Even before the COVID-19 pandemic began, a majority of Americans reported feeling anxiety and stress surrounding their finances. Researchers at the Global Financial Literacy Excellence Center at the George Washington University and the FINRA Investor Education Foundation found that 60% of Americans in 2018 indicated feeling anxious when thinking about their personal finances, while half said money causes them outright stress.

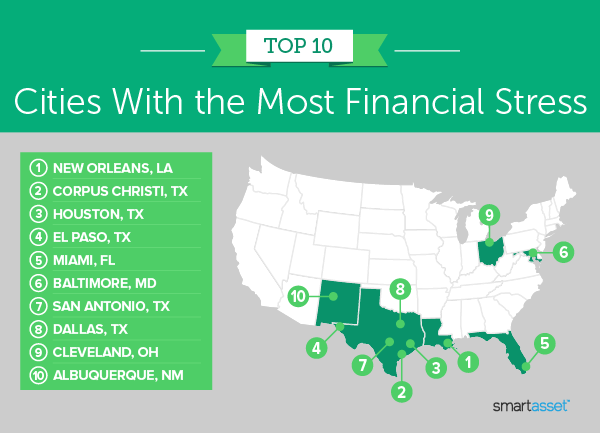

There are many reasons a person may feel financially stressed. Unemployment and high housing costs are two obvious factors, but a number of other factors can also come into play. With this in mind, SmartAsset set out to find which cities in the U.S. have the most financial stress in 2021.

We compared data for 86 of the largest U.S. cities across the following eight metrics: unemployment rate, percentage of the population living below the poverty line, percentage of households severely burdened by housing costs, recent housing insecurity, recent food insufficiency, percentage of the population who reported not seeing a doctor because of cost, four-year change in median household income and divorce rate. For details on our data sources and how we put all the information together to create our final rankings, read the Data and Methodology section below.

This is SmartAsset’s 2021 study on the cities with the most financial stress. Check out the 2020 version here.

Key Findings

- New Orleans is the most financially stressed for another year. Just like last year, New Orleans, Louisiana is rated as the city with the most financial stress. It had the highest June 2021 unemployment rate, 12% – nearly double the study-wide average of 6.6% for that metric.

- Financial stress is high in Texas cities. The Lone Star State is home to five of the 10 most financially stressed cities: Corpus Christi, Houston, El Paso, San Antonio and Dallas. All five cities rank within the worst 30 of 86 for percentage of the population living below poverty level. Beyond this, Texas has the highest percentage of residents who did not see a doctor because of cost and the second-highest levels of recent food insufficiency.

1. New Orleans, LA

Not only does the city of New Orleans have the highest June 2021 unemployment rate in our study (12.0%), the state of Louisiana has the highest levels of food insufficiency (13.3%). This metric measures the percentage of adults in households where there was either sometimes or often not enough to eat in the previous seven days. Meanwhile, 23.2% of the population in New Orleans lives below the poverty line (fifth-highest) and nearly 14% of households spend 50% or more of their income on housing costs (also fifth-highest).

2. Corpus Christi, TX

Located along the Gulf Coast of Texas, Corpus Christi has the fifth-worst four-year change in median household income, at just 8.41%. The city also has the 11th-highest divorce rate (13.9%) and 14th-highest unemployment rate (8.1%). It has the 11th-highest rate of recent housing insecurity, 7.6%, measured at the state level.

3. Houston, TX

Like Corpus Christi, Houston, Texas has a paltry four-year change in median household income (9.13%), sixth-worst overall. Almost one in five residents of Houston (19.7%) live below the poverty level, which is the 13th-highest percentage for this metric. Meanwhile, the city had a 7.4% unemployment rate in June 2021, higher than 75% of cities in the study.

4. El Paso, TX

Situated along the U.S.-Mexico border, El Paso, Texas has the fourth-worst change in four-year median income (7.71%). More than 18% of El Paso’s population lives below the poverty level, more than 65 other cities in the study. Unemployment there was 7.3% in June 2021, 24th-highest across this study.

5. Miami, FL

Miami, Florida has the second-highest percentage of households that are severely housing cost-burdened (18.45%), meaning they spend 50% or more of their income on housing. Florida as a whole has the third-highest percentage (9.2%) of adults who either missed the previous month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time. Meanwhile, 20.3% of Miami’s population lives below the poverty line, 10th-highest across the entire study.

6. Baltimore, MD

Baltimore, Maryland has the 11th-highest percentage of residents living below the poverty line (20.2%) and the 13th-highest unemployment rate (8.4%) across the entire study. Baltimore also has the 17th-slowest four-year growth rate for median household income, rising only 13.61%. Maryland as a whole has the 15th-highest rate of recent food insufficiency (10.5%).

7. San Antonio, TX

San Antonio, Texas ranks 10th from the bottom of the study for its four-year change in median household incomes (9.99%). The state of Texas has the highest percentage of people who reported not being able to see a doctor because of cost (18.8%) and 11th-highest rate of recent housing insecurity (7.6%). Just under 17% of the San Antonio population lives below the poverty level, which is the 29th-highest poverty rate for this study.

8. Dallas, TX

The fifth and final Texas city in the top 10, Dallas has the 18th-highest percentage of severely housing cost-burdened households (11.28%). Meanwhile, 11.4% of adults in Texas live in households where there was not enough to eat in the last week.

9. Cleveland, OH

Located on the shores of Lake Erie, Cleveland, Ohio has a higher percentage of residents living below the poverty line (30.8%) than any city in our study. Cleveland also has the 11th-highest divorce rate (13.9%) and 13th-lowest four-year change in median household income (11.18%). Severely housing cost-burdened households account for 11.26% of all households in Cleveland.

10. Albuquerque, NM

New Mexico’s largest city, Albuquerque, has the third-highest divorce rate in our study (14.9%). In June 2021, unemployment in Albuquerque was 7.9%, 16th-highest out of all 86 cities. As a whole, New Mexico has the 10th-highest levels of recent housing insecurity (8.4%).

Data and Methodology

To find the cities with the most financial stress, we compared data for 86 of the largest U.S. cities across the following eight metrics:

- Unemployment rate. Data comes from the Bureau of Labor Statistics and is for June 2021. Data is reported at the county level.

- Percentage of the population living below the poverty line. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Percentage of severely housing cost-burdened households. This is the percentage of households that spent 50% or more of their income on housing costs. Data comes from the Census Bureau.

- Recent housing insecurity. This is the percentage of adults who missed the previous month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time. Data comes from the Census Bureau and was collected in July and August 2021. Data is reported at the state level.

- Recent food insufficiency. This is the percentage of adults in households where there was either sometimes or often not enough to eat in the previous seven days. Data comes from the Census Bureau and was collected in July and August 2021. Data is reported at the state level.

- Percentage reporting not seeing a doctor because of cost. Data comes from the Kaiser Family Foundation and is for 2019. Data is reported at the state level.

- Four-year change in median household income. Data comes from the Census Bureau’s 2015 and 2019 1-year American Community Surveys.

- Divorce rate. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

First, we ranked each city in each metric. We then found the average ranking for each city, giving equal weight to every metric except for unemployment, which we gave a double weight. We used this average ranking to create our final score. The city with the highest average received a score of 100, while the city with the lowest average ranking received a score of 0.

Tips for Managing Financial Stress

- Work with a professional. A financial advisor can help guide you through important decisions and assess your overall financial picture. SmartAsset’s free matching tool can pair you with up to three advisors in as little as five minutes. If you’re ready to connect with an advisor, get started now.

- Create a realistic budget. In order for a budget to work, it has to be actionable. Setting unrealistic spending and savings goals may deter you from actually staying on budget. Use SmartAsset’s budget calculator to analyze your spending and make an actionable plan.

- Understand your spending habits. Do you know the difference between a fixed expense and a variable expense? While fixed expenses largely remain static, like rent or car payments, variable expenses are often tied to your everyday spending decisions. Knowing how much of your income is devoted to fixed and variable expenses can help you identify areas where you can potentially save.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/sturti