Death and taxes, right? To paraphrase Benjamin Franklin: nothing else in this world is guaranteed. Both are unpleasant and both are unavoidable—but that doesn’t mean we can’t try to put them off for a while, or at least to lessen their sting. It’s why we have doctors, and why each year, come tax season, we all take the time to painstakingly complete our tax returns. We want to find every extra penny we can.

Filing a tax return is more like taking an aspirin than seeing a doctor, however: it treats the symptoms, not the disease. If you really want to reduce your tax bill, it’s a good idea to do some planning. Every financial decision you make has an impact on your taxes, and for many, the biggest such decision concerns homeownership. If you’re thinking about buying a home or moving to a new city, it only makes sense for you to figure out the tax implications beforehand. If you plan carefully, you may be able to save yourself tens of thousands in taxes through the mortgage interest deduction. Think of it as preventive care.

Miracle cure: the mortgage interest deduction

Thanks to a law passed all the way back in 1913 (and amended in 1986), most of the interest paid on home mortgage loans is eligible for the mortgage interest deduction. It’s not as complicated as it sounds: any income you spend can be subtracted from your total taxable income, which in turn lowers the amount you pay in income taxes.

So, let’s say for example that you make $75,000 this year and spend $10,000 of that on mortgage interest—that’s about the amount you would spend in the first year of a $250,000 mortgage with a 4% interest rate. By taking the mortgage interest deduction, your taxable income would fall to $65,000. Assuming your marginal tax rate is 25%, you could save $2,500 in taxes, just like that!

Even with a more modest $150,000 mortgage, you could still save on the order of $1,500 in income taxes taking this deduction in your first year of paying off the mortgage. That’s a lot of money, but keep in mind that your yearly savings from the mortgage interest deduction will fall over time. This is a natural result of the amortization of your loan. As you pay off your mortgage, a smaller portion of each payment goes toward interest, so there’s less interest to deduct.

As with anything involving the IRS, there are some exceptions to the mortgage interest deduction. It can only be applied to interest payments on first and second homes, so if you’ve already got a beach house in Florida (in addition to your house-house), there’s no tax incentive to buy that ski lodge in Aspen. Likewise, you can only apply the deduction to the first $1 million of any mortgage, so from a tax perspective the 50,000 square-foot villa isn’t much better than the 10,000 square-foot mansion.

As those exceptions indicate, the intent of the mortgage interest deduction (at least as it was amended in 1986) was to benefit the typical homeowner, and to encourage middle-class homeownership. To that end, there are a few other deductions and credits that can work to your advantage. A big one is the real estate tax deduction, which allows you to deduct property taxes on a first or second home from your taxable income. Depending on the property tax rate where you live and on the value of your home, that can add up to thousands of dollars in deductions every year

If you ever consider selling your home, another tax rule that may come into play is the home sale capital gains exclusion. This is a rule that says a person selling her primary residence does not have to pay taxes on the first $250,000 she makes in profits. None! So if she buys her house in 2014 for $100,000, and sells it in 2024 for $350,000, she keeps every single penny of that gain. For married couples, the deal is even sweeter: families can keep all gains up to $500,000. (But remember, this only applies to a primary residence, which means you must have lived in the house for two of the five years prior to the sale.)

The common cold: state and local taxes

If you’re staying in one place, buying a home will almost always reduce your tax bill, but if you’re changing cities, that might not be the case. Since every state has its own system of taxation, and most counties and cities throw a few extra levies on top of that, there’s a good chance that your big move could have a big impact on your taxes. Just how big depends on where you are now and where you’re going..

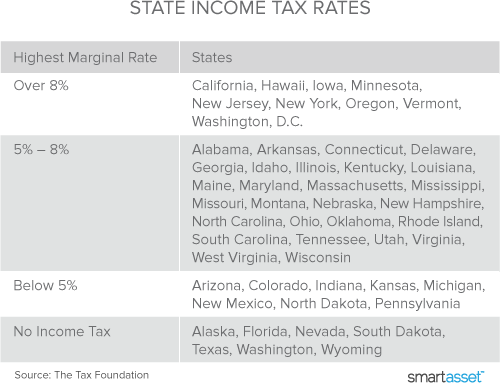

Most states charge an income tax of some kind; only seven charge no income tax whatsoever (Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming), and two states only tax income from interest and dividends (New Hampshire and Tennessee). Within the states that do charge an income tax, rates vary from under 5% to well over 10%. According to the Tax Foundation, a non-partisan think tank, the state with the highest income tax in 2014 was California, with a top marginal rate of 13.3%. (This is the rate paid by people in the top income bracket; lower earners pay less.)

So how would moving to California affect a typical person’s taxes? Let’s say you live in Texas (where there’s no income tax), and you’ve just been offered a job in San Jose. You’ll be making $60,000 a year and you plan on buying a $200,000 house. Even with the added benefits of becoming a homeowner, you would still pay slightly more in income taxes after the move because of California’s state income tax. Over time, as your savings from the mortgage interest deduction fell (for the reasons described above), that difference would become even more pronounced.

But that’s an extreme example. It is far more common for the tax math to favor buying a home, even if that home happens to be in a state with higher income tax rates. In either case, it always makes sense to investigate the tax implications before you buy. To borrow from Benjamin Franklin one more time, “by failing to prepare, you are preparing to fail.” That’s some advice we can all live by.