Strains on consumer finances during the COVID-19 pandemic have increasingly pushed Americans to seek assistance from the Consumer Financial Protection Bureau (CFPB), which serves as an intermediary between consumers and financial companies. Consumers can file complaints on consumer financial products or services through the CFPB, which relays these concerns to financial institutions and also publishes anonymized data on all these submissions.

This data shows that across the 50 states and District of Columbia, the CFPB received 62% more consumer financial complaints in 2020 compared to 2019. Moreover, the CFPB reports that “beginning in April 2020, consumers began to submit more than 3,000 complaints mentioning coronavirus keywords nearly every month.”

Given the large increase in consumer financial complaints during COVID-19, SmartAsset took a closer look at the types of complaints filed and geographical differences in complaint rates. Specifically, in this study, we identify the financial products that were most complained about, along with the states that had the most consumer financial complaints relative to the population. We additionally rank the states with the largest increases in consumer financial complaints by comparing the number of financial complaints for every 1,000 people in 2019 and 2020. For more information on our data and how we put it together, read our Data and Methodology section below.

Key Findings

- Credit reporting remained the top financial complaint in 2020. Almost two in three filed complaints in the 50 states and the District of Columbia are related to incorrect information reported on one’s credit report. Additionally, it was the top complaint in each state individually and the District of Columbia.

- The financial complaint rate increased in all but one state. Across 49 states and the District of Columbia, the number of financial complaints for every 1,000 residents increased between 2019 and 2020. Wyoming is the only state that saw a slight decrease in the number of financial complaints filed per capita.

- From 2019 to 2020, Southern states saw large increases in consumer financial complaints. The top five states with the largest increases in consumer financial complaints are all in the South. They include Arkansas, Alabama, Florida, Georgia and Tennessee. In four out of the five states (all excluding Tennessee), at least one additional person for every 1,000 reported a financial complaint in 2020 relative to 2019.

Consumers’ Top Financial Complaints

The CFPB categorizes the complaints it receives by product, which includes bigger topics like mortgage or credit cards and then specific issues within each topic. For example, if a consumer wanted to complain about having trouble using their credit or prepaid card, they would file the complaint under the larger category of credit and prepaid cards and then the more specific issue of trouble using one’s card.

In 2020, credit reporting was cited as the financial product with the most complaints. Roughly 68% of these complaints are related to incorrect information on one’s credit report. Two other credit reporting issues cited by consumers included facing problems with a credit reporting company’s investigation into an existing dispute and the improper use of one’s report.

The next two most-common complaints about financial products have to do with debt collection and credit or prepaid cards. According to CFPB data, roughly 12% of 2020 complaints relate to debt collection while around 7% of them deal with credit or prepaid cards. And approximately 52% of consumers who complain about debt collection cite the primary issue as “attempts to collect debt not owed.” Meanwhile, the most common issue for credit or prepaid card complaints relates to problems with a purchase shown on one’s statement. About 26% of consumers with credit or prepaid card complaints mark this as their issue.

Less than 10,000 complaints were filed for four financial products in 2020. They include money transfer, virtual service or money service; vehicle loan or lease; student loan and payday, title or personal loans. Of complaints filed with the CFPB, only about 5% of consumers cite one of these four financial products. The table below shows consumer financial complaints in 2020 sorted by product type.

States With the Most Consumer Financial Complaints

In 2020, Florida was the state with the most consumer financial complaints adjusted for population. Data from the CFPB shows that there was a total of 2.87 complaints for every 1,000 people during the year. Roughly 74% of those complaints were related to credit reporting. The next most cited complaint in Florida during 2020 was related to credit and prepaid cards, with 5.12% of complaints referencing one of those financial products.

Across the top 10 states with the most consumer financial complaints, an additional seven states are located in the South, according to Census regional divisions. They include Georgia, Arkansas, Alabama, Delaware, Texas, Tennessee and Maryland. In four of those states (Georgia, Arkansas, Alabama and Delaware) along with Nevada and the District of Columbia, there were more than two financial complaints for every 1,000 people in 2020.

Financial complaints are least common in South Dakota, West Virginia and North Dakota. In 2020, a total of 241 complaints were filed by South Dakota residents, 530 were filed by West Virginians and 221 were filed by North Dakotans. Relative to population, 0.30 or fewer complaints were filed per 1,000 people in all three states. The heat map below shows consumer financial complaints in 2020 relative to population.

States With the Largest Increases in Consumer Financial Complaints

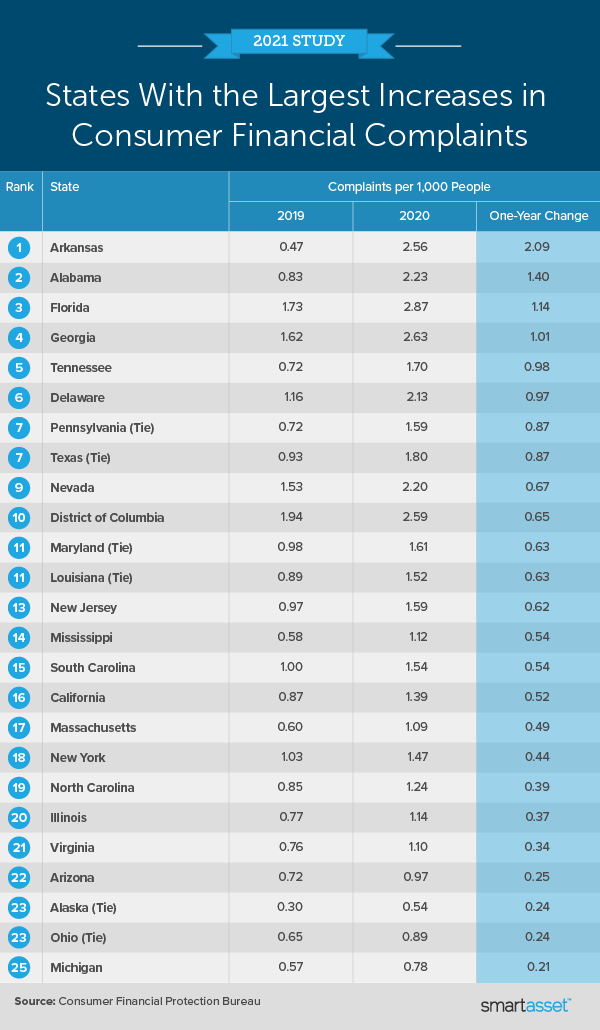

To identify the states with the largest increases in consumer financial complaints, we found the difference between the number of financial complaints per 1,000 people in 2019 and 2020. We ranked states according to that difference.

As previously noted, the top five states with the largest increases in financial complaints are Arkansas, Alabama, Florida, Georgia and Tennessee. Arkansas has the largest difference in complaint rates between 2019 and 2020 by a large margin. In 2019, roughly 0.47 complaints were filed with the CFPB per 1,000 residents. In 2020, that figure stood at 2.56 complaints per 1,000 residents, marking an increase of 2.09 more individuals per 1,000 reporting an issue to the CFPB.

Beyond those five states, the number of complaints per 1,000 people increased by 0.50 or more in 11 additional states. Of this group, the three largest states population-wise are California, Texas and Pennsylvania. Pennsylvania and Texas tie as the state with the seventh-largest increase in consumer financial complaints meanwhile California ranks 16th. The table below shows the top 25 states with the largest increases in consumer financial complaints between 2019 and 2020 by comparing complaints for every 1,000 individuals in the two years.

Data and Methodology

All data for this report comes from the Consumer Financial Protection Bureau (CFPB). We considered data from 2019 and 2020. For the second and third sections, we looked specifically at consumer financial complaints relative to the population, as reported by the CFPB.

Tips for Protecting Your Finances

- Boost your emergency savings. One of the best ways to prepare for the unknown is by having an emergency fund. Though typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, six months’ may be a better figure to shoot for, especially during recessions. Check out our budget calculator to see how much you spend each month, what six months of expenses would look like and how cutting back on discretionary expenses can increase your savings rate.

- Prioritize paying off debt, if possible. Do you have a debt you need to pay off? One way is to set aside some money each month to chip away at the debt. Use SmartAsset’s budget calculator to set up a spending plan that includes paying off a portion of your debt each month.

- Seek expert advice if you feel it’s right for you. A financial advisor can also help you create a plan to take greater control of your finances. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: iStock.com/Hispanolistic