Buying a house can be stressful. For many people, it turns out to be the most significant and expensive financial transaction of their lives. Scoring a deal, though, can help allay some anxiety. But even though you’re able to haggle over home price, it pays to know where your negotiation skills may prove most effective. That’s why SmartAsset crunched the numbers to find the metro areas in America where it pays off to negotiate on your home.

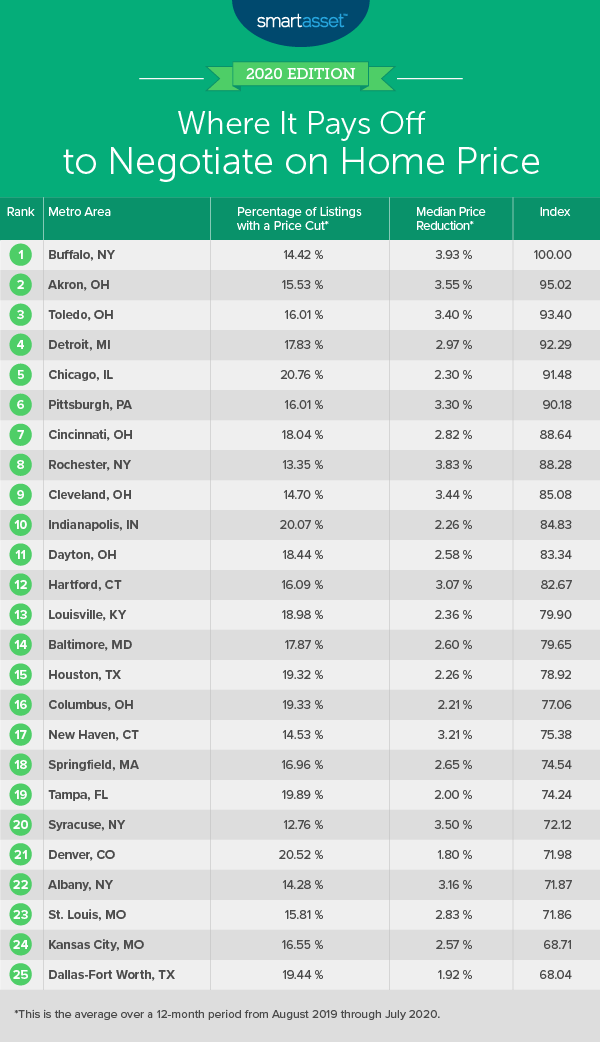

Specifically, we compared 100 of the largest U.S. metro areas across the following two metrics: percentage of listings with a price cut and the median price reduction. For details on our data sources and how we put the information together to create our final rankings, check out the Data and Methodology section below.

This is the 2020 edition SmartAsset’s study on where it pays off to negotiate on home price. Check out the 2019 version here.

Key Findings

- Look to the Rust Belt. All of the top 10 metro areas in this study are located in the U.S. Rust Belt. After a decline in manufacturing in previous decades that has contributed to lower home prices in this region, many new homebuyers have been investing in property in this region in recent years. The low home prices there, compared to in coastal cities, are attracting millennial buyers, according to CNBC.

- Price reductions aren’t uncommon. Across all 100 metro areas in the study, an average of 15.70% of home listings have a price cut. What’s more, the average price reduction across all locales is 2.40%. Even if you aren’t sure your negotiation tactic is going to work, it can’t hurt to go in with an offer lower than the listing price.

1. Buffalo, NY

Between August 2019 and July 2020, homes in Buffalo, New York had an average price reduction of 3.93%, the highest in the study. If you don’t mind the relatively cold winters, you can likely get a pretty good price on a home there. More than 14% of the listings in Buffalo have a price cut.

2. Akron, OH

Akron is the first of four Ohio metro areas that rank within the top 10 of the study. Akron has the third-highest median price reduction in this study, decreasing 3.55% between August 2019 and July 2020. With 15.53% of listings in the metro area having a price cut, Akron ranks toward the middle of the pack for that metric, at No. 54.

3. Toledo, OH

The second Ohio locale to make the top 10 is Toledo, located on the shores of Lake Erie. The median August 2019 to July 2020 price reduction in Toledo is 3.40%, sixth-best overall. Furthermore, the metro area places 46th overall in terms of the percentage of listings with a price reduction – at 16.01%

4. Detroit, MI

Detroit, Michigan has gone through many periods of decline and revitalization in the past few decades, but it is still a good market for homebuyers. The metro area places in the top 20 for both of our metrics. The median price reduction between August 2019 and July 2020 was 2.97%, ranking 15th overall, and the percentage of listings with a price reduction was 17.83%, ranking 20th overall.

5. Chicago, IL

The Windy City leads the study in terms of the percentage of listings with a price reduction – with 20.76% of all listings having a price drop. The median price reduction in the Chicago metro area is 2.30%, ranking 52nd overall.

6. Pittsburgh, PA

Pittsburgh, Pennsylvania has a median August 2019 to July 2020 price reduction of 3.30%, the seventh-highest rate for this metric in our study. The Steel City metro area also places 45th overall for the percentage of homes with a price reduction, at 16.01%.

7. Cincinnati, OH

Another Ohio metro area, Cincinnati, takes the No. 7 spot. Cincinnati is one of just two top 10 locales to place in the top 20 for both of our metrics. That includes coming in 17th overall for percentage of listings with a price reduction, at 18.04%, and 20th overall for the median price reduction, at 2.82%.

8. Rochester, NY

Rochester, New York has a real estate market with a median August 2019 to July 2020 price reduction of 3.83%, the second-highest rate for this metric in the study. Additionally, more than 13% of the listings in the metro area have a price cut.

9. Cleveland, OH

The final Ohio metro area in our top 10 is Cleveland. It ranks fifth overall for median price reduction, at 3.44%, and 67th overall for the percentage of listings with a price cut, at 14.70%.

10. Indianapolis, IN

The final metro area in our top 10 is Indianapolis, Indiana. The market there saw 20.07% of listings take a price cut between August 2019 and July 2020, the third-highest rate for this metric in the study. The median price reduction is 2.26%, 53rd-highest in the study.

Data and Methodology

In order to find the metro areas where it pays off the most to negotiate on home price, SmartAsset analyzed data across 100 of the largest metro areas in the U.S. Specifically, we looked at the following two metrics:

- Percentage of listings with a price cut. This is the average percentage of current for-sale listings that experienced a price cut between August 2019 and July 2020.

- Median price reduction. This is the median price cut of the above-mentioned listings, month-over-month, for the same time period.

Data for both metrics comes from Zillow, which we then performed calculations on to reflect year-long averages.

First, we ranked each metro area in each metric. From there, we found each metro area’s average ranking, assigning each metric an equal weight. We used each metro area’s average ranking to create our final score. The place with the best average ranking received a score of 100 while the place with the worst average ranking received a score of 0.

Tips for Buying a Home

- Lay a strong financial foundation. Before you make a big purchase like a home, it might make sense to work with a financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Build your budget. To save money to buy your dream home, consider making a budget now so that you can start putting money away.

- Measure twice, cut once. Make sure to calculate your mortgage before you buy a house, whether you are able to negotiate or not.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/Worawee Meepian