Tesla released its Q1 earnings results on April 24, missing Wall Street expectations by 4.29% for revenue and 9.10% for earnings per share (EPS). The company posted earnings of 45 cents per share, falling short of the estimated 50 cents. Revenue came in at $21.3 billion, compared to the expected $22.2 billion.

Tesla’s operating income declined by 56% year-over-year to $1.17 billion. The company also reported a negative free cash flow of $2.5 billion, primarily due to significant investments in AI infrastructure and an increase in inventory levels. The company has roughly $26.9 in cash equivalents on hand.

Despite these misses, Tesla shares rose over 12% in after-hours and pre-market trading after forward guidance from management, which included an accelerated timeline for a more affordable next-generation car to be produced on existing manufacturing lines. This comes after a 41.79% decline in share price year-to-date, and 11.04% decline over the past year.

There’s alpha in information. For simplified stock market news delivered right to your inbox, sign up for SmartAsset’s free Market Minute Newsletter.

Challenges in Q1

Operationally, Tesla cited several hurdles this quarter, including the macroeconomic environment, geopolitical tensions and production disruptions at the Gigafactory Berlin due to an arson attack, contributing to a 13% year-over-year decrease in total automotive revenues. The early phase of the updated Model 3 ramp at the Fremont factory and shutdowns from shipping diversions caused by the Red Sea conflict further exacerbated the situation. CEO Elon Musk also cited challenges to electric vehicle (EV) adoption worldwide as other companies announce plans to shift to plug-in hybrid vehicles, but remains confident that EVs will “ultimately dominate the market”.

Management on Main Business Opportunities

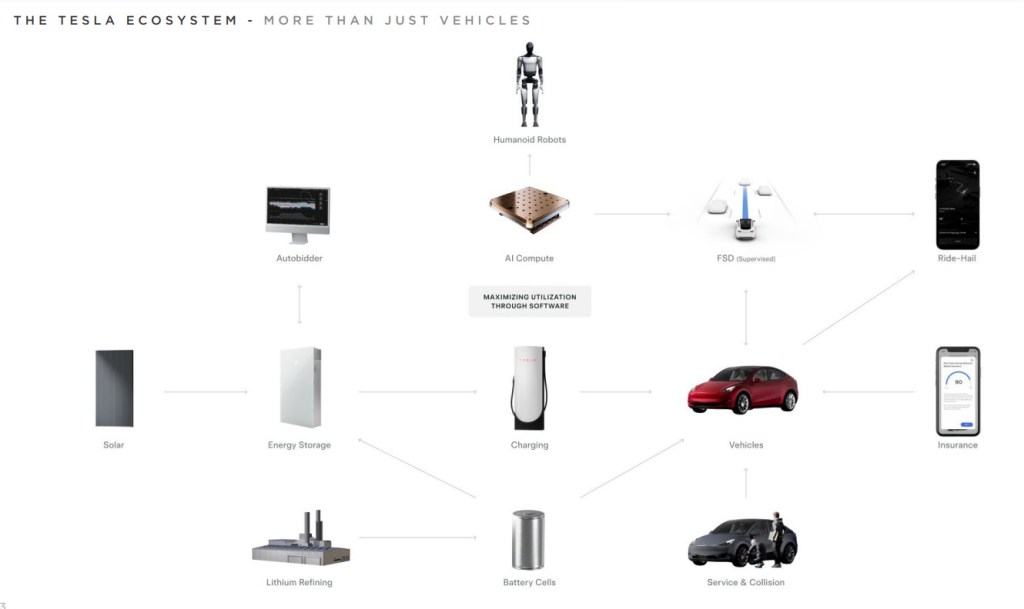

AI

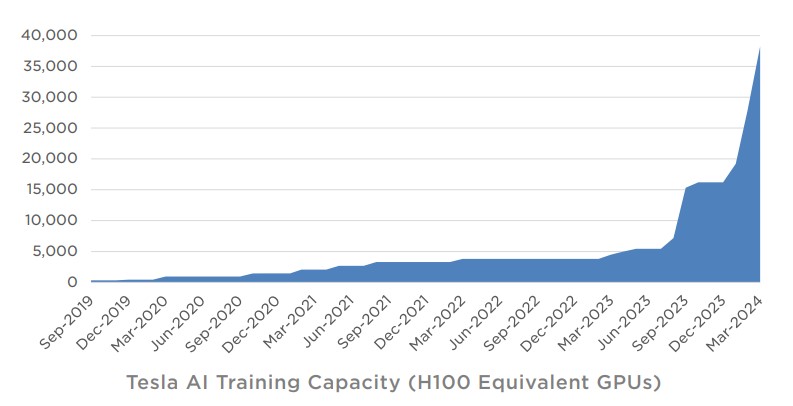

Tesla spent $1 billion in expenditures on AI infrastructure in Q1. AI training compute was increased by more than 130%, and Tesla says it is no longer compute-constrained. Elon Musk said in the call that Tesla has 35,000 H100 GPUs currently installed and commissioned, with an expected 85,000 by end of year for training purposes.

Full Self-Driving (Supervised)

Tesla initiated a 30-day free trial of its Full Self-Driving (FSD) (Supervised) software for qualified vehicles in the US starting in March 2024, upgrading it from opt-in beta testing. This trial was part of a broader strategy to improve the adoption and capabilities of the FSD system. The trial version started with FSD (Supervised) v12.3, with updates rolling out to eligible vehicles in the U.S. and Canada. This initiative is part of Tesla’s efforts to introduce users to the advancements in autonomous driving technology, particularly the enhancements in the FSD v12 upgrades, which utilize a fully vision based approach with end-to-end neural networks.

Tesla aimed to make the FSD (Supervised) technology more accessible by reducing the subscription price to $99/month (from $199) and the purchase price to $8,000 (from $12,000) in the US. The trial aimed to demonstrate the system’s capabilities and potentially encourage more users to subscribe to the FSD (Supervised) service, which adds to Tesla’s available training data. Elon Musk also reiterated during the call that Tesla is in talks with a major car manufacturer about potentially licensing the software.

The company described the long-term goals of FSD (Supervised) to bring an autonomous robotaxi network online, where Tesla will own some of the fleet while individuals own others. Elon Musk described it as a “combination of AirBNB and Uber”, where consumers can choose to hail a ride, and Tesla owners can choose to put their car to work in the Tesla fleet on their own terms. The robotaxi will be unveiled at an investor event scheduled for August 8 (more below).

To stay up to date on earnings calls, the stock market and economy, sign up for the Market Minute newsletter for free.

Optimus

In response to a shareholder question, Elon Musk said Optimus, Tesla’s humanoid robot, is currently performing simple tasks in the lab, with the potential for Optimus to perform useful tasks in the factories by end of year. Additionally, Musk stated that Tesla could start selling the Optimus humanoid robot to customers outside of the company by the end of 2025.

Automotive

Model 3 and Model Y

The company cited Model 3 ramp challenges at the Fremont factory, contributing to the missed expectations on deliveries this quarter. The combined deliveries for Model 3 and Model Y make up the bulk of Tesla’s delivery figures, with 369,783 being delivered in Q1.

On the production side, Tesla achieved a total production figure of 433,371 vehicles in Q1 2024. The Model 3 and Model Y production accounted for 412,376 of the total production.

The Model S and Model X deliveries, along with some Cybertruck sales, were reported at 17,027, indicating a slight decrease from the previous quarter.

Cybertruck

Management relayed that the ramp of the 4680 battery is staying ahead of the Cybertruck production ramp. The company reached production of 1,000 Cybertrucks per week in April.

New-Generation Vehicle

Tesla expressed an accelerated expected timeline for production start of the next-generation car, thanks in part to being able to produce it with existing unused manufacturing capacity on Model 3 and Y lines. This means that no additional factories or manufacturing lines are necessary for this product. Tesla currently has a production capacity of 3 million vehicles annually, and produced around 1.8 million total vehicles in 2023. Previously stated timelines included production beginning in the second half of 2025, but Tesla now says production could start in late 2024 or early 2025.

Sign up for the Market Minute Newsletter to get stock and economic information right to your inbox.

Energy

Megapacks – a large-scale energy storage product – reached an all-time high in deployments and profitability, Elon Musk said in the earnings call. A total of 4,053 MWh were deployed in Q1, up 4% year over year. Energy storage and generation revenue came in at $1.6 billion, up 7% year over year.

Upcoming Investor Events

1. Tesla Annual Shareholder’s Meeting: Thursday, June 13, 2024

To vote at the 2024 Tesla Annual Shareholders Meeting, you needed to be a shareholder of record as of April 15, 2024. You do not need to be present and can cast a proxy vote via your brokerage.

The main items to be voted on this year include:

- Moving Tesla’s incorporation from Delaware to Texas: Shareholders will vote on whether to approve Tesla’s move from Delaware to Texas. Texas is currently headquarters to Tesla, and the proposal comes after a Delaware judge recently voided a compensation package approved by Tesla shareholders in 2018.

- Ratification of Elon Musk’s 2018 compensation package: Shareholders will vote on whether to ratify a 100% performance-based stock option award to Elon Musk that was initially approved in 2018. This package was recently struck down by a Delaware Court despite being approved by 73% of shareholders in 2018, but is being put up for ratification by the shareholders.

2. Robotaxi Unveil: Thursday, August 8, 2024

Originally announced by Elon Musk on Twitter on April 5, the Robotaxi event is expected to give investors more insights into the next-generation vehicle platform, applications of autonomy and Tesla’s plan for a robotaxi network.

Resources

- To keep up to date on important events affecting Tesla and other companies, sign up for the free Market Minute Newsletter.

- Money is always in motion. For help valuing stocks for your portfolio, get matched and speak with a financial advisor for free.

Photo credit: ©iStock.com/Roman Tiraspolsky