Are you considering an FHA loan? FHA loans come with lower down payment requirements than conventional loans, making them an excellent option for many first-time homebuyers. Here, we’ll cover everything you wanted to know about FHA loans and FHA loan limits but were afraid to ask.

How does an FHA loan work?

The Federal Housing Administration (FHA) doesn’t actually lend money to homebuyers. Instead, it guarantees loans, making lenders less wary of extending mortgages and helping more Americans build equity in a home of their own. When you shop around for an FHA loan you’re really shopping for an FHA-backed loan.

Are there limits to how much I can borrow with an FHA loan?

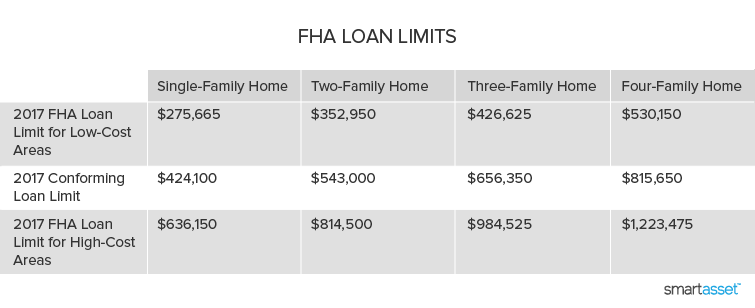

FHA loan limits vary by state and county, and they do change over time. Usually, there is an upward trend in loan limits, but at the end of 2013 the government lowered the loan limits in many areas.

Do I have to be rich to get an FHA loan?

Nope! On the contrary, the FHA wants to loan to Americans who might otherwise have a hard time financing a home purchase, like young people who haven’t yet saved up enough for a big down payment.

Down payment requirements for FHA loans go as low as 3.5% of the home value. That 3.5% doesn’t have to be money you’ve saved yourself, either. The money for your down payment can come from a friend or family member’s gift.

Though you don’t need to be rich to get an FHA loan, you will need to meet debt-to-income requirements.

Debt-to-what?

Debt-to-income ratio. It’s a measure that compares your gross income to how much you owe in debt. “Debt” is usually understood loosely, to include things like taxes, housing costs and insurance premiums, not just credit card debt or student debt.

The debt-to-income requirements on loans are usually expressed with two numbers, e.g. “31/43.” The first number tells you what portion of your gross income can be housing expenses (in the case of our example, 31%). The second number tells you what percentage of your income can be the combination of housing expenses and regular recurring debt (in our example, 43%). So, if the debt you already have before you apply for an FHA loan is a high-enough percentage of your income, you might not qualify for the loan because your debt-to-income ratio would be too high after taking out a mortgage.

Is there more than one kind of FHA loan?

The most commonly-used type of FHA loan is the 203(b), a standard fixed-rate mortgage. The 203(b) is the FHA loan with the lowest down payment minimum. Plus, there is no minimum income requirement to qualify for the loan. If the home you want to finance is within FHA loan limits, you have decent credit and a sufficiently low debt-to-income ratio, you may be a shoe-in.

Another option is the 203(k), designed to help people who want to make significant improvements to the house they are financing. The 203(k) loan combines a normal mortgage with a home improvement loan, saving you the time, hassle and expense of applying for two separate loans.

What’s the catch?

Aside from the fact that the house you want might be outside of FHA loan limits, the catch is that FHA loans require what is called Mortgage Insurance Premium (MIP). What’s that you say? But the FHA is already providing the mortgage insurance? You’re right, but they still want a little extra insurance from you to make up for the low down payment requirement.

If you went with a regular, non-FHA loan and you didn’t have a 20% down payment, you would have to pay private mortgage insurance. Once your equity in the home hit the 20% mark, though, your lender would automatically stop charging for insurance.

With an FHA loan, however, the MIP can last for the entire life of the loan, depending on the term-length of the loan and the loan-to-value ratio. With an FHA loan, there is also an up-front mortgage insurance fee, known as the Up-Front Mortgage Insurance Premium (UFMIP). The current UFMIP is 1.75% of the home’s base loan amount.

Can I get an FHA loan for my vacation home or investment property?

No, but nice try. To be eligible for an FHA loan, a home must be your primary residence.

Is it true that FHA loans are assumable?

It is indeed! This is another big benefit of the FHA loan. If your loan is assumable and you want to sell your home, the person who buys your house can “assume” the loan, saving hassle and closing costs. Having an assumable loan makes it considerably easier to sell your house.

How would I go about refinancing an FHA loan?

Ah, now we get to one of the biggest perks attached to FHA loans: Streamline Refinance. Since the 1980s, FHA loans have been eligible for streamline refinancing. What does that mean to you? Less paperwork, that’s what. If you’re current on the payments for your FHA loan and a refinance would lower your monthly bill, you meet the requirements for a Streamline Refinance.

The Streamline Refinance is a fast and easy way to take advantage of interest rates that are lower than they were when you first financed your home purchase. You can’t use the Streamline Refinance feature to cash out on your mortgage, though, as you can with many other private refinance options.

FHA doesn’t allow lenders to include closing costs in the new mortgage amount of a streamline refinance. Often, the lender will pay the closing costs, but pass on the cost to the homeowner in the form of higher interest rates than you would get if you paid the closing costs in cash.

The FHA Streamline Refinance program is especially good for homeowners who are underwater on their mortgage (underwater mortgages are usually extremely difficult to refinance). And unlike a typical refinance option, FHA’s Streamline Refinance doesn’t require a home appraisal.

FHA refinances are available in fixed-rate or adjustable-rate form, and can have terms of 15 or 30 years.

If they’re so great, why doesn’t everybody get an FHA loan?

When interest rates are low across the board and credit requirements are loose, homebuyers tend not to flock to FHA loans. That’s because they can get favorable interest rates with low down payment requirements from any old lender, and pay less in insurance over the life of the loan.

But when banks boost their down payment, income and credit requirements, as they did after the financial crisis, the popularity of FHA loans rises. Basically, when it is more difficult to get a conventional loan, FHA loans become more popular.