Buying a home requires just as much care as any other significant investment. If being a first-time homebuyer is a part of your American dream, it’s important to choose a home that fits your budget based on your savings at the same time that it meets your other lifestyle needs. First-time homebuyers might find the home-buying process especially daunting, but there are many programs out there to help make it easier. And location, of course, is a crucial factor. Local market conditions, such as how stable the housing market is, can sometimes make all the difference. To help you get a better sense of where to start looking, SmartAsset created this list of the best cities for first-time homebuyers.

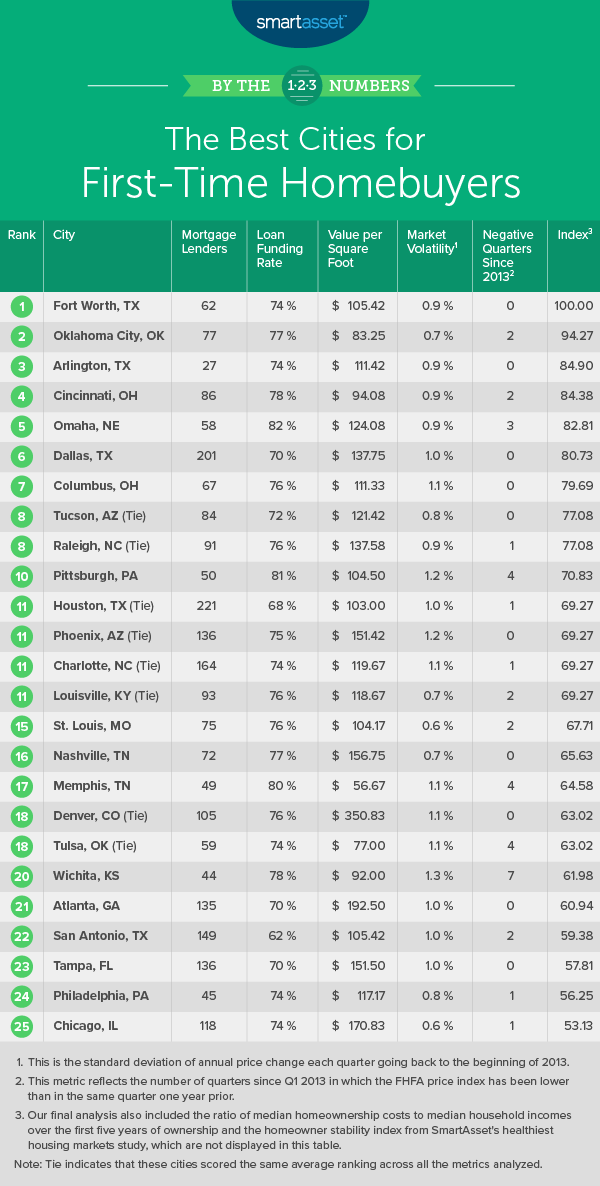

To find the top contenders, we ran the data to find the best cities for first-time homebuyers. We looked specifically at data on seven factors: the number of HUD-approved lenders, loan funding ratios, the average price per square foot, housing affordability, homeowner stability, home price volatility and the number of negative quarters over the past six years. You can learn more about our data sources and how we created final rankings by reading the Data and Methodology section below.

Key Findings

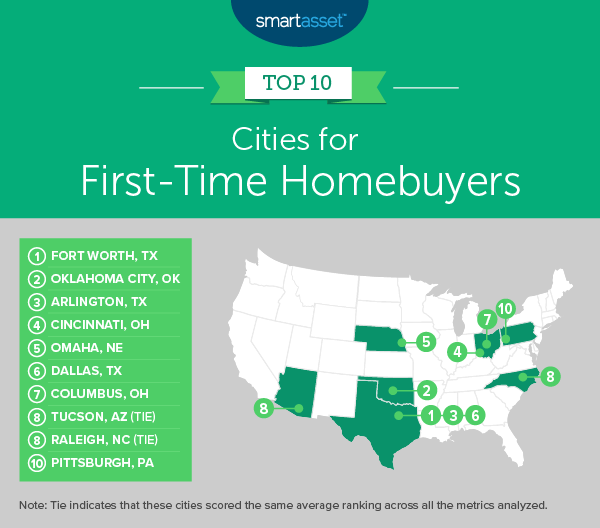

- The West Coast and Northeast struggle. The highest-ranked city in a state on the West Coast is Fresno at 28. Seven of the study’s bottom 10 cities are in California. Similarly, the Northeast only has two cities in the top 25. One reason for this may simply be that cities on the West Coast and in the Northeast tend to have a higher cost of living than cities in the center of the country.

- Texas still hot for first-time homebuyers. The Lone Star State consistently does well in our rankings, and this year is no different. Three Texas cities are in the top 10, and two of those are in the top three.

- Volatile markets sink to the bottom. While the top cities do better across multiple metrics, the top-10-ranked cities do relatively better than the bottom-10-ranked cities in terms of market volatility.

This is SmartAsset’s fifth annual study of the best cities for first-time homebuyers. Read the 2018 version here.

1. Fort Worth, TX

Fort Worth, Texas moved up 10 spots from last year’s list to claim the title as the best city for first-time homebuyers in 2019. The North Central Texas city ranks first overall in the metric of negative quarters, with our data showing the city has had zero year-over-year negative quarters between 2013 and 2018.

Fort Worth also ranks in the top 20 in our study for the metrics of affordability ratio, homeowner stability, market volatility and value per square foot.

2. Oklahoma City, OK

This is Oklahoma City’s third year in a row claiming the second spot on this list. Oklahoma City ranks better than any other top 10 city in the metric of value per square foot. It has the fifth-lowest price per square foot at $83.25.

Oklahoma City also has the lowest level of market volatility of any city in the top 10. Market volatility was at 0.70% from 2013 to 2018.

3. Arlington, TX

Another Texas city, Arlington, comes in third among the best cities for first-time homebuyers. Jumping from the 14th spot last year, Arlington has had zero negative quarters year over year between the first quarter of 2013 and the final quarter of 2018. This ties it with Fort Worth and several other cities for first in this metric.

Arlington is also tied with Fort Worth in 10th place for affordability. Our data indicates that Arlington has a five-year income-to-housing-costs ratio of 4.92. On the downside, it has the lowest number of HUD-approved mortgage lenders – 27 – out of any top-10 city.

4. Cincinnati, OH

Cincinnati, Ohio offers both housing affordability and a low average price per square foot, ranking ninth overall in both metrics. The city has a five-year income-to-housing-costs ratio of approximately 5.01 and an average value per square foot of $94.08.

Cincinnati also ranks in the top 10 overall for loan funding rate. An estimated 78% of conventional mortgage loan applications here are funded.

5. Omaha, NE

Unlike the previous four cities, Omaha, Nebraska actually dropped a couple of spots in this year’s list. The city has had three year-over-year negative quarters between 2013 and 2018. It also has a higher average value per square foot – $124.08 – than seven other top 10 cities.

However, it still holds strong in a number of metrics. In Omaha, an impressive 82% of conventional mortgage loan applications are funded, which puts the city in second overall for that metric. It also has a top-10 score for homeowner stability.

6. Dallas, TX

Dallas, which appeared in the 10th spot last year, is the third Texas city to make it into our top 10 for 2019. The city stands out for the number of HUD-approved mortgage lenders there. It ranks second overall in this metric, with a total of 201 mortgage lenders. Additionally, Dallas has had zero year-over-year negative quarters between 2013 and 2018, tying it for first in this metric.

Dallas does have the lowest loan funding rate in our top 10, with only 70% of conventional mortgage loan applications there funded. It also has the highest value per square foot of any city in our top 10, at $137.75.

7. Columbus, OH

In further evidence that Ohio is becoming increasingly hospitable to first-time homebuyers, Columbus is the second Buckeye State city to move into the top 10 after not even making the top 25 in 2018. Like several other cities in our top 10, Columbus has had zero year-over-year negative quarters between 2013 and 2018, which is a top score.

The city also has a top-20 score for loan funding rate, with 76% of conventional mortgage loan applications funded.

8. Tucson, AZ (tie)

Tucson, Arizona landed in the 8th spot this year also after not even entering the top 25 last year. It has had zero year-over-year negative quarters between 2013 and 2018, which ties it for first in this metric with several other cities. Tucson also has a top-20 score for housing affordability ratio.

One factor that might have kept Tucson from ranking higher this year is its homeowner stability index score, which is lower than that of any other city in our top 10.

8. Raleigh, NC (tie)

Raleigh, North Carolina jumped nine spots this year and now ties with Tucson. North Carolina’s capital city boasts top-20 scores in two metrics, loan funding rate and market volatility. Out of all the conventional mortgage loans in the city, 76% are funded. Raleigh’s market volatility, or its standard deviation of annual housing price changes from 2013 to 2018, is 0.90%.

The city has only had one quarter of negative growth in home values between 2013 and 2018.

10. Pittsburgh, PA

Our list of the top 10 best places for first-time homebuyers concludes with Pittsburgh, Pennsylvania, which was our top-ranking city last year. Where Pittsburgh especially lags behind the rest of the top 10 is in its ranking for number of negative quarters. The Steel City has had four year-over-year negative quarters between 2013 and 2018. It makes up for this lag, though, with its third-place spot in the metric of loan funding rate. About 81% of conventional mortgage loans here are funded. The city also ranks in the top 10 for the metrics of affordability ratio and homeowner stability index.

Data and Methodology

To determine the best cities in the country for first-time homebuyers, SmartAsset analyzed data for every U.S. city with a population of more than 300,000. That left us with 66 cities, and we compared them across the following seven metrics:

- Mortgage lenders. We looked at the total number of HUD-approved mortgage lenders in each city. This data comes from the Department of Housing and Urban Development.

- Value per square foot. For most cities, we calculated the average value using 2018 data from Zillow. For cities for which we did not have data, we calculated the average using 2018 county data.

- Loan funding rate. This is the number of conventional mortgage loans originated in 2016 as a percentage of conventional mortgage loan applications. Data comes from the Mortgage Bankers Association.

- Affordability ratio. This is the ratio of median household income to median housing costs (within the first five years of ownership). It includes property taxes, closing costs and homeowners insurance. Data comes from the U.S. Census Bureau’s American Community Survey, government websites and the National Association of Insurance Commissioners.

- Market volatility. We looked at the standard deviation of quarterly annual housing price changes from the first quarter of 2013 to the fourth quarter of 2018. Data comes from the Federal Housing Finance Agency’s Home Price Index.

- Negative quarters. This is the number of quarters starting with the first quarter of 2013 and ending with the last quarter of 2018 in which home prices fell on a year-over-year basis. Data comes from the Federal Housing Finance Agency’s Home Price Index.

- Homeowner stability index. This measures homeowner stability by looking at the number of years homeowners stay in their homes and the number of homeowners with negative equity. This metric comes from SmartAsset’s analysis of the healthiest housing markets. Calculations are based on data from Zillow and the U.S. Census Bureau’s American Community Survey.

To create our final rankings, we started by ranking each city in each metric. Then we found each city’s average ranking, giving equal weighting to each metric. We used these average rankings to create our final scores. The city with the best average ranking received a score of 100. The city with the worst average ranking received a score of 0.

Tips for First-Time Homebuyers

- Start early. You will need to make a down payment in order to buy a home. In an ideal world, you can make a down payment of at least 20%. But even if it isn’t that much, make sure to put down as much as possible, because the higher that lump-sum, the less you will spend on interest. To save enough for a down payment, remember that the earlier, the better. The effects of compound interest mean that starting to sock away money sooner will have a big impact on how much you have.

- Plan for extra costs. First-time homeowners are often surprised at the costs they incur outside of their mortgage. Your local property taxes could add up to more than $1,000 each year, depending where you live. There are also additional costs like homeowners insurance and condominium fees. As you look for homes, make sure you factor in these expenses.

- Don’t overspend. Set a budget when you start looking for a home and don’t exceed it. It’s tempting to pay a little extra sometimes in order to get that dream home, but it’s not worth the years of struggle that will follow as you try to pay off the bigger bills. The last thing you want is to have to sell a home because you can’t afford to make payments.

- Get an expert opinion. Buying a home is a big decision. To help you choose the right home and to plan your finances after the purchase, consider talking to a financial advisor who can help you look over your entire financial situation. Such a professional is trained in multiple areas of finances, which means that she can also help with more than just finding an affordable mortgage. For example, a financial advisor may be able to help you plan for your retirement, save for a loved one’s education costs, draft an estate plan or create a budget when starting a family. To find an advisor, we recommend this free matching tool. It will narrow your search down from thousands of advisors to up to three in your area who meet your needs.

Becca Stanek, CEPF® contributed additional reporting.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Pureradiancephoto