average tax bills that exceeded the national average that same year. In particular, five of them (Massachusetts, Wyoming, Washington, New Hampshire and Connecticut) had average tax bills of over $7,000.

- One-fifth of all tax returns had underpayments. Of the 156.8 million tax returns filed across the 50 states and the District of Columbia in 2019, just over one-fifth (21.26%) had underpayments. As a result, 33.3 million taxpayers owed the IRS money that year.

1. Massachusetts

Massachusetts had the nation’s largest average tax bill ($7,605) in 2019. Out of the 794,440 tax returns filed in the state that year, 22.7% had underpayments. The total amount of taxes underpaid was $6.04 billion.

2. Wyoming

Wyoming taxpayers who underpaid their taxes in 2019 owed an average of $7,541, second-most of all 50 states and the District of Columbia. Wyoming had the nation’s fewest tax returns filed in 2019 (280,640), nearly 20% of which had underpayments. Wyoming taxpayers who underpaid their taxes in 2019 owed the IRS more than $416 million.

3. Washington

Taxpayers in Washington with underpayments in 2019 owed an average of $7,145, third-most in the U.S. Meanwhile, 23.21% of all tax returns filed in the Evergreen State had underpayments. Those underpayments equaled more than $6.2 billion, the nation’s eighth-largest sum in 2019.

4. New Hampshire

The Live Free or Die State had the fourth-highest average tax bill in 2019. New Hampshire taxpayers who underpaid that year owed an average of $7,084 at tax time. Of the 723,640 returns filed in 2019, 20.44% had underpayments. New Hampshire had a total of $1.04 billion in underpaid taxes, 36th-most across our study.

5. Connecticut

The third New England state in the top 10, Connecticut taxpayers who underpaid their taxes in 2019 owed an average of $7,063. Nearly 400,000 tax returns had underpayments that year totaling $2.82 billion, which was more than what was owed 30 other states.

6. Florida

Florida had the sixth-highest average tax bill in 2019, as taxpayers who underpaid that year owed $6,902 on average. IRS data shows there were 2.19 million tax returns with underpayments in 2019 totaling $15.1 billion in taxes owed (third-most).

7. North Dakota

For 2019 tax returns with underpayments, North Dakota taxpayers owed an average of $6,851, the seventh-most in the U.S. Of the 371,950 tax returns filed that year, 21.13% had underpayments. In total, North Dakota taxpayers owed $538 million, the sixth-smallest sum across our study.

8. District of Columbia

The nation’s capital had the eighth-highest average tax bill in 2019, as taxpayers who underpaid their taxes owed an average of $6,781. Of the 351,550 tax returns filed in the District of Columbia that year, 24.96% had underpayments.

9. Nevada

With an average tax bill of $6,716, Nevada taxpayers owed the IRS the ninth-most money in the nation in 2019 on average. The state had a total of 310,130 tax returns with underpayments adding up to $2.08 billion in owed taxes.

10. California

The Golden State had the highest percentage of tax returns with underpayments (26.11%) in the country in 2019. The average taxpayer who underpaid their taxes that year owed $6,690 to the IRS, the 10th-highest average across our study.

Data and Methodology

To find the states with the largest tax bills, we examined data for all 50 states and the District of Columbia, focusing on two metrics:

- Number of tax underpayments. This is the number of tax returns where taxpayers did not pay sufficient taxes on income earned and thus owe money to the IRS.

- Amount of underpaid tax. This is the total amount of taxes owed to the IRS on returns for income that taxpayers have failed to pay throughout the previous year.

For each state, we divided the amount of total underpaid tax (the money taxpayers owed) by the number of tax underpayments in that state. The result represents the average underpayment amount for taxpayers who underpaid on taxes throughout the year. We used this dollar figure for each state to rank the entire list from highest to lowest.

All data comes from the IRS and is for 2019.

Tips for Managing Your Tax Liability

- Work with a financial advisor. If you’re looking for ways to cut down on your tax liability, consider working with a financial advisor who specializes in tax strategy. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Be mindful of your capital gains. Investments you sell at a profit will generate taxable income that you’ll need to report to the IRS. Remember, assets sold less than one year after being purchased are taxed as ordinary income, while those that are sold after being held for more than a year are taxed at the more favorable long-term capital gains rates. Use our capital gains calculator to estimate how much you may owe in taxes when selling an investment.

- Tax advantage of tax credits and deductions. It’s important to understand the tax credits and deductions for which you may be eligible. Tax credits reduce the amount of taxes you owe on a dollar-for-dollar basis. In other words, if you owe $2,000 in taxes but qualify for a $1,000 credit, your tax bill will be $1,000. A deduction, on the other hand, simply lowers the amount of income that you’ll ultimately pay taxes on.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/nortonrsx