While most borrowers get a 30-year mortgage and methodically pay off the loan by making regularly-scheduled monthly payments, there is another repayment option. Rather than making 12 monthly payments per year, some borrowers arrange with their mortgage lender to pay half of their monthly bill every other week. As a result, they make the equivalent of 13 monthly payments per year.

A financial advisor can help you figure out just how much you should spend on a home. Find a trusted advisor today.

“By making biweekly payments, you’re actually making 26 payments each year instead of 12, which means you’re paying an extra month per year,” said Kris Lippi, a licensed real estate broker and owner of the real estate website, ISoldMyHouse.com. “This means you’ll be able to pay down your principal faster.”

So how much can this strategy save you? We ran the numbers to find out. But first, let’s review the parameters of our analysis before we delve into the comparison.

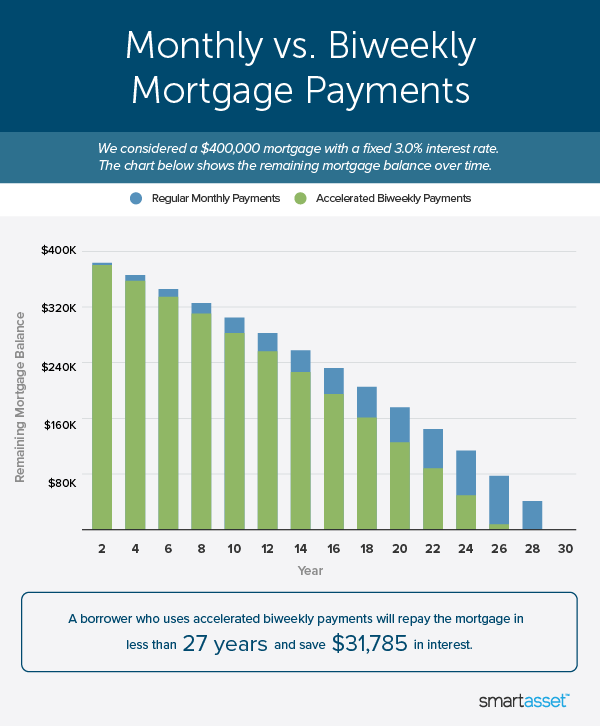

To compare the long-term cost of making monthly payments versus biweekly payments, we calculated how much a $400,000 home loan on a 30-year mortgage would cost in total using both strategies. For our comparison, we assumed an annual interest rate of 3%.

Monthly vs. Biweekly Mortgage Payments: A Case Study

If you choose to go the conventional route of paying your mortgage on a monthly basis, your regular payment will be $1,686 per month. As a result, you’ll pay $20,232 per year. Over the course of the 30-year mortgage, you’ll pay a total sum of $607,110, including $207,110 in interest.

However, if you set up accelerated biweekly payments, you’ll stand to pay off your loan earlier and save thousands of dollars in the process.

Here’s why: instead of paying $1,686 once a month, you’ll pay half that amount ($843) every other week. Since there are 52 weeks in a year, you’ll make 26 payments of $843 per year. This means you’ll essentially make one extra monthly payment each year and pay off your mortgage in approximately 26 years and three months.

With a biweekly payment plan, the mortgage will cost you $575,325 in total, including $175,325 in interest. That means you’ll shave nearly $32,000 off of your total interest paid and take full ownership of your home several years earlier.

The chart below illustrates how paying on a biweekly schedule will reduce the size of your mortgage balance faster than monthly payments.

What to Consider Before Switching to Biweekly Payments

Then again, there are some potential roadblocks to switching to a biweekly payment plan. First, you’ll have to determine whether you have the budget flexibility to make what amounts to an extra monthly mortgage payment every year. Doing so could limit your spending in other areas that may be equally as important, like saving for retirement or your children’s education.

Second, you’ll have to set up a biweekly payment plan with your lender, who may charge a fee for doing so. If your lender doesn’t offer this option, you can still make extra payments, but you’ll need to request that this extra money be applied to your principal.

“Depending on the lender and the specific policies they have in place for making biweekly mortgage payments, there may be excessive enrollment or setup costs,” Lippi said. “You may also be charged transaction and maintenance costs in addition to enrollment fees. Charges may also apply if payments are made through a third-party provider.”

You’ll also need to find out whether your lender charges a prepayment penalty for paying off your mortgage early. These fees typically only apply when a borrower pays off his or her entire mortgage balance at once, but it’s something to keep in mind, nonetheless.

Lastly, the agreement is permanent, noted Dan Belcher, CEO of Mortgage Relief, a company that works with homeowners facing foreclosure. “You cannot switch back on a whim,” he said. “Before choosing a biweekly payment plan, borrowers need to consider how often they get paid in addition to monthly bills and emergency funds.”

Bottom Line

After running the numbers on a $400,000 home loan, we found that you can save more than $32,000 by paying your mortgage on a biweekly schedule. The math is simple enough: split your monthly payment in half and then pay that amount every other week. Instead of 12 monthly payments, you’ll make 26 biweekly payments or the equivalent of 13 monthly payments per year. This will allow you to pay off your mortgage several years early and give your net worth a boost.

Tips for Managing Your Mortgage

- A financial advisor can help you with more than just investment advice. A certified financial planner (CFP) may be able to help you budget for housing costs and integrate your mortgage into a holistic financial plan. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Mortgage rates are more volatile than they have been in a long time. Check out SmartAsset’s mortgage rates table to get a better idea of what the market looks like right now.

- Owning a home isn’t always the best financial decision. SmartAsset’s rent vs. buy calculator can help you determine whether renting or buying is the better option for you.

- Set a budget and stick to it as best you can. Use SmartAsset’s mortgage calculator to estimate how much your monthly payment will be and how much interest you’ll pay over the full term of the mortgage.

Photo credit: ©iStock.com/Ivan Pantic