Credit cards are part-convenience, part-curse for those who don’t use them wisely. Pulling out the plastic to pay for things you can’t really afford and only paying the minimum each month is the easiest way to land yourself in debt. When the bills grow to the point where you can’t pay, you may be tempted to just turn your back on them altogether. Yet while skipping out on a credit card bill isn’t quite as serious as defaulting on a mortgage, you’ll pay the price in more ways than one. If you’ve fallen behind on your monthly payments, here’s a look at what you can expect.

Your Debt Will Grow

Just because you stop charging things to your credit card, it doesn’t mean your balance won’t increase. Interest will continue to accrue and your creditor may even decide to jack up your rate. They’ll also pile on late fees and overlimit fees if your growing balance exceeds your credit line. Throw in an increase in your finance charges and it’s easy to see how quickly the debt can get out of control.

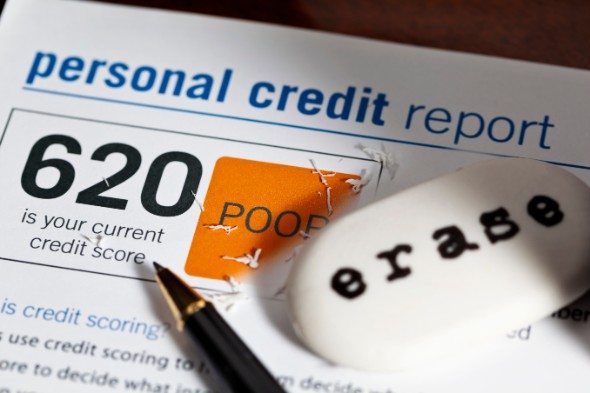

Your Credit Score Suffers

On top of increasing the amount you owe, your creditor’s also going to report your unpaid account to the credit bureaus. Having just one late or missed payment can be extremely detrimental to your score, and the damage is even worse when you’ve got several consecutive missed payments. Once you reach the six-month mark without payment, your creditor may decide to charge off the account, which causes your score to fall even further.

All of these negative marks can stay on your credit report for up to seven years, making it harder to get approved for new loans or lines of credit in the meantime. Not only that, but a low credit score may mean you’ll pay more for insurance or have to shell out fat deposits to get utility services in your name. Some employers also consider your credit history as part of the hiring process, and if yours is littered with late payments or charge-offs, it could cost you the job.

Your Account Will Be Sent to Collections

Once you reach the charge-off stage, the creditor may decide to assign or sell your account to a third-party collection agency. This is when things can really get interesting. You may start receiving letters advising you of your obligation to pay or daily phone calls from collectors about the debt. You do have certain rights when it comes to what debt collectors can and can’t do, including asking them not to contact you, but that doesn’t mean you’re not still responsible for what you owe.

You Could Be Sued

Some creditors are more aggressive than others when it comes to collecting on a debt, and they may decide to pursue a lawsuit against you. If that happens, you’ll have to show up in court and prove that you don’t owe the debt or that the creditor doesn’t have the authority to sue you. Generally, the latter only applies if the debt has exceeded the statute of limitations for collections in your state.

If a creditor wins their claim, they have to take additional steps to actually get the money. Depending on where you live, this may include garnishing your wages, seizing your bank account or putting a lien against your property. There are circumstances where you can reverse a garnishment or lien, but it’s difficult to do if the court determines that you’re responsible for the debt.

You May Have to File Bankruptcy

If you’re facing lawsuits or collection actions from multiple creditors for accounts you’ve defaulted on, bankruptcy may be the only way to deal with the situation. A Chapter 7 bankruptcy allows you to eliminate all your debts, but you have to be within certain income limits to qualify. With a Chapter 13, your income and assets aren’t taken into account, but you will have to repay some or all of what you owe over a set period of time.

Filing bankruptcy can wipe the slate clean if you’ve run into trouble with credit cards, though it’s not without consequences. Your credit history will take an even bigger blow, since bankruptcy is reported for up to 10 years, based on the chapter you file. It may take a few years after your case is discharged before you can get another credit card or loan, so you have to consider whether the relief it provides is worth the cost in the long run.

Update: Have more financial questions? SmartAsset can help. So many people reached out to us looking for tax and long-term financial planning help, we started our own matching service to help you find a financial advisor. The SmartAdvisor matching tool can help you find a person to work with to meet your needs. First you’ll answer a series of questions about your situation and goals. Then the program will narrow down your options from thousands of advisors to three fiduciaries who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

Photo credit: flickr, ©iStock.com/stocknshares, ©iStock.com/Reptile8488