The rising cost of a college education has been well documented over the last 30 years. In that time, average tuition and fees for in-state students at four-year universities has more than doubled, according to the College Board. However, in-state tuition still remains significantly more affordable than out-of-state tuition. In 2020-2021, average published tuition and fees for in-state students were $10,740 compared to $27,560 for out-of-state students.

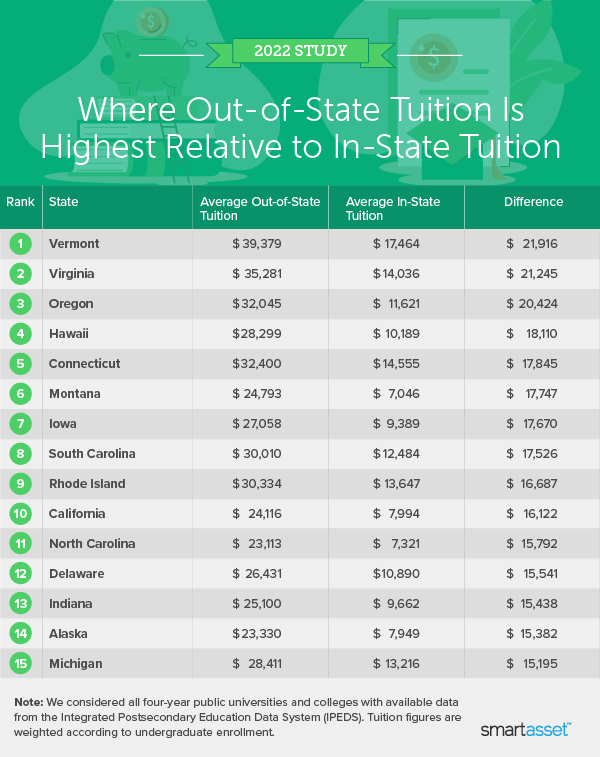

With this in mind, we set out to find the colleges and universities where it’s most expensive to be an out-of-state student. We analyzed data for all 50 states and the District of Columbia, as well as hundreds of public universities. For details on our data sources and how we put all the information together to create our final rankings, read the Data and Methodology section below.

Key Findings

- Out-of-state students pay more. Nationally, out-of-state students pay an average of $16,910 more than students who live in the states where they attend college. Though this figure varies across states, the lowest average difference between in-state and out-of-state tuition is $3,255 in South Dakota.

- Tuition is highest in Vermont. Not only does Vermont have the nation’s highest average out-of-state tuition ($39,379), but also the highest in-state tuition. Residents of the Green Mountain State pay an average of $17,464 per year when attending one of the state’s public colleges and universities.

- Tuition is lowest in Florida and South Dakota. At just $4,451, the average Florida in-state tuition is lowest in the nation. Meanwhile, South Dakota offers the lowest average out-of-state tuition at just $12,244.

States Where It’s Most Expensive to Be an Out-of-State Student

Vermont is not only home to the most expensive in-state and out-of-state tuition in the country, it also has the largest difference between the two. Vermont residents who attend one of the state’s four public universities paid an average of $17,464 in tuition and fees in 2020-2021. Meanwhile, average tuition and fees for out-of-state students ($39,379) was $21,916 more expensive per year.

In-state tuition and fees at Virginia’s 15 public universities averaged $14,036 in 2020-2021. That’s $21,245 less expensive than tuition and fees for out-of-state students, who paid an average of $34,281. Meanwhile, out-of-state students who attend Oregon’s eight state schools paid $20,424 more in tuition and fees than in-state students in 2020-2021. That’s the third-largest difference across our study. Oregon residents paid just $11,621 in tuition and fees that year, while out-of-state students paid $32,045.

Hawaii is home to the fourth-largest spread between in-state and out-of-state tuition. On average, out-of-state students paid $18,110 more than in-state students at the four public universities in the Aloha State in 2020-2021. In Connecticut, there was a $17,845 difference between in-state and out-of-state tuition in 2020-2021, the fifth-largest discrepancy in our study. On average, an in-state student paid $14,555 in tuition and fees at Connecticut’s 10 public schools, while an out-of-state student paid $32,400.

Schools Where It’s Most Expensive to be an Out-of-State Student

No state university has a larger discrepancy between in-state and out-of-state tuition than the University of Michigan-Ann Arbor. For the 2020-2021 school year, Michigan residents paid $15,948 in tuition and fees, while out-of-state students paid more than three times as much: $52,266. That’s a difference of $36,318.

At the University of Virginia’s main campus in Charlottesville, in-state tuition ($18,960) was $33,883 cheaper than out-of-state tuition ($52,843) in 2020-2021, which is the second-largest spread in our study among individual institutions. The University of California system, which comprises nine different campuses, had the third-largest discrepancy between in-state and out-of-state tuition at $29,754.

The University of Texas at Austin and Virginia Military Institute had the fourth- and fifth-largest gaps between in-state and out-of-state tuition in our study: $28,584 and $28,010, respectively.

States With Tuition Reciprocity Programs

Not all out-of-state students are stuck paying significantly higher tuitions than in-state students. Thanks to tuition exchange and reciprocity programs, some out-of-state students receive tuition reductions or even pay in-state rates at certain schools.

These initiatives are typically available to students in neighboring states or those located in the same geographic region. For instance, students from Illinois, Indiana, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, and Wisconsin may be eligible for tuition reductions at certain public and private schools via the Midwest Student Exchange. Meanwhile, through the Western Undergraduate Exchange (WUE), eligible students in 16 member states and territories can choose from hundreds of undergraduate programs outside their home states and pay no more than 150% of the in-state tuition.

“The benefits of these programs are that they enable a student to have an out-of-state college experience without incurring the full expense of attending a private university or a non-participating out-of-state public school,” said Dr. Deb Geller, a former associate dean of students at UCLA and current expert at Intelligent.com, a college rankings website. “In some cases, it may even cost less than attending one’s own in-state flagship public university, particularly when room and board are included in the cost analysis.”

Tuition reciprocity programs may enable a student to pursue an undergraduate degree not offered by their state school. However, they are not usually offered by highly competitive campuses, she added.

Data and Methodology

To rank the states and schools where it’s more expensive to be an out-of-state student, we examined higher education data for 50 states and the District of Columbia, and compared them across two metrics:

- Average in-state tuition and fees. Data comes from the Integrated Postsecondary Education Data System (IPEDS) and is for the 2020-2021 school year.

- Average out-of-state tuition and fees. Data comes from the Integrated Postsecondary Education Data System (IPEDS) and is for the 2020-2021 school year.

For each state, we calculated the weighted average in-state and out-of-state tuitions according to undergraduate enrollment. We then ranked the states according to the difference between average in-state and out-of-state tuition figures. We additionally looked at data for 733 individual four-year, public colleges and universities to find the schools where it’s most expensive to be an out-of-state student.

Tips for Saving for College

- Work with a financial advisor. A financial advisor can help you plan for your children or grandchildren’s education needs and save for college. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Invest in a 529 plan. These unique savings vehicles allow you to save pre-tax dollars for education expenses, including college tuition. Savings can be invested in mutual funds and other investments. Every state sponsors at least one 529 plan. Here’s a look at each state’s plans.

- Reconsider raiding your 401(k). Taking money out of your employer-sponsored retirement plan to pay for your child’s tuition may be tempting, but you should try to avoid it. Not only will you have to pay a 10% penalty on the withdrawals (in addition to income tax), but you’ll lose the future interest that the money could have generated had it remained invested.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/urbazon