Simple has announced that it will be closing in 2021. Once the bank is officially closed, customers' accounts will be transferred to Simple's parent company, PNC Bank.

If you’re frustrated with the offerings of traditional banks, Simple may be a worthwhile option for you. Simple is a mobile and online bank that was established in 2009, when its founders Josh Reich and Shamir Karkal sought to create an uncomplicated banking experience. Simple sought to eliminate the fees most often associated with bank accounts to help customers feel more confident with their money. As a result, there aren’t any fees here for account maintenance, overdrafts or out-of-network ATM usage.

However Simple is limited in the types of accounts that it offers. You can open only one type of checking account, which earns interest at a low rate - 0.01% APY, which is not enough to keep pace with inflation. However, if you open a Protected Goals Account in conjunction with your Simple Checking Account, your interest rate will increase to as high as 0.40%. This account works together with your checking account to help you save up for your short- and long-term financial goals. If you so desire, Simple allows customers to make their account a Shared Account.

Banking is a sometimes forgotten aspect of people's financial lives, as areas like retirement, taxes and education funding often get much more consideration. A financial advisor can help you optimize your banking life, as well as all of the other aforementioned topics. SmartAsset's financial advisor matching tool can easily set you up with suitable advisors in your area based on your answers to a series of questions about your current and desired financial life.

| Product | Key Details |

| Checking Account |

|

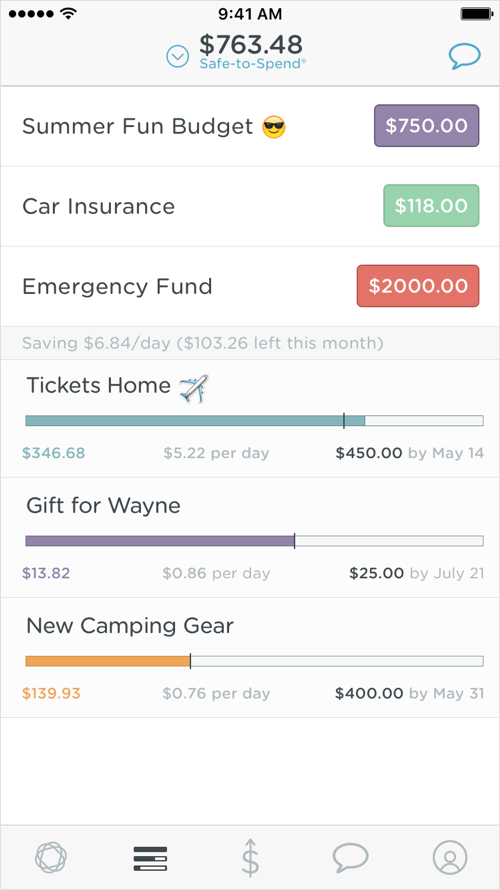

With one checking account to offer, Simple pours itself into this account, providing convenient and helpful tools. You’ll have access to the Protected Goals Account, which allows you to stash away funds in a separate high-yield checking account for expenses like rent or your next vacation. The bank also offers a Safe-to-Spend® feature which helps you budget and spend responsibly, according to your actual income and account balance. You can also track each and every expense you make by logging them in your account with pictures, captions and even hashtags.

Simple Checking Account & Protected Goals Account

| Key Features | Details |

| Minimum Deposit | $0 |

| Access to Your Checking Account | Online, mobile and over the phone |

| Security | FDIC insurance up to the maximum amount allowed by law |

| Fees | None |

| Current Terms and Rates |

|

If you’re looking for an easy checking account, the Simple Checking Account is a good option. Simple doesn’t charge any fees, not even for maintenance, overdrafts, transfers or debit card replacements. You also won’t be held to any minimum balance requirements, so you can become an account holder with as little as a few bucks.

The interest rate structure at Simple is based on the "daily collected balances" of your accounts. Once you have a Simple Checking Account, you'll be eligible to open a secondary high-yield checking account called the Protected Goals Account. After you complete this second step, your account's APY will skyrocket from 0.01% to 0.40%.

If you stick to using Allpoint® ATMs, you won’t encounter any ATM fees. The same applies to out-of-network ATMs, but Simple warns that ATM operators may charge you their own fees. When you use your Simple Visa debit card for foreign purchases, Visa will charge an International Service Fee of up to 1% of the transaction value.

Your account also includes tools to help you track your spending with detailed reports, labels and even photos and hashtags. This allows you to quickly search your transaction history and gain insights from Simple’s graphs, charts and other helpful features. That way you can easily see where you might be overspending.

The Safe-to-Spend® tool helps you spend responsibly by budgeting your available balance, goals and scheduled payments all in one place. In turn, you’ll always know exactly what you can actually afford to spend. As part of this, Simple provides the Goals tool to aid you in budgeting and saving for tangible expenses, like rent, a new car or a family vacation. You can set an amount to save and a date you would like to have it saved by. This tool will then automatically help you along toward those various objectives, all the while hiding the funds from your Safe-to-Spend® number so you don’t use them for any unintended purposes.

Where Can I Find Simple?

Simple does not offer any physical branch locations. However, you access Simple's services online, on your mobile devices and at over 40,000 Allpoint® ATMs. You can download the bank's mobile app on both Apple and Android devices. You can also call (888) 248-0632 to manage your money or ask any questions you might have.

What Can You Do Online With Simple?

Without any physical branches, Simple’s online and mobile presence is extensive, convenient and user-friendly. In fact, it allows you to do basically anything you'd need to do at any normal, branch-based financial institutions.

Once you have an account, you can access it online by logging in with your username and passphrase. (Instead of a password, Simple has you create a passphrase, which is just a combination of four random words.) Then you can check on your transactions, set and edit your goals, manage your budget and more.

For example, as shown in the accompanying image, you can look at all your savings goals and budgets on one page. You can see how close you are to reaching each specific one. Plus, you can also see your Safe-to-Spend amount at the top of the page.

Compare Simple Bank to Other Competitive Offers

How Do I Access My Money?

You can access your money online, on the bank’s mobile app, at an Allpoint® ATM or over the phone. To access your money online and on mobile, you’ll need to login with your username and passphrase. Once you’ve done this online or through your mobile device, you can check your account balances and transaction histories, send money to anyone or pay your bills. To use an Allpoint® ATM, you’ll use your Simple Visa® debit card. Of course, when you access your account at an ATM, you’ll only be able to make withdrawals and deposits.

How Can I Save More Money With a Simple Account?

The Simple Checking Account earns interest at an initially low APY of 0.01%. You can easily boost your interest earnings, though, when you open a Protected Goals account too. If you do this, your APY will jump up to 0.40%.

In addition to these great interest rates, the bank offers a number of special features that can help you save through more responsible money management habits. The Goals tool helps you set aside funds for specific purposes, working essentially like virtual envelopes to prevent you from spending important funds on the wrong expenses. Plus, you can track your savings towards those goals more easily than you could with a real envelope full of cash.

Simple also includes Safe-to-Spend®, which works as a budgeting tool that can tell you right away what you can and cannot afford. It takes into account the funds you have stashed away in your Goals, which you are not “allowed” to spend, your remaining balance and the costs of the purchases you want to make. That way it can tell you whether you can responsibly spend those funds in the interest of keeping your savings on track.

What’s the Process for Opening an Account With Simple?

To open an account, you just need to visit the bank’s website or mobile apps and click the “Apply Now” button. You’ll then create a username and passphrase for yourself and enter your email address, as shown here. You will also need to provide information like your Social Security number and home address. The process should only take a few minutes to complete.

What’s the Catch?

If you’re not keen on the idea of an online- and mobile-only bank, Simple is not the right choice for you. The bank does not have any physical branches, which means you’ll mainly have to use your smartphone and your computer to manage your accounts and any related activities. The ability to get your hands on some cash should be fairly easy, as the fee-free Allpoint® ATM network is 40,000 machines strong.

You also won’t be able to open a variety of accounts with Simple, since the bank offers only a couple of accounts. So if you’re looking to keep all of your checking and savings accounts together at one institution, this likely won’t be the bank for you.

Bottom Line

Banking with Simple offers just that: a simple banking experience. There are basically no fees you need to worry about, nor are there any minimum balance and deposit requirements whatsoever. You’ll have easy access to your account with the bank’s optimized website and mobile apps. Plus, you gain access to a number of handy features, like Goals and Safe-to-Spend®, that help you manage your money responsibly.

Finally, note that a checking account is just one small part of your overall financial picture. To address needs like retirement planning and investing, try consulting with a financial advisor in your area.