According to Census data, more than 17% of American households earn between $50,000 and $74,999, making it the income bracket comprising the highest number of people. This large cohort may not be among the most handsomely paid in the U.S., but strategically living in a place with robust employment opportunities and a lower cost of living can help Americans stretch their dollar further and enable them to sock away ample savings. With that in mind, SmartAsset decided to find the best cities in America for those with an annual income of $60,000, the sweet-spot of this range.

To find the best cities in America to live on a $60,000 salary, we compared 97 cities (all with a population of at least 60,000 and a median household income of between $55,000 and $65,000) across the following nine metrics: median household income, median monthly housing costs, housing costs as a percentage of a $60,000 income, entertainment establishments per 10,000 residents, civic establishments per 10,000 residents, percentage of people without health insurance, average commute time, unemployment rate and poverty rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s second annual study on the best places to live on a $60,000 salary. Read the 2019 version here.

Key Findings

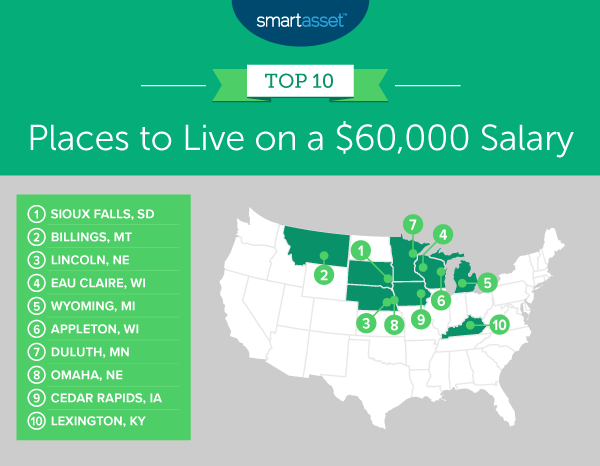

- Smaller cities – especially in the Midwest – rank highly. It probably comes as no shock that big cities aren’t making the cut here. Real estate and cost of living are just too expensive in big cities, and especially on the coasts. For true value, look to places a bit off the beaten path. Eight of our top 10 cities (all except Omaha, Nebraska and Lexington, Kentucky) have fewer than 300,000 people. Additionally, eight of our top 10 cities (all except Billings, Montana and Lexington, Kentucky) are located in the Midwest.

- Under one grand. All but one of the top 10 cities in our study (Omaha, Nebraska) have median housing costs of less than $1,000 a month, or $12,000 a year, representing less than 20% a $60,000 income.

1. Sioux Falls, SD

The best city to live in on a $60,000 salary is Sioux Falls, South Dakota, according to the data we analyzed. Sioux Falls comes in sixth overall for two of our nine metrics: average commute time (17.4 minutes) and poverty rate (8.6%). It also comes in eighth for three other metrics: entertainment establishments (8.75 per 10,000 residents), civic establishments (13.00 per 10,000 residents) and July 2020 unemployment rate (5.8%).

2. Billings, MT

Billings, Montana has 13.08 civic institutions per 10,000 residents (the seventh-highest rate for this metric in the study) and 10.48 entertainment establishments per 10,000 residents (the sixth-highest rate in the study). Only 4.4% of the population in Billings is without health insurance – the sixth-lowest rate for this metric across all 97 cities we analyzed.

3. Lincoln, NE

Lincoln, Nebraska had an unemployment rate of just 5.0% in July 2020, the second-lowest ranking overall for this metric. Lincoln has 13.26 civic establishments per 10,000 residents, sixth-highest in the study. The city places 10th overall for average commute time, with the average person going from home to work in 18.4 minutes.

4. Eau Claire, WI

Eau Claire, Wisconsin has an average commute time of just 15.1 minutes, ranking second-shortest in the study. The city places eighth for two other metrics: median monthly housing costs ($915) and housing costs as a percentage of a $60,000 income (18.30%).

5. Wyoming, MI

Wyoming, Michigan has a poverty rate of just 8.5%, ranking fifth-best across all 97 cities we studied. Wyoming places fourth in two separate metrics related to housing costs: median monthly housing costs ($880) and median housing costs as a percentage of a $60,000 income (17.60%). There are 12.01 civic establishments per 10,000 residents, ninth-highest overall.

6. Appleton, WI

The July 2020 unemployment rate in Appleton, Wisconsin was 6.1%, 10th-lowest of the 97 cities for which we considered data. Appleton’s median monthly housing costs amount to $920 (an 11th-best ranking) represent just 18.40% of a $60,000 income (also an 11th-best ranking). Appleton’s other top-20 ranking is for a relatively low poverty rate of 11.5%.

7. Duluth, MN

Duluth, Minnesota has the highest number of civic establishments of any city we analyzed, at 15.62 per 10,000 residents. The city comes in third in terms of the percentage of residents without health insurance, at just 3.5%, and fifth for average commute time, at 16.8 minutes. While Duluth has a median household income of just $55,819 – ranking 88th overall for this metric – it ranks ninth overall for both housing cost metrics we considered.

8. Omaha, NE

Omaha, Nebraska had the 11th-lowest July 2020 unemployment rate in the study, coming in at 6.4%. The city places 20th for its relatively low poverty rate, with 11.6% of the population living below the poverty line. Omaha is fairly expensive, with median monthly housing costs of $1,044, which represents 20.88% of a $60,000 income – ranking 31st out of 97 in the study for both housing costs and housing costs as a percentage of income.

9. Cedar Rapids, IA

Cedar Rapids, Iowa has monthly median housing costs of $902, which is 18.04% of a $60,000 income. The city places seventh in our study for both of those metrics. Cedar Rapids has two other top-15 metrics: It ranks 12th overall for the relatively low percentage of people without health insurance (5.5%) and 13th overall for average commute time (18.7 minutes).

10. Lexington, KY

Lexington, Kentucky had the seventh-lowest July 2020 unemployment rate of the 97 cities we analyzed, at 5.7%. Median monthly housing costs in Lexington total $991, which is 19.82% of a $60,000 budget (a top-25 rate). Lexington also ranks 10th out of 97 for its relatively high number of civic establishments, at 11.98 per 10,000 residents.

Data and Methodology

To find the best cities in the U.S. to live on a $60,000 salary, SmartAsset first created a list of the cities in which the population was at least 60,000 people and the median household income was between $55,000 and $65,000. We did this in order to find the cities where an income of $60,000 fell within the range of an average household. This resulted in a list of 97 cities, which we compared across the following nine metrics:

- Median household income. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Median monthly housing costs. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Housing costs as a percentage of income. We calculated this by finding the median monthly housing costs as a percentage of a $60,000 salary. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Entertainment establishments per 10,000 residents. Data comes from the Census Bureau’s 2018 Business Patterns Survey. It is measured at the county level.

- Civic establishments per 10,000 residents. Data comes from the Census Bureau’s 2018 Business Patterns Survey. It is measured at the county level.

- Percentage of people without health insurance. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Average commute time. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Unemployment rate. Data comes from the Bureau of Labor Statistics and is for July 2020.

- Poverty rate. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

First, we ranked each city in each metric. From there, we calculated the average ranking for each city, assigning each metric an equal weight. Using this average ranking, we created our final score. The city with the highest average ranking received a score of 100. The city with the lowest average ranking received a score of 0.

Tips for Managing your Money With $60k in Income

- Seek expert financial advice. If you’re making $60,000 a year, you might stretch your dollar further by living in a place with lower living costs. But no matter your salary, a financial advisor can help you make the most of your money. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Create a budget you can count on. If you’re trying to make your $60k salary cover all your expenses (and still have something leftover to save), consider using SmartAsset’s budget calculator.

- It’s never too early to be saving even a little for retirement. You work hard to earn that $60k a year. Now make that money work for you. Even if you’re on a relatively tight budget, try to make sure you save for retirement, perhaps using a workplace savings vehicle like a 401(k).

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/AndreyPopov