Form 4684 allows individuals, businesses and estates to claim deductions against any unexpected losses due to theft or disasters. These deductions can help reduce taxable income, but they come with specific eligibility requirements and limitations. In most cases, only losses caused by federally declared disasters or qualified thefts can be deducted.

A financial advisor can help you claim tax deductions for disaster or theft losses using Form 4684.

What Is Form 4684?

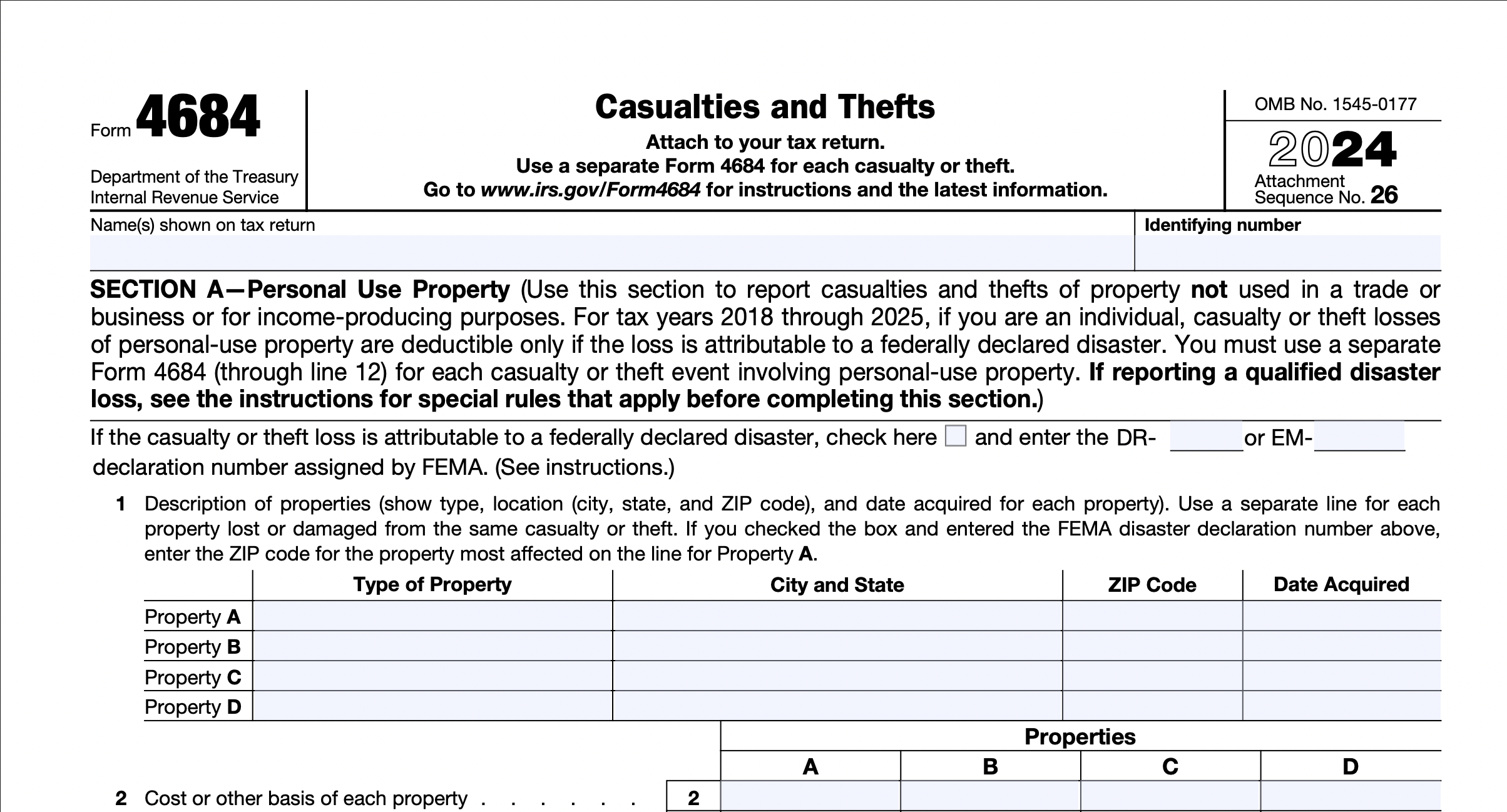

Form 4684, titled Casualties and Thefts, is used to report financial losses that result from unexpected events, such as natural disasters, accidents or theft. The IRS distinguishes between casualty losses — caused by sudden and unusual events like hurricanes, earthquakes or fires — and theft losses, which result from criminal acts such as burglary or fraud. The deduction amount is limited by insurance reimbursements and a required $100 reduction per event for personal-use property. Additionally, the deductible portion of the loss must exceed 10% of the taxpayer’s adjusted gross income (AGI).

How to File Form 4684

If you want to claim deductions for disaster or theft losses, here are seven general steps to help you get started:

- Download Form 4684 from the IRS website or obtain it through tax preparation software.

- Calculate the cost basis of the property, which refers to its original value before the loss.

- Determine the fair market value (FMV) before and after the event to assess the financial impact.

- Subtract any insurance reimbursement or compensation received from insurance claims, government assistance or settlements.

- Apply the $100 reduction per event and further reduce the loss by 10% of adjusted gross income (AGI) for personal-use property.

- Transfer the calculated loss to Schedule A (Itemized Deductions) if claiming a personal deduction.

- Attach Form 4684 to Form 1040 and submit it with your tax return.

What Qualifies as a Qualified Disaster Loss?

The loss must result from a federally declared disaster as designated by the Federal Emergency Management Agency (FEMA). The loss must be sudden, unexpected and beyond the taxpayer’s control (e.g., floods, wildfires, tornadoes, earthquakes) and the damaged or destroyed property must be personal-use or business property that was not already compensated by insurance or other relief programs. Additionally, tax laws allow affected individuals to claim losses in either the tax year the disaster occurred or the previous tax year for potentially greater tax benefits.

Examples of qualified disaster losses include:

- A home destroyed by a wildfire in a declared disaster area.

- A vehicle damaged by flooding in a FEMA-designated flood zone.

- A business property impacted by a hurricane, resulting in structural damage.

Non-qualified losses, however, would include:

- Property damage due to wear and tear or gradual deterioration (e.g., termite damage).

- Losses from personal negligence (e.g., leaving a car unlocked and experiencing theft).

- Property damage without a federally declared disaster designation.

Frequently Asked Questions

Can I Deduct a Casualty Loss If I Do Not Itemize Deductions?

No, except for qualified disaster losses, casualty and theft loss deductions require itemizing on Schedule A. However, for federally declared disasters, taxpayers may claim a standard deduction increase instead.

How Do I Report a Theft Loss on Form 4684?

To report a theft loss, taxpayers must provide proof of the event, including police reports, insurance claims, and fair market value changes. The same calculation method applies as for casualty losses, subtracting reimbursements before applying the deduction.

What If My Insurance Reimbursement Exceeds My Loss?

If insurance payments exceed the original property value, the excess may be considered taxable income rather than a deductible loss. Taxpayers should report this on their tax return as a capital gain, if applicable.

Can I Carry Forward a Casualty Loss Deduction?

For personal-use property losses, there is generally no carryforward option beyond the year the loss occurred. However, business or investment-related losses may qualify for a carryover under different tax provisions.

Bottom Line

Filing Form 4684 allows taxpayers to claim a deduction for financial losses caused by sudden disasters or theft. But eligibility is often limited to federally declared disasters for personal-use property. To complete the form, you must calculate the total loss, subtract any insurance reimbursements, and apply the deduction limits set by the IRS. Accurate records and supporting documents are essential for a successful claim.

Tax Planning Tips

- Given the complexity of tax rules governing casualty and theft deductions, working with a financial advisor can help you navigate the filing process and maximize tax relief opportunities. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you want to know how much your next tax refund or balance could be, SmartAsset’s tax return calculator can help you get an estimate.

Photo credit: ©Department of the Treasury Internal Revenue Service, ©iStock.com/Prostock-Studio