With online and mobile banking increasing in popularity, physical banks have struggled to keep their doors open. Over the past five years, the number of branch locations in America declined by 7%. Though digital banking services may allow for easier service for some customers as they deposit checks into their savings, bank branch locations continue to be an important resource for others.

In a recent Federal Reserve report, researchers note that the shift to digital banking channels is occurring more gradually for older individuals, those with lower incomes or fewer years of formal education and inhabitants of rural communities. Additionally, for all customers, even those who mostly use digital bank services, branches continue to be the dominant channel when applying for new products. According to Deloitte survey results, 65% of Americans prefer branches when applying for a mortgage, and 58% prefer one when opening a checking account.

The decline of branch offices has not been felt evenly by different banks and throughout the country. In this study, SmartAsset looked at trends in branch closures for the five largest banks in America and the cities where it has become most difficult to visit a physical bank. For details on our data sources and how we put all the information together to create the final rankings, check out the Data and Methodology section below.

Key Findings

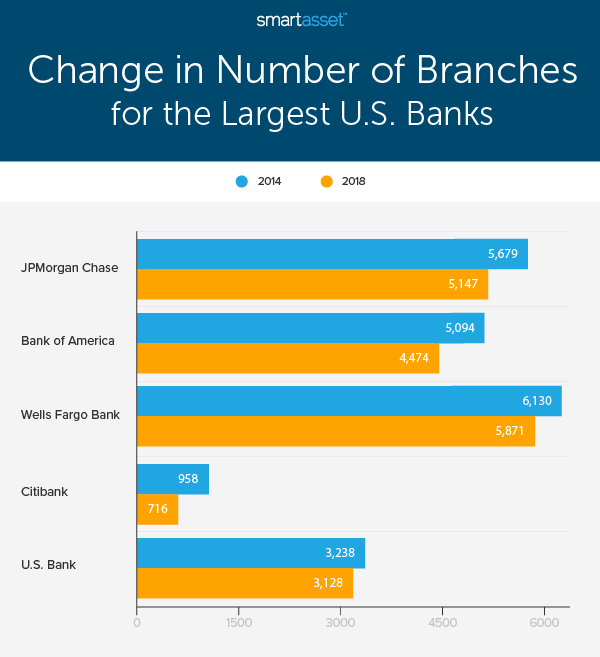

- Large banks are closing at varying rates. Between 2014 and 2018, three of the largest five banks in the U.S. closed branch locations at rates greater than the national average of 7%. They include JPMorgan Chase Bank, Bank of America and Citibank. By contrast, over the same time period, Wells Fargo Bank closed branches at a rate equal to the national average while U.S. Bank branch locations declined by only 3.4%.

- The number of branches declined in 49 of the 50 largest U.S. cities. Of the largest 50 cities in the U.S., only Raleigh, North Carolina had the same number of physical banks in 2018 as it did in 2014. The remaining 49 all experienced declines over the past five years, with 26 cities having decreases greater than the national average.

- Northeast cities have seen the fewest branch closures. None of the 10 cities where it is hardest to visit a physical bank are in the Northeast. In fact, Philadelphia, Pennsylvania is the Northeast city where it is hardest to find a physical bank branch, but it ranks roughly in the middle of all 50 cities in our study. Over the past five years, the number of bank branches declined by only about 5% in Philadelphia. Additionally, in New York, New York, fewer than 20 bank offices closed between 2014 and 2018, or only about 1% of the more than 1,700 total branches.

National Trends

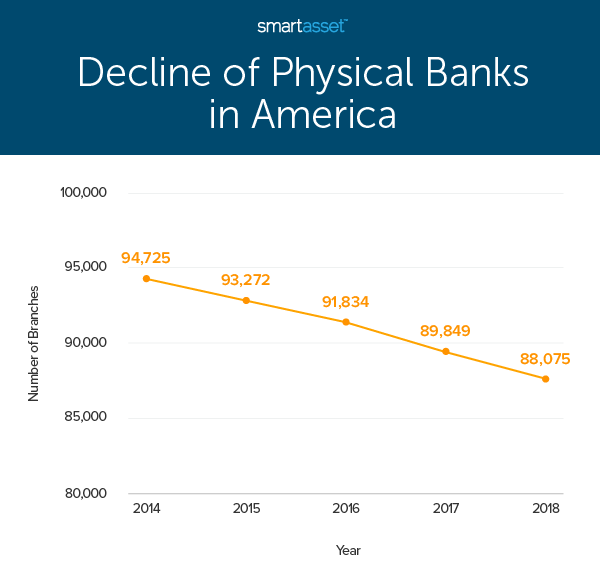

In 2014, there were a total of 94,725 federally insured banks in the U.S., or about 30 for every 100,000 people. More than 6,600 banks closed over the following five years, and in 2018, there were just 88,075 federally insured banks in the U.S., or fewer than 27 for every 100,000 people.

By net assets, JPMorgan Chase Bank, Bank of America, Wells Fargo Bank, Citibank and U.S. Bank are the largest banks in America. The Federal Deposit Insurance Corporation (FDIC) reported the following net asset figures for each of those banks at the end of 2018:

- JPMorgan Chase Bank: $2.17 billion

- Bank of America: $1.76 billion

- Wells Fargo Bank: $1.68 billion

- Citibank: $1.40 billion

- U.S. Bank: $453 million

All five banks have shut down branch locations in recent years, with Bank of America shuttering the greatest number of local offices (620) and Citibank experiencing the steepest percentage decline (25.3%). Despite numerous legal troubles in the past several years, Wells Fargo Bank closed branches at a rate equal to the national average, approximately 7.0%. Finally, JPMorgan Chase Bank closed about 530 offices – or 9.4% of their total branches – between 2014 and 2018, while U.S. Bank closed 110 offices, or 3.4% of their branches. The chart below shows the number of branch locations for each bank in 2014 and 2018.

Cities Where It’s Hardest to Visit a Physical Bank

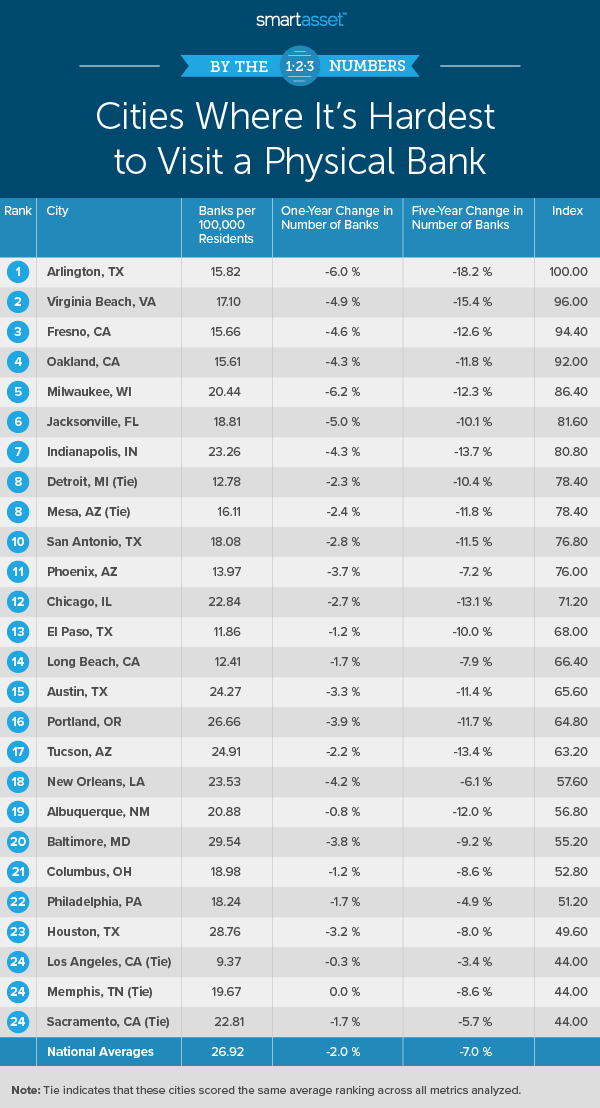

Over the past several years, some places have seen more bank closures than others. The map below shows the cities where it has become harder to visit a physical location.

1. Arlington, TX

Relative to the number of residents, banks are about 40% less common in Arlington, Texas than they are nationally. In 2018, there were 15.82 banks for every 100,000 residents in Arlington compared to the national average of 26.92. Arlington has also felt the squeeze of banks in recent years more than other cities have. Between 2014 and 2018, the number of bank branch locations in Arlington declined by 18.2%, the largest decline of any city in our study.

2. Virginia Beach, VA

With a population of roughly 450,000 and 77 bank branch locations, Virginia Beach, Virginia has the 11th-lowest number of banks per 100,000 residents of the 50 largest U.S. cities. Behind Arlington, Texas, Virginia Beach also had the second-largest decline between 2014 and 2018, with the number of local bank branches decreasing by 15.4%.

3. Fresno, CA

Over the past year, the number of banks in Fresno, California fell by 4.6%, the sixth-largest decrease for this metric of any city in our study. Specifically, there were 83 banks in Fresno in 2018 compared to 87 the year prior. Of the five largest banks in the U.S. (JPMorgan Chase, Bank of America, Wells Fargo, Citibank and U.S. Bank), Bank of America and Wells Fargo Bank are the banks in Fresno that have the highest number of branches, with 13 and 12 local offices, respectively.

4. Oakland, CA

Oakland, California ranks in the bottom fifth for all three metrics we considered: banks per 100,000 residents, one-year change in number of banks and five-year change in number of banks. In 2018, there were only 15.61 banks per 100,000 residents in the city. Moreover, the number of federally insured bank offices declined by 4.3% and 11.8% over the past one and five years, respectively.

5. Milwaukee, WI

Almost half of the five-year decline in physical bank locations in Milwaukee, Wisconsin happened within the last year. The number of banks decreased by 12.3% between 2014 and 2018, the seventh-largest percentage decline in our study. However, between 2017 and 2018 alone, the number of banks fell by 6.2%, the greatest one-year percentage decline of any city in our study.

6. Jacksonville, FL

Almost 20 branch offices closed in Jacksonville, Florida between 2014 and 2018. In percentage terms, this was a decline of 10.1%, the 16th-largest in our study. As a result of that drop, there were 170 banks in Jacksonville at the end of 2018 according to FDIC data, or about 19 per every 100,000 residents.

7. Indianapolis, IN

Though Indianapolis, Indiana has the largest number of banks per 100,000 residents (23.26) of any place in our top 10, the number of banks fell by 13.7% between 2014 and 2018, the third-largest decline during that window in the study overall. More than 30 banks closed over that time period. Specifically, in 2014, there were 233 branch locations in Indianapolis, and in 2018, there were only 201.

8. Detroit, MI (tie)

Detroit, Michigan has the lowest number of banks per 100,000 residents of any city in our top 10. We found using FDIC bank data and Census Bureau population data that there were only about 13 banks for every 100,000 residents in 2018, the fourth-lowest concentration of any of the 50 largest U.S. cities, following only Los Angeles, California; El Paso, Texas; and Long Beach, California. Over the past one and five years, the number of bank offices declined by 2.3% and 10.4%, respectively.

8. Mesa, AZ (tie)

Mesa, Arizona ties with Detroit as the eighth-most-difficult place in the country to visit a physical bank. Though only two bank offices closed in Mesa from 2017 to 2018, 11 closed between 2014 and 2018, marking an 11.8% decline. In 2018, there were 16.11 bank offices for every 100,000 residents, the 10th-lowest rate in our study.

10. San Antonio, TX

San Antonio, Texas is the largest U.S. city on this list, with a population of about 1.5 million. In 2018, there were 277 banks in the city, or about 18 banks for every 100,000 residents. Of those banks, 33 were JPMorgan Chase, 25 were Bank of America and 30 were Wells Fargo Bank. The total number of physical banks in San Antonio decreased from 313 branches in 2014 and 285 in 2014.

Data and Methodology

To find the cities where it’s hardest to visit a physical bank, SmartAsset looked at the 50 largest cities in the U.S., considering only federally insured banks as reported by the Federal Deposit Insurance Corporation (FDIC). We compared them across the following three metrics:

- Banks per 100,000 residents. Data on the number of banks comes from the Federal Deposit Insurance Corporation (FDIC), while population data comes from the Census Bureau’s 1-year American Community Survey. Data for both metrics is for 2018.

- One-year percentage change in the number of banks. This is for 2017 through 2018. Data comes from the Federal Deposit Insurance Corporation (FDIC).

- Five-year percentage change in the number of banks. This is for 2014 through 2018. Data comes from the Federal Deposit Insurance Corporation (FDIC).

We ranked each city in every metric, giving a full weighting to all three metrics. We then found each city’s average ranking and used the average to determine a final score. The city with the best average ranking received a score of 100. The city with the worst average ranking received a score of 0.

Tips for Finding Local Financial Help

- Determine the right bank nearest you. The Federal Deposit Insurance Corporation’s Bank Find tool allows users to find out if their bank is FDIC-insured, locate other branches, find out if your bank has merged or been acquired and review your bank’s history. The tool may be found here. Additionally, SmartAsset has a comprehensive review of the best banks in America in 2020, which may help if you are still trying to decide where to open an account.

- Use an online bank. Are you not in need of the services of a brick-and-mortar bank? Understand the differences between online and traditional banks and see if an online high-yield savings account might work well for you.

- Consider a financial advisor. Just as many consumers would like to have a physical bank nearby, a local financial advisor is often preferred by many consumers. A local financial advisor can help you make smarter financial decisions to be in better control of your money while also being available for day-to-day questions you may have. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/simonkr