Whether it’s $14 avocado toasts, $5 lattes or $1,000 iPhone Xs, millennials have become the punchline of many jokes for their alleged profligacy. But is this reputation earned? SmartAsset gathered spending data to analyze millennial money habits. Read on as we discover how single male and female millennials spend their money.

Not sure what to do with your savings? Check out high-interest savings accounts.

In order to find out what male and female millennials spend money on, we examined spending data across a broad range of categories. We compared male and female millennials’ spending on essentials like housing and food and non-essentials like entertainment. For this study, we defined “millennials” as persons ages 25 to 34. Check out our data and methodology section below to see where we got our data and how we put it together.

Key Findings

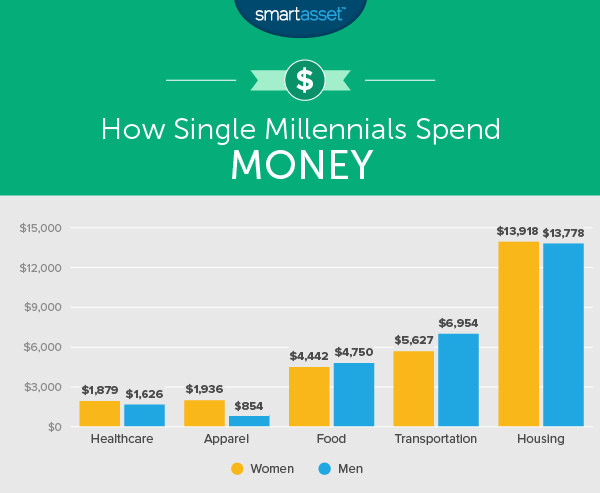

- Many similarities in spending – It turns out that men and women tend to spend a similar amount of money on similar items. In categories like housing and food, men and women spent almost an identical portion of their budgets.

- Millennials are housing cost-burdened – Both male and female millennials struggle with paying for shelter. Housing costs make up over 36% of both groups budgets, higher than the Department of Housing and Urban Development’s recommended 30%.

- Millennials should save more – Most budgets recommend saving about 20% of your income. Single millennials, both men and women, only manage to save about 10%. There is probably room in both groups’ budgets to make improvements.

- Women spend on clothing, men spend on take out – While both groups have similar overall budgets, there are differences in where they splurge. Men seem to have a large preference for eating out. They spend over $3,000 per year eating away from home. That’s $700 more than women do. Meanwhile in the apparel and services category, women outspend men by about $1,080 per year.

Housing Costs

In general, single male and female millennials spend about same amount of money on housing. On average, single millennials spend around 36% of their total budget on housing. The vast majority of this housing budget, around 70% for both, is spent on shelter. The rest is split between utilities, home furnishings, housekeeping supplies and household operations.

The data also corroborated previous research which showed millennials are less likely to be homeowners than other generations. In this data set about 81% of men and 78% of women were renters.

Food Spending

Data on food suggests there may be a nugget of truth to the idea that millennials could use some budgeting help. According to our data, single millennial men and women both spend the majority of their food budgets on eating out. Overall, women spend about $2,300 per year on food away from home while men spend just over $3,000. For women that means about 52% of their food budget is spent on eating out, while for men that figure is 64%.

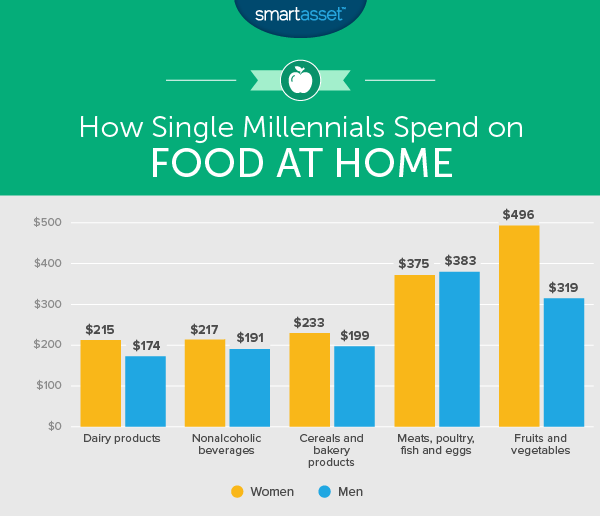

What about when it comes to money spent on eating at home? Millennials seem to be eating balanced diets. Men eat slightly more meat, poultry, fish and eggs, while women eat more fruits and vegetables.

Both men and women it seems could benefit from cooking classes. Our data shows that on average about 40% of what millennials spend on eating at home is spent on miscellaneous foods. This category includes items like frozen prepared meals, canned soups and snacks like potato chips or nuts. Another big ticket item for single millennials is non-alcoholic beverages. Both groups spend almost $200 per year on colas and sparkling waters. With LaCroix dominating the non-alcoholic drink aisles these days, we may see that number rise.

Savings

Millennials in general should probably save more money. It is important to start saving early so you can take advantage of compound interest and get a head start on retirement. According to our data, single millennials, both men and women, are putting away about 10% of their incomes into savings.

Many experts say that figure should be closer to 20%. This may be especially true for millennials who have several years before retirement. The sooner they put money into their 401(k)s, the sooner they’ll see the effects compound interest. Of course, just putting money into a savings account is better than spending it.

Transportation Costs

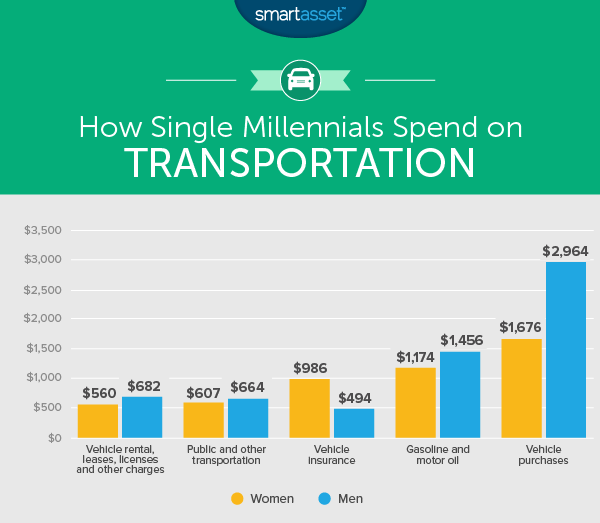

When it comes to getting around, single male millennials are more likely to spend money on buying new or used cars than females are. In fact, men spend almost twice as much as women on vehicle purchases ($1,670 per year compared to $2,900 per year, on average).

There is one transportation-related cost item on which women outspend men: vehicle insurance. Single millennials women spend almost twice as much per year purchasing vehicle insurance than their male counterparts. Women spend just under $1,000 per year on insurance while men spend just under $500.

Both men and women could probably save more if they took more public transportation. On average, public transportation costs make up only 10% of the millennial transportation budget. By switching from driving to public transportation millennials could cut back on expenses like gas and car maintenance. In fact saving on gas could prove to be very worthwhile. Both men and women dedicate over 20% of their transportation budget to gas and motor oil. One way to save on gas is to choose a rewards credit card which specifically rewards gas spending.

Education Costs

Do women prioritize their education more than men? Perhaps. We found that on average single female millennials spend almost 4.5% of their budget on education while their male counterparts spend only 2.7%.

Despite this fact men out earn women, according to our data. The average male millennial in our data set earns $44,670 while the average female millennial earns $40,789 – about 10% less.

Healthcare Costs

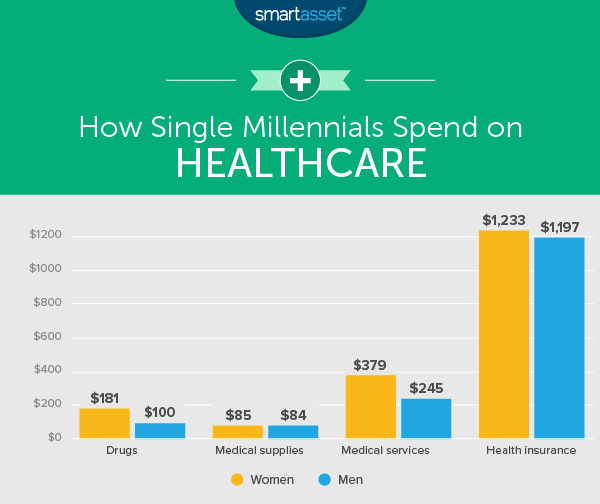

According to BLS data, single female millennials spend an average of $1,800 per year on healthcare costs. Single male millennials, on the other hand, spend $1,600 on average. For both groups healthcare spending takes up only about 4.5% of their overall budgets.

Women tend to spend slightly more across all healthcare categories. The largest difference comes in drugs and medical services, which includes things like X-rays and doctor’s appointments. Women spend just over $200 per year more than men in those two items.

Entertainment Spending

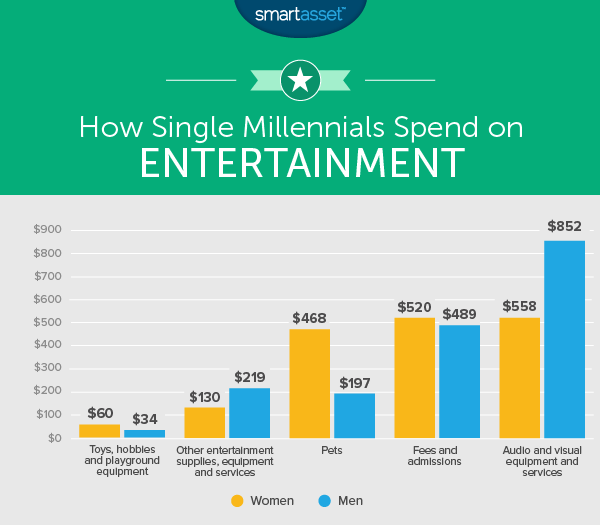

This category perhaps best illustrates that millennials are more frugal than many people give them credit for. Both male and female single millennials spend an average of $1,700 per year on entertainment. This category includes money spent on attending sporting events and concerts and buying audio and visual equipment like headphones or a new TV.

There is a notable difference in how men and women spend on entertainment. Men are more likely to spend money on audio and visual equipment compared to women. The average single male millennial spends around $850 on this category – which notably includes video games – per year. In comparison women spend $550, on average, in that category.

The Bureau of Labor statistics, somewhat oddly, classifies spending on pets under the “entertainment spending” category. This is one subset where millennial woman outspend men. On average single millennial women spend $260 more per year on pets than men do.

Alcohol and Tobacco Spending

Men could probably spend a bit less on alcohol. Our data shows that the average single male millennial spends almost 2.5%, or $915 of his annual budget on alcoholic beverages. Women, on the other hand, spend an average of $500.

In terms of tobacco consumption neither male nor female single millennials spend much. For both groups tobacco represents less than 1% of their budgets. Although on average men are slightly more likely to consume tobacco. Men spend about $110 more per year on tobacco than women.

Apparel Spending

Women’s savings from food and alcohol tend to go toward shopping. The average millennial woman spends almost $2,000 per year on her wardrobe, or almost 5% of her annual budget. For the average man that same figure is only $854, or almost 2.5% of his annual budget.

The majority of both men and women’s apparel and services budget goes toward clothes, which is no surprise. But what may be surprising is that relative to their apparel budgets, both men and women spend the same amount on shoes. Men spend over $190 per year on shoes, out of a total apparel budget of $854, while women spent $485 on shoes out of a total apparel budget of $1,936. For both groups that means around 25% of the total apparel budget is spent on shoes.

Personal Care Spending

Single female millennials vastly outspend men on personal care products and services. On average, women spend around $714 in this category while men spend about $297.

Although this is not a particularly large spending category for either group. For women it makes up only 1.8% of their budget and 0.7% for men.

Data and Methodology

In order to examine millennial money habits, SmartAsset analyzed data for both single men and women between the ages of 25 and 34. Data comes from the 2016 Bureau of Labor Statistics Consumer Expenditure Survey. We compared male and female millennials across all categories in terms of total dollars spent as well as percent of budget spent. Because men on average earn more than women, comparing across percent of budget spent allowed us to create a comparable metric.

Saving Tips for Millennials

One takeaway from this article is that the average millennial should save more money. While 10% isn’t bad, 20% is better. Here are two tips for millennials looking to save.

First, look for places where you can cut back in your budget. Our data showed average millennials spend around 36% of their budgets on housing. It might be possible to get that number closer to 30% by moving in with a roommate. In some cities, living with a roommate saves thousands of dollars a year.

Another simple way to save is to make the most out of your spending. If you’re passionate about travel and you prioritize spending in this area, you could benefit from using the right travel credit card. By using credit cards that earn points with airlines or hotels, you could potentially save hundreds of dollars per year.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/Eva-Katalin