The Federal Reserve says that revolving consumer credit debt – including debt from credit cards, home equity lines of credit and personal lines of credit – increased to $974.4 billion in February 2021, marking a 10.1% annual rate increase from the year prior. This is almost one-third of all consumer debt – which also includes student and car loans – and adds up to a grand total of $4.2 trillion. With so many people trying to pay off credit card debt, SmartAsset crunched the numbers to identify and rank the best cities where it’s easiest to do so.

To do so, we considered unemployment rate, median post-tax income, lower-quartile rents and disposable income to find where debt could be paid off the fastest, assuming average interest rates and a total debt of $7,935. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

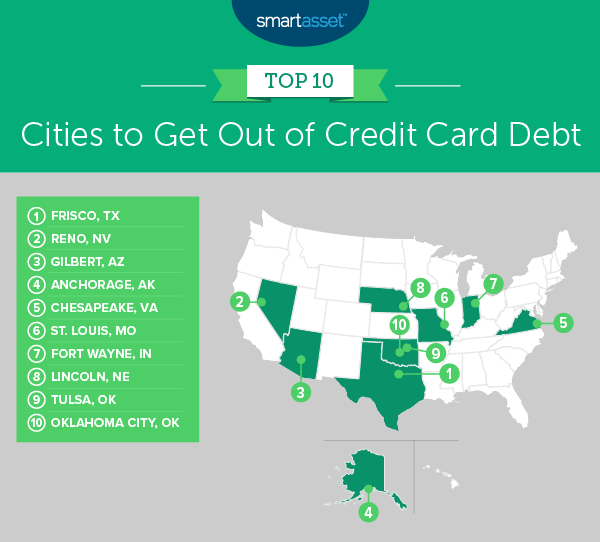

This is SmartAsset’s 2021 study of the best cities to get out of credit card debt.

Key Findings

- Timelines can vary widely. Debt in the top 10 cities of our study can be paid off in just over 10 months, while the average for the bottom 10 is almost 18 months. Frisco, Texas is the city where debt can be paid fastest – under nine months. And Arlington, Virginia takes more than four times longer – a little over 36 months.

- Residents in smaller cities can pay debt faster. Small and mid-sized cities in this study can pay debt off quickly. All of the top five cities have fewer than 250,000 residents. Affordable rent and a sizable disposable income (which is the money you take home after taxes) are key factors for residents in these cities to pay off debt.

1. Frisco, TX

Frisco, Texas residents can pay off a credit card debt of $7,935 in 8.59 months. The post-tax income for high-school graduates in this city is just over $37,000. And with a lower-quartile rent (the most affordable unit one could reasonably acquire) of $1,126 per month, residents can afford to make monthly debt payments of $979.

2. Reno, NV

Reno, Nevada residents can get out of $7,935 debt in 9.43 months. The post-tax income for high school graduates is around $31,000 and the lower-quartile rent is $787 per month. This means that if they apply 50% of their disposable income after rent to paying down credit card debt, they can afford a monthly payment of $896.

3. Gilbert, AZ

The median post-tax income for high school graduates in Gilbert, Arizona is $35,463. Residents in this city can pay off a credit card debt of $7,935 in 9.60 months. And with a lower-quartile rent (the lowest number under which 25% of renters pay for rent) of $1,192 per month, monthly debt payments of $882 are possible.

4. Anchorage, AK

Anchorage, Alaska residents can pay off a credit card debt of $7,935 in 10.04 months. The median post-tax income for a high school graduate is $30,650 and the lower-quartile rent is $863 per month. If a resident applies half of their disposable income to paying down debt, they could make monthly payments of $846.

5. Chesapeake, VA

Chesapeake, Virginia residents can pay a debt of $7,935 off in 10.11 months. The median post-tax income for a high school graduate is $29,087, Furthermore, the most affordable rental unit, at the lower-quartile mark, costs $744 per month. With just over $20,000 in disposable income after rent, residents can apply half to monthly debt payments of $840.

6. St. Louis, MO

St. Louis, Missouri’s median income for high school graduates is just under $26,000 and the lower-quartile rent total is $519 a month. If someone with that income and rent adopted a relatively aggressive repayment strategy and put half of their disposable income towards paying a credit card debt of $7,935, they would be free of credit card debt in 10.37 months.

7. Fort Wayne, IN

Fort Wayne, Indiana’s median post-tax income for high school graduates is $24,881 – the lowest in the top 10 of this study. The lower-quartile rent (the most affordable unit one could reasonably acquire) in this city is $496 a month. Someone with almost $19,000 in disposable income after rent could pay off a total credit card bill of $7,935 in 10.81 months.

8. Lincoln, NE

The median post-tax income for a high school graduate in Lincoln, Nebraska is $25,828. And the lower-quartile rent in this city is $589. If residents were able to afford to put half of their disposable income after rent towards repayment, they could pay down a credit card bill of $7,935 in 10.91 months.

9. Tulsa, OK

Residents in Tulsa, Oklahoma could pay off a credit card debt of $7,935 in 10.98 months. This is based on a median post-tax income of $25,038 and a lower-quartile rent payment of $532, which means that they could afford a monthly debt payment of $777 using a relatively aggressive repayment strategy.

10. Oklahoma City, OK

Oklahoma City, Oklahoma is the most-populous in the top 10 of this list and it has a median post-tax income of $25,125 for high school graduates. The lower-quartile rent payment is $558 a month. Using a relatively aggressive repayment strategy, a resident who puts half of all disposable income after rent towards debt could pay a credit card bill of $7,935 in 11.12 months.

Data and Methodology

In order to find the best places to pay off credit card debt, we created a credit card debt payment model for 56 cities. To determine our list of cities, we excluded cities with a population smaller than 200,000 and those with a below-average unemployment rate.

To complete the analysis, we first calculated the amount of disposable income a high school graduate could have in each city, assuming he or she earned the median salary for high school graduates with no further education. Using SmartAsset’s income tax calculator, we found the after-tax income for local high school graduates. We then subtracted the annual lower-quartile rent to get how much disposable income the average high school graduate would have. Lower-quartile rent is the lowest number under which 25% of renters pay for rent.

We then assumed that high school graduates would dedicate half of their disposable income to credit card payments. Using that figure, we calculated how long it would take to pay off $7,935 of credit card debt, determined by dividing the estimated outstanding credit card debt by the number of households in the U.S. in February 2021. We also assumed consumers would be paying interest of 15.91%, which was the estimated average credit card interest rate, according to the Federal Reserve.

Data for population, median income for high school graduates and lower-quartile rent comes from the U.S. Census Bureau’s 2019 1-year American Community Survey. February 2021 unemployment figures come from the Bureau of Labor Statistics (BLS) and are measured at the county level.

Credit Card Tips

- Consider consulting an expert. A financial advisor can help you plan so that you don’t find yourself in debt. SmartAsset’s free tool connects you with financial advisors in five minutes. If you’re ready to be matched with advisors, get started now.

- Budgeting can go a long way in minimizing or even preventing debt. A budget is another way to make sure you don’t end up with too much credit card debt. Use SmartAsset’s free budget calculator to plan how much to spend on various categories so you don’t end up owing more than you make.

- Choose the right card for you. If you do use a credit card, use SmartAsset’s Best Credit Cards rankings to find one that is best for your lifestyle.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/Farknot_Architect