What is HARP?

HARP is a government initiative to help people who owe more on their home than the home is worth—in other words, people who are underwater on their mortgage. It stands for Home Affordable Refinance Program, and it’s run by the Federal Housing Finance Agency (FHFA).

Why HARP?

After housing prices crashed in 2008, many Americans found themselves with a hefty mortgage and a depreciated home. Mortgage interest rates fell, but lenders were unwilling to refinance underwater mortgages, so these unlucky folks couldn’t take advantage of the lower rates to cut their monthly bills. Then, in April 2009, the federal government stepped in and created HARP, also known colloquially as the Obama refinance program.

A HARP refinance allows qualified homeowners to refinance even if they owe more than their house is worth. Usually, lenders won’t refinance underwater mortgages. But with HARP, the government gave Fannie Mae and Freddie Mac the go-ahead to back refinancing of underwater mortgages and offer competitive rates. For those who have used the program, it has meant lower housing costs and greater peace of mind.

Sounds great, but who qualifies?

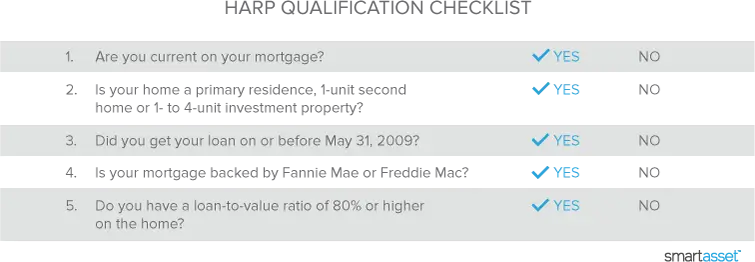

People who qualify for a HARP mortgage all meet a certain set of requirements:

- They are current on their mortgage.

- Their home is a primary residence, 1-unit second home, or 1-to-4 unit investment property.

- They got their loan on or before May 31, 2009.

- Their mortgages are backed by Fannie Mae or Freddie Mac.

- They have a loan-to-value ratio of 80+% on the home.

What’s a loan-to-value ratio?

To calculate the loan-to-value ratio (LTV) on your home, divide the outstanding balance on your mortgage by the current value of your home, then multiply by 100 to get a percentage. If this percentage is 80 or higher, you may be eligible for a HARP mortgage, assuming you meet the other requirements.

What’s the difference between a mortgage servicer and a mortgage backer?

Good question! Plenty of people mistakenly think they don’t qualify for HARP because they don’t send their monthly mortgage checks to Fannie Mae or Freddie Mac. Instead, they send their checks to a regular bank. The bank you deal with directly is your mortgage servicer, but it’s likely that either Fannie Mae or Freddie Mac is your mortgage backer, meaning that at some point your mortgage was repackaged and handed over to them. You can check online with both Fannie and Freddie to find out if they back your mortgage.

How many people qualify for a HARP mortgage?

It’s estimated that at least 500,000 homeowners—and maybe as many as 2 million—qualify for HARP but haven’t taken advantage of the program yet. If this is you, act quickly so you don’t leave money on the table! Just because you have low or no equity doesn't mean you can't refinance.

I heard that HARP is ending soon?

HARP was recently extended through 2016.

Is HARP too good to be true?

One of the problems the FHFA has had in matching homeowners with HARP mortgages is that people think HARP is just another scam by the kind of unscrupulous lenders whose predatory practices led to the housing price crash in the first place. This is an expensive mistake. If you’re underwater on your mortgage, HARP may sound too good to be believed, but believe it. And then apply for it. And then close on your HARP mortgage before the end of 2016. Remember, though, that you'll still have to pay closing costs with a HARP refinance, so compare the savings on your monthly payments to this costs. If you're planning on moving soon, it might not be worth it to refinance.

What’s the difference between HARP and a regular refinance?

The obvious difference between HARP and a regular refinance lies with the eligibility requirements. HARP was designed to pick up the slack left by lenders’ unwillingness to let people with high-LTV homes refinance. If you don’t qualify for a regular refinance, you may qualify for HARP.

Another important difference is that there is no “cash-out” option with HARP. With a conventional refinance, borrowers often have the option to take out a slightly larger mortgage and “cash out” the difference between the mortgage and what they really owe. They can use the cash to pay off other debts. HARP mortgages do not come with this option.

Will I need mortgage insurance?

If you pay mortgage insurance to your lender for your existing loan, you will need to pay the same insurance fees after a HARP mortgage refinance. But if you don’t pay for mortgage insurance now, HARP won’t require you to get it.

What if I don’t like my lender?

Not a problem. When you refinance through the HARP program you don’t have to use the same lender who hooked you up with your original mortgage.

All servicers for loans owned or guaranteed by Fannie Mae or Freddie Mac are required to participate in HARP, so you should have plenty of options in your area if you decide to pursue a refinance through a different lender.

What documentation will I need to supply with my application?

The documentation you need to supply will depend on whether you are working with the same lender or a new lender, and on the individual requirements of the lender. The basic papers to put together are your mortgage statements (including those for a second mortgage if you have one), and your income details (paystubs and income tax returns).

What if I’m not current on my mortgage payments?

If you don’t have the payment record to qualify for HARP, try HAMP, the Home Affordable Modification Program. Like HARP, HAMP is part of the government’s Making Home Affordable® program. Unlike HARP, HAMP is available to people who have fallen behind on their mortgage payments due to financial hardship. Plenty of mortgage servicers participate in HAMP as well as HARP, so contact your lender if you think HAMP is the right fit for you.

I applied for a HARP mortgage and was turned down. Now what?

It pays to shop around. Under the umbrella of the HARP program, individual lenders are permitted to make variations on the eligibility requirements. For example, a lender might decide it wants a higher credit score than HARP guidelines allow, or that it won’t accept lenders with particularly high LTVs. Banks can use their discretion to modify requirements before helping homeowners refinance.

If at first you don’t succeed, try, try again. Just because one lender doesn’t want to work with you on a HARP mortgage refinance doesn’t mean you won’t have better luck with another bank, credit union or mortgage company. The websites for both Fannie Mae and Freddie Mac have tools you can use to look up HARP lenders in your area. Look around for the lowest HARP mortgage rate you can find with a lender who is willing to work with you.