All debt is not created equal. If you take on a mortgage to buy a house, that can be a smart move as long as you can afford it. Likewise, student loan debt is often considered to be “good debt” by experts, as pursuing a higher education degree has the potential to increase your lifetime earnings. On the other hand, going into credit card debt to finance a lavish lifestyle is generally viewed as an example of bad debt.

Struggling to pay off your credit card debt? Check out our guide to the best balance transfer cards.

The key metric in determining what is an affordable amount of debt for someone to take on is typically their debt-to-income ratio. For the most part, debt becomes more unaffordable as your debt-to-income ratio rises. In general paying 36% or less of your income on debt payments is considered a good debt-to-income ratio. With this in mind, SmartAsset found the states where residents have the highest debt-to-income ratios in order to determine the states with the most debt.

Key Findings

- Richer states take on more debt – There is a fairly strong positive correlation between incomes and debt, even in relative terms. The top 10 states with the most debt (i.e. the highest debt-to-income levels) have an average income of $31,832. The 10 states with the least debt (i.e. the lowest debt-to-income ratios) have an average income of $26,754.

- The majority of debt in the U.S. is mortgage debt – Residents of states with the highest debt-to-income ratios tend to have the vast majority of their debt in housing. For example, on average the top 10 states with the most debt have about 74% of their debt tied up in housing. The bottom 10 least-in-debt states have around 60% of their income tied up in housing. Homes tend to be appreciating assets compared to vehicles or credit card debt.

- A big divide – The most leveraged state, California, has twice as much debt per capita as West Virginia, the state with the least in debt.

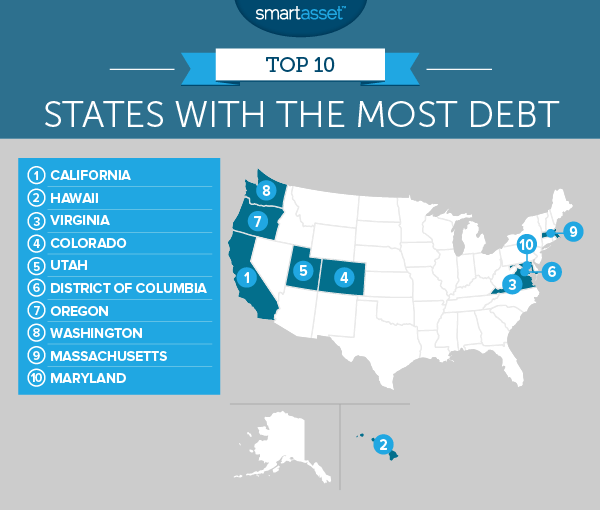

1. California

California has the highest debt-to-income ratio in the country. Residents of the Golden State make about $28,000 annually on average, according to U.S. Census Bureau data. The New York Federal Reserve Bank shows that Californians have a per resident debt balance of $65,740. This gives Californians a debt-to-income ratio of 2.34 on average. Like many other states, most of Californians’ debt is held up in their mortgages. Californians owe about $51,190 on their mortgages on a per capita basis.

2. Hawaii

Hawaii comes in second with a debt-to-income ratio of 2.1. On average Hawaiians make slightly more than Golden State residents. The median income in Hawaii is $31,905 as compared to $28,068 in California. Residents of Hawaii also have slightly more debt per capita than those in California: $67,010 to $65,740. Hawaiians have the second-highest proportion of debt tied up in mortgage. In total, $51,770 out of the total $67,010 in per capita debt that Hawaiians hold is owed on mortgages. That means 77% of per capita debt is mortgage debt.

3. Virginia

Virginia comes in third with a debt-to-income ratio just below 2. The average Virginian makes about $31,557 and has $62,520 in debt. One reason why lenders may feel safe lending to Virginians, allowing them to have a high debt-to-income ratio, is their low delinquency rates. Only 1.27% of mortgage debt in Virginia is delinquent by at least 90 days. That is the 13th-lowest rate in the country. Virginia also has a relatively high proportion of its debt in student loans (7.76%).

4. Colorado

Of Colorado’s total debt, 6.85% is tied up in automobile debt. That’s the second-highest rate in the top 10. However it is quite a bit lower than the national average of 9.57%. Overall there is not much separating Colorado from Virginia: Colorado has a debt-to-income ratio of 1.96. The median income in Colorado is $31,664 and the per capita debt is $62,200.

5. Utah

Like the rest of the top 10, Utah residents have the vast majority of their debt tied up in mortgages. Utah residents have $52,150 in per capita debt, $38,240 of which is mortgage debt. The state also has one of the lowest delinquency rates for mortgage debt. Only 1.05% of mortgage debt is 90 days past due in Utah. Again this may partially explain why lenders are so willing to lend to Utahans looking for mortgages.

6. Washington, D.C.

Almost 15% of all debt held in the nation’s capital is owed on student loan debt. All that higher education may be paying off though. D.C. has the highest median income in the country and over half of the population over the age of 25 has at least a bachelor’s degree. In fact, there are more people over the age of 25 in D.C. with a graduate degree (32.3%) than there are with only a bachelor’s degree (23.8%). The capital also has the lowest percent of debt in the country tied up in auto loans (3.35%), probably due to the accessible public transportation available in the area.

7. Oregon

Oregon has a debt-to-income ratio of 1.89. On average Oregonians make less than many other states in the top 10. The median income in the Beaver State is $26,188, according the U.S. Census Bureau. Oregon also has the least per capita debt in the top 10, at $49,550 per resident. For the most part Oregonians choose to go into debt to buy homes. Over 72% of overall debt is held in mortgages. One area where Oregonians struggle is in paying off credit card debt. Just over 7% of all credit card debt in the state is delinquent. One way to eliminate credit card debt is using a balance transfer credit card. With a balance transfer credit card, new users typically have a limited time to make no-interest payments.

8. Washington

Washington, Oregon’s northwest neighbor, comes in eighth for highest debt-to-income ratio. The state has the third-lowest percent of debt tied up in student loans (6.29%) but the third-highest percent of debt tied up in mortgages (75.35%). Washingtonians also tend to be some of the most responsible holders of debt in the country. They rank above average in delinquency rates on all types of debt and rank in the top 10 for lowest rates of auto loan delinquency and credit card delinquency.

9. Massachusetts

On average Massachusetts residents earn about $32,352 per year and have about $59,820 in debt per capita. That works out to a debt-to-income ratio of 1.84. Once again, like other states, the majority of that debt is mortgage debt. About 72% of per capita debt in the Bay State is mortgage debt. The state’s residents don’t take on as much credit card debt as other states do. About 5.45% of per capita debt is tied up in credit card debt.

10. Maryland

The Old Line State rounds out our top 10 states with the highest debt-to-income ratios. Maryland residents are some of the most well-off in the country, with an average individual income of $36,316. In terms of debt, Maryland residents have $67,020 in per capita debt, meaning their debt-to-income ratio is 1.84.

Data and Methodology

In order to find the states with the most debt, SmartAsset gathered data on total debt per capita in every state (plus Washington, D.C.) and median individual incomes in every state (plus Washington, D.C.). To find the debt-to-income ratio in each state, we divided the 2015 total debt level per capita by the 2015 median individual incomes. We then ranked each state from highest debt-to-income ratio to lowest debt-to-income ratio.

Data for total debt per capita comes from the Federal Reserve Bank of New York. Data on median incomes comes from the U.S. Census Bureau’s 2015 5-Year American Community Survey.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Geber86