The pandemic is complicating many people’s efforts to file their 2020 taxes by the deadline. But the good news is that the IRS has extended until May 17, 2021, the amount of time filers have to turn in their 2020 returns. But even if the extra month is not time enough to complete your returns, don’t worry. Missing the cutoff date isn’t necessarily the end of the world, although you could end up getting hit with some hefty penalties if you don’t get your return in on time. If you already owe a sizable tax bill you may find yourself digging an even deeper hole the longer you wait. Here’s what you can do to minimize penalties and interest if you end up filing your taxes late.

E-File Your Return

The most important thing you need to do is file your tax return as soon as possible and e-filing is the fastest way to get your information to the IRS. Typically, e-filing services are available through Oct. 15, which is the deadline for filing late if you requested an extension. If your income is $57,000 or less you can file for free through the IRS website.

If you didn’t file an extension by the tax filing deadline, you’ll have to pay a failure-to-file penalty. The penalty is 5% of the amount of taxes you owe for every month your return is late, up to a maximum of 25%. The penalty for filing late is ten times higher than the penalty for paying late so it pays to get your return in as quickly as you can.

Pay What You Can

When you can’t afford to pay your tax bill in full it can be tempting to hold off on filing until you’ve got enough cash but you’re just creating a bigger problem in the long run. If you’re filing late, you should try to pay as much as possible to minimize the penalties and interest. Even though the failure-to-pay penalty is just 0.5% of what you owe, it can still add up relatively quickly.

If you need more time to pay, you should look into the different payment plans the IRS offers. There are several different types of installment agreements available, both for individuals and business owners, and your eligibility typically depends on the amount of taxes you owe. Penalties and interest will continue to accrue until the bill is paid in full but as long as you’re making your payments on time you won’t be subject to any additional collection actions.

Special Situations

The IRS recognizes that there are certain circumstances that may prevent you from filing your return on time. If you’re a U.S. citizen and you’re out of the country on the deadline for filing, you’re automatically granted an additional two months to file your return and pay any taxes due without incurring any penalties. If you need more time to file, you can request a four-month extension but you’ll still need to pay any taxes you owe as soon as possible.

You may also be able to get a waiver for penalties if you couldn’t file because of a situation that was beyond your control. For example, if you were having major surgery or you had an emergency situation that required you to travel the IRS might be willing to cut you a break.

When You’re Due a Refund

The IRS won’t assess any penalties if you’re owed a refund but you should still file your return as close as possible to the filing date. The longer you wait to file, the longer it will take for the IRS to process your return and cut you a check. You should also keep in mind that you can’t put off filing your return indefinitely when you’re expecting a refund. You only have three years from the filing deadline to get your return in; otherwise, you forfeit any cash Uncle Sam owes you.

If You Don’t File at All

If you don’t file your tax return at all, don’t assume the IRS won’t notice. It may take several months or even years but eventually the tax man will come calling. Typically, you’ll receive a letter notifying you that you have an outstanding tax liability. By this time, you’ve already racked up hundreds or even thousands of dollars in penalties, interest and late fees.

If you continue to ignore notices about your tax bill, the IRS could decide to put a lien against your property. You may also find yourself the target of an audit if the government suspects you didn’t file your taxes properly in previous years. All of these potential consequences add up to major financial headaches so if you’re thinking of not filing at all, it’s best to think again.

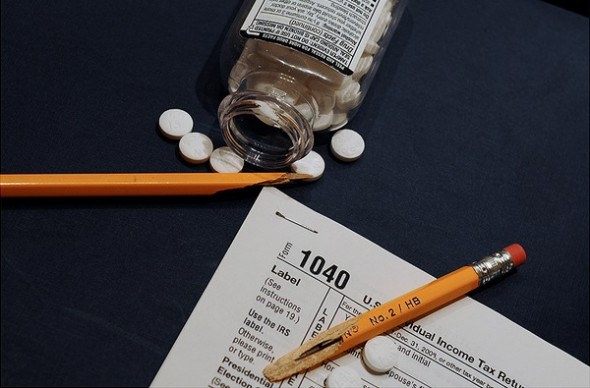

Photo credit: MFitzPhoto, ©iStock.com/-zlaki-, ©iStock.com/Juanmonino