Perhaps counterintuitively, consumer credit card debt has fallen since the beginning of the COVID-19 crisis. Federal reserve data shows that the total amount of revolving consumer credit, which primarily consists of credit cards charges, fell below one trillion in April 2020 for the first time in close to two years. Data from Experian tells a similar story. Between the end of Q2 2019 and Q2 2020, the average credit card balance of borrowers fell by about 11% from $6,629 to $5,897.

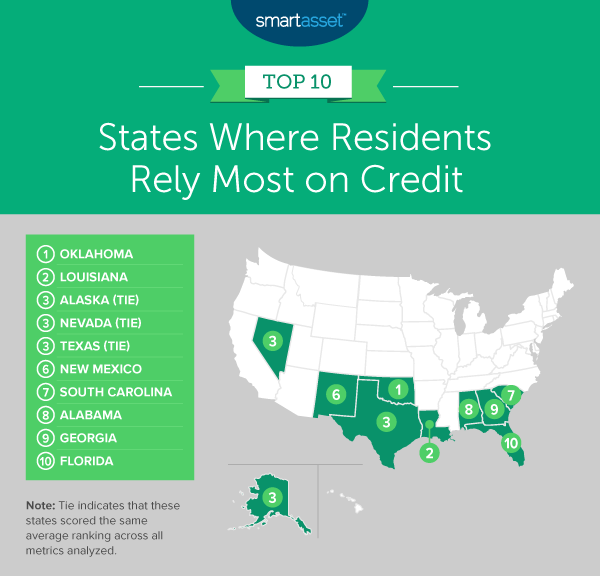

Though average credit card debt is decreasing nationally, it remains high in some states and may increase during the holiday season. In this study, SmartAsset looked at states where residents tend to rely on credit the most. Using data from Experian and the Census Bureau, we ranked all 50 states and the District of Columbia based on five metrics relating to credit card debt. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is the 2020 edition of our study on where residents most rely on credit. Read the 2019 version here.

Key Findings

- Credit card debt is high in Southern states. Seven of the 10 states where residents rely most on credit are in the South: Oklahoma, Louisiana, Texas, South Carolina, Alabama, Georgia and Florida. In all seven states, average credit card debt exceeds $5,600 and makes up more than 10% of the median household income.

- 13 states saw one-year increases in average credit card debt. Though Experian data shows that national average credit card debt fell by 11.04% over the past year, certain states still saw increases. Average credit card debt increased by more than 3% in two states – Idaho and North Dakota – and rose by 1% or more in six additional states – Oklahoma, Hawaii, Mississippi, West Virginia, South Dakota and Iowa.

1. Oklahoma

Oklahoma ranks as the state where residents most rely on credit. Experian data shows that though average credit card debt fell in many places between the end of the second quarter in 2019 and 2020, it rose by 2.00% in Oklahoma, from about $5,800 to almost $6,000. With that rise, we estimate average credit card debt for Oklahoma residents makes up 10.96% of the median household income – the fourth-highest percentage for this metric in our study.

2. Louisiana

Though average credit card debt in Louisiana ranks toward the middle of the study at 24th, it makes up the second-highest percentage of median household income, at 11.25%. Additionally, credit card debt may build up in Louisiana, as the state has relatively high poverty and unemployment rates. Data from the Census and Bureau of Labor Statistics shows that Louisiana also has the second-highest poverty rate (14.3%) and 15th-highest September 2020 unemployment rate overall (8.1%).

3. Alaska (tie)

Average credit card debt in Alaska fell by close to 5% over the past year, but it is still the highest in our study, at close to $7,700. Additionally, Alaska ranks in the worst half of the study for two other metrics, average credit card debt as a percentage of income and September 2020 unemployment rate. Average credit card debt makes up 10.15% of the median household income (the 10th-worst rate for this metric overall). In September of this year, unemployment stood at 7.2% (the 23rd-worst in the study).

3. Nevada (tie)

Nevada ranks in the bottom half of the study for all five metrics we considered. It has the 11th-highest average credit card debt, the 22nd-worst one-year change in average credit card debt and the 17th-highest average credit card debt as a percentage of median household income. Census Bureau data from 2019 shows that Nevada has the 20th-worst poverty rate of all 50 states and the District of Columbia, at 8.7%. Moreover, in September 2020, the unemployment rate (12.6%) was the second-highest in the country, behind only that of Hawaii.

3. Texas (tie)

Texas ties with Alaska and Nevada as the No. 3 state in the country where residents rely most on credit. Though average credit card debt in Texas fell by almost 5% over the past year, it remains elevated compared to other states. Experian data shows that at the end of the second quarter in 2020, average credit card debt was $6,423 – the seventh-highest of any state. Additionally, Texas’ poverty rate is the ninth-highest in the study, at 10.5%.

6. New Mexico

Credit card debt in New Mexico is high relative to average incomes. We found that average credit card debt as a percentage of the median household income was third-highest in our study, at 10.98%. New Mexico residents may also struggle with credit card debt more, as unemployment and poverty rates are high. In 2019, the unemployment rate was 9.4% (eighth-highest in the study) and in September 2020, the poverty rate was 13.7% (the third-worst in the country).

7. South Carolina

South Carolina actually has the lowest September 2020 unemployment rate (5.1%) of any of the 10 states where residents most rely on credit. However, the state ranks relatively poorly on the other four metrics we considered. It has the 18th-highest average credit card debt, 14th-worst one-year change in average credit card debt, eighth-highest average credit card debt as a percentage of income and 11th-highest poverty rate.

8. Alabama

Using Experian and Census Bureau data, we found that average credit card debt for Alabama residents makes up almost 11% of the state’s median household income. Additionally, Alabama has the sixth-highest 2019 poverty rate (11.2%) of all 50 states and the District of Columbia.

9. Georgia

At the end of the second quarter of 2020, average credit card debt in Georgia stood at roughly $6,200. This debt may affect residents more in Georgia, as debt makes up more than 10% of the median household income in the state. In addition, almost 10% of individuals fall below the federal poverty line.

10. Florida

Florida has the 12th-highest average credit card debt (about $6,100) and ninth-highest average credit card debt as a percentage of median household income (10.31%). In September 2020, the unemployment rate in Florida was the 20th highest in the country, at 7.6%.

Data and Methodology

To determine the states where residents rely most on credit, we compared all 50 states and the District of Columbia across five metrics:

- Average credit card debt. Data comes from Experian and is for Q2 2020.

- One-year change in average credit card debt. Data comes from Experian and is from Q2 2019 to Q2 2020.

- Average credit card debt as a percentage of median household income. This is the average credit card debt (per borrower with credit card debt) divided by median household income. Data for average credit card debt comes from Experian and data on median household income comes from the Census Bureau’s 2019 1-year American Community Survey.

- September 2020 unemployment rate. Data comes from the Bureau of Labor Statistics.

- Poverty rate. This is the percentage of the population below the federal poverty level. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

First, we ranked each state in every metric, giving a double weight to both of the average credit card debt metrics, a single weight to the change in average credit card debt metric and a half weight to September 2020 unemployment rate and poverty rate. We then found each state’s average ranking and used the average to determine a final score. The state with the best average ranking received a score of 100. The state with the lowest average ranking received a score of 0.

Tips for Managing Credit Card Debt During the COVID-19 Downturn

- Contact your credit card company. Many credit card companies are offering financial relief to their customers during the COVID-19 pandemic. The Consumer Financial Protection Bureau recommends that the best first steps in receiving relief are contacting your credit card company, telling them you’ve been affected and asking questions about the relief packages they offer.

- Create a plan to pay it off. Credit card debt can be incredibly stressful, especially during a recession when jobs are less secure and employment opportunities are more limited. Our credit card calculator is here to help. By adding your credit card details, you can calculate the total interest and time it will take you to pay off your debt.

- Consider a financial advisor. A financial advisor can help you make smarter financial decisions to be in better control of your money and get previous debt under control. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/bernie_photo