Older American workers have been disproportionately impacted by not only the health impacts of COVID-19, but also its corresponding economic shock, which has deeply affected their ability to budget and save for their retirement. In fact, workers 65 and older have seen some of the highest recent unemployment rates. A Kaiser Family Foundation analysis of April 2020 data from the Bureau of Labor Statistics (BLS) shows that the unemployment rate was highest among workers in the youngest age cohort (ages 16 to 24) – at 27.4% – and next highest among workers in the oldest age cohort (ages 65 and older) – at 15.6%.

The BLS has not yet published data on how senior employment within specific occupations has changed during COVID-19, so this study investigated the employment trends among seniors leading up to 2020. Specifically, we looked at the most popular jobs as well as fastest-growing jobs for seniors. For details on our data sources and how we put all the information together to establish our findings, check out the Data and Methodology section below.

Key Findings

- Lawyers, chief executives and real estate brokers & sales agents stand out as popular jobs. In all three occupations, there is a high gross number of senior employees. BLS data from 2019 shows that more than 160,000 seniors are employed in each of them. Furthermore, seniors make up a large percentage of the workforce in these occupations. Individuals who are 65 years and older make up more than 15% of lawyers, more than 13% of chief executives and almost 15% of real estate brokers and sales agents.

- Between 2015 and 2019, senior employment doubled in two occupations. In 2015, about 34,000 and 25,000 seniors were employed as construction managers and applications and system software developers, respectively. Those figures doubled over the following four-year period. BLS figures from 2019 show that there are roughly 77,000 construction managers and 56,000 applications and system software developers who are 65 and older.

Most Popular Jobs for Seniors

More than one in 10 of all employed seniors work in five occupations: retail salespersons (281,000 senior workers), sales and truck drivers (279,000 senior workers), secretaries and administrative assistants (249,000 senior workers), first-line supervisors of retail sales workers (232,000 senior workers) and chief executives (219,000 senior workers).

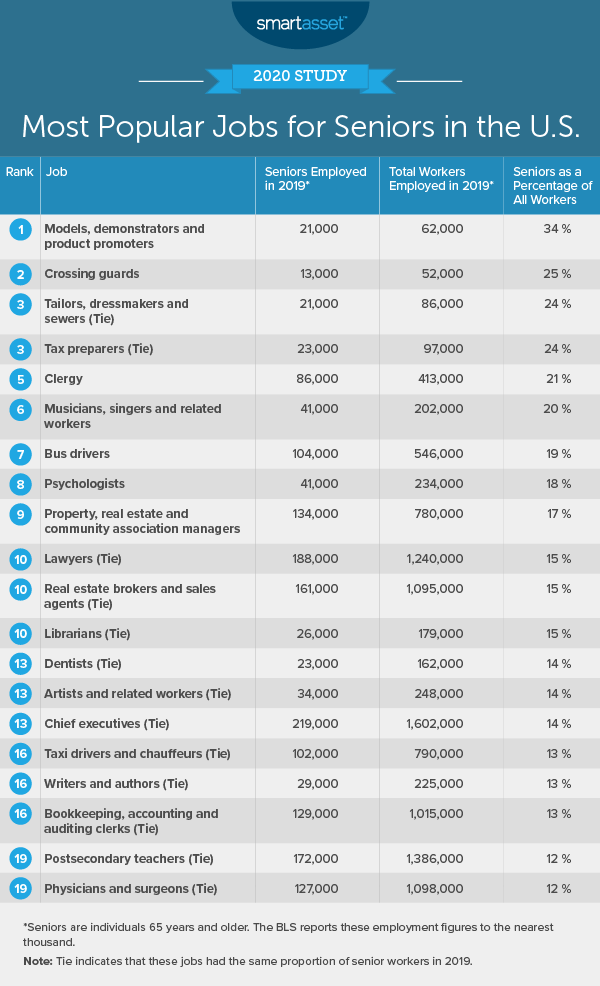

Though those occupations employ the highest gross number of seniors, seniors make up larger percentage of the workforce in a different set of jobs. BLS data shows that more than a third of models, demonstrators and product promoters are 65 or older. Specifically, of the total roughly 62,000 people employed in this occupation in 2019, about 21,000 were seniors. Average earnings for those working in this field are modest. Nationally, the average annual wage for demonstrators and product promoters in 2019 was about $35,300.

Seniors make up more than 20% of employed workers in five other jobs:

- Crossing guards

- Tailors, dressmakers and sewers

- Tax preparers

- Clergy

- Musicians, singers and related workers

Across those five occupations, the highest gross number of employed seniors work in the clergy. In 2019, there was a total of roughly 86,000 workers in the clergy who were 65 and older. The table below ranks occupations according to the percentage of seniors employed in 2019.

Fastest-Growing Jobs for Seniors

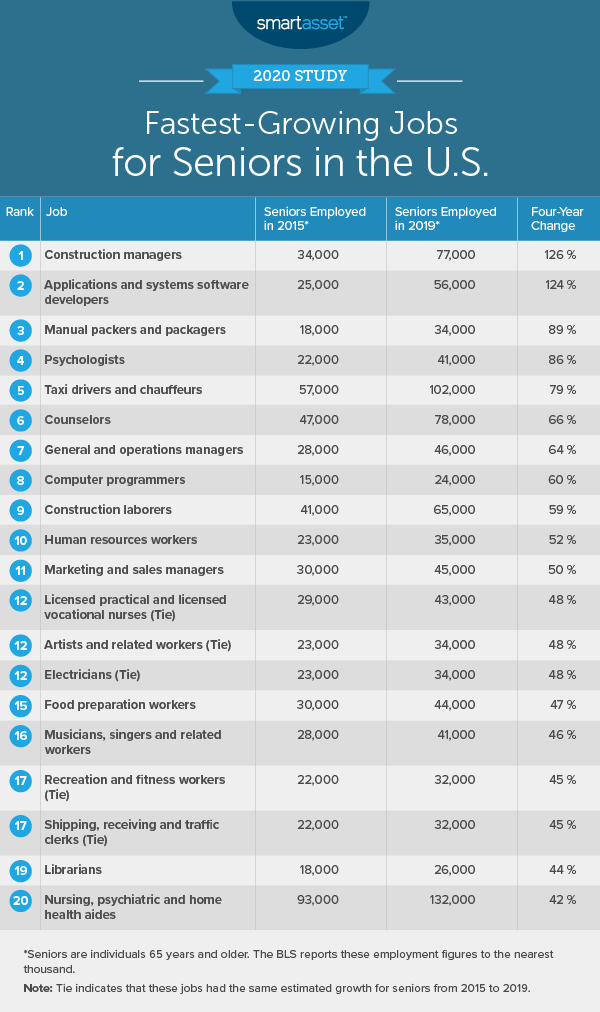

Between 2015 and 2019, construction managers and applications and systems software developers were the fastest-growing jobs for seniors. Similar occupations also rank high on our list. Specifically, a growing number of seniors have become employed as construction laborers and computer programmers in recent years. In 2015, about 41,000 construction laborers were 65 and older while in 2019, there were about 65,000 in this age group. Similarly, senior employment of computer programmers grew by about 60% over this time. In 2015, about 15,000 computer programmers were 65 and older while the BLS estimates more recently estimates that 24,000 computer programmers are seniors.

Beyond construction and computer occupations, the number of workers 65 and older grew by more than 50% in six additional occupations:

- Hand packers and packagers

- Psychologists

- Taxi drivers and chauffeurs

- Counselors

- General and operations managers

- Human resource workers

Of those occupations, taxi drivers and chauffeurs saw the largest gross increase in employed seniors. Roughly 57,000 taxi drivers were 65 and older in 2015 relative to about 102,000 in 2019. The table below shows the 20 fastest-growing jobs for seniors between 2015 and 2019.

Data and Methodology

Data for this report comes from the Bureau of Labor Statistics’ Current Population Survey. In both sections, we filtered out any occupation that employed fewer than 15,000 seniors in 2015. We also filtered out any occupation with “other” or “miscellaneous” in the title due to lack of occupational specificity. In the first section, we ranked occupations based on the percentage of workers who were 65 and older in 2019. In the second section, we looked at the four-year percentage change in seniors employed in each occupation from 2015 to 2019, ranking the occupations from highest to lowest change.

Tips for Ensuring a Comfortable Retirement

- Know how much you will need. Perhaps the most important data point when planning for your retirement is to know how much money in total you must have saved up to sustain yourself in your post-work life. From there, you can figure out how long you should stay in the workforce based on your savings rate. Our retirement calculator can help with this.

- Catch-up contributions. If you did not save enough for retirement as a young adult, catch-up contributions may help. Catch-up contributions allow people ages 50 and older to make additional deferrals to their 401(k) or IRAs after they reach the annual contribution limits set by the IRS. For more information, take a look at our guide here.

- Consider a financial advisor. Another great way to plan for retirement is through a financial advisor. A financial advisor can help you make smarter financial decisions to be in better control of your money and keep you on track in terms of your saving. Finding the right financial advisor doesn’t have to be hard though. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors who will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/