Despite the ease it provides, paying in cash isn’t always the most secure form of payment. Instead, you may be asked to pay with a money order. You can get a money order almost anywhere, like banks, post offices and even Walmart. One you have one, it’s as easy as filling out the order, keeping the receipt and handing it over to the person you’re paying. Knowing how to fill out a money order can ensure that you won’t have any issues with it.

How to Get a Money Order

Before you can fill out a money order, you have to buy one. Again, it is pretty easy to find a money order. While you might want to head immediately to your nearest bank, banks often charge a significant fee for money orders. It’s not unusual for banks and credit unions to charge between $5 and $20.

You can find lower fees at most convenience stores and grocery stores. For example, Walmart charges $1 or less. You can also head to a USPS location to buy a money order for $1.65 (on amounts up to $500) or $2.20 (on amounts up to $1,000). You can also buy money orders from Western Union and MoneyGram.

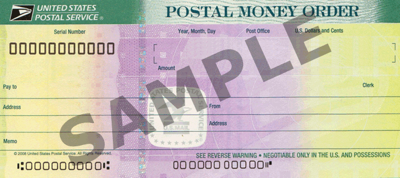

How to Fill Out a Money Order

Before you can cash a money order, you need to know how to do it. To correctly fill out your money order, follow these six steps:

- Recipient: Look for where it says “Pay to the order of” or “Pay to.” Write in the recipient’s name. Add their address if there is room.

- Purchaser/Sender: Fill out your full name and address where it says “Purchaser” or “Sender.”

- Amount: Add the amount of your money order in both numerical and word form on the line.

- Memo: Look for “Memo,” “Re:” or “Payment For” and add in a note explaining why you are making this payment. If you have an order or tracking number, include that, as well. This will help for tracking purposes, especially if you are paying a business or government entity.

- Signature: Sign your name on the signature line to validate your money order. Only sign the front of your money order; the back will be completed by the recipient.

- Store your receipt: Before you mail out your money order, remove the detachable receipt portion for record-keeping and tracking purposes. This can help you if the recipient fails to cash the money order or if it gets lost or stolen.

How to Send a Money Order

With your money order filled out, it’s time to send it. Most often, people use money orders for their better sense of security over cash. Addressing a money order to a specific recipient means that no one else can use it, even if they do steal it. This makes it much easier to send a money order in the mail with some peace of mind.

Before you send your money order, double check that you’ve detached your receipt portion or carbon copy. Then, you can slip the order into a stamped envelope, address it to the payee and send it out. You can also simply hand the money order to the recipient in person.

How to Cash a Money Order

If you’ve received a money order as payment, you can deposit or cash it just like you would with a check. To deposit your money order into your bank account, bring it to your bank and deposit it with a teller. To cash a money order, you can either bring it to your bank, or to the money order issuing company (like Western Union or the USPS) for payment.

You may want to check that the money order isn’t a fake before exchanging your goods. This is especially important if you’re not familiar with the buyer. If the order is fake, you won’t be able to collect any cash when you bring it to the bank. Online scammers often use fake money orders, so if you suspect anything, report it to the authorities.

Bottom Line

Not only are money orders secure forms of payment, but they’re also pretty convenient. You can find them at a number of locations and fill them out with ease. When filling out a money order, though, double checking is key. You’ll want to make sure the correct amount has been printed, you’ve written the correct payee name and you’ve kept the receipt. Once you’re satisfied everything is correct, you can send it off.

Banking Tips

- Since you’re reading about money orders, you probably know that sending cash through the mail isn’t a secure way to transfer money. If you don’t want to send a money order either, you still have a ton of options, especially with today’s technology. For one, you can send a wire transfer which usually takes a couple days.

- If you have the right checking account, you can also easily send money electronically without extra fees. You can also typically use these funds immediately, rather than having to wait a few days.

- Managing your savings and checking accounts responsibly can help with your long-term financial plan, which a financial advisor can also help with. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/martin-dm, United States Postal Service, ©iStock.com/dardespot