Cap rate, or capitalization rate, is a metric used in real estate to evaluate the potential return on an investment property. It serves as an indicator of the property’s profitability relative to its market value. The cap rate is expressed as a percentage and helps investors compare different properties without the need to delve into more complex financial analyses. Understanding how to accurately calculate and interpret the cap rate can help you make more informed and strategic decisions when investing in real estate.

If you’re interested in investing in real estate, consider reaching out to a financial advisor who specializes in the real estate market.

What Is the Cap Rate?

The cap rate is the ratio between a property’s net operating income (NOI) and its current market value. It represents the percentage of the property’s value that is being generated as income annually. This metric can show the investor their expected return on investment, assuming they purchase the property outright with no need for financing. It can help investors gauge whether a property meets their investment criteria and risk tolerance.

Using Cap Rates in Real Estate Investing

Cap rates are an important metric to consider when investing in real estate for several reasons:

- Cap rates allow for a straightforward comparison between different properties. By converting each property’s income potential into a percentage, you can easily see which properties offer higher returns.

- Cap rates help in assessing the risk associated with an investment, too. Higher cap rates usually indicate higher potential returns, but also higher risk, as these properties might be in less desirable locations or require more maintenance. On the other hand, lower cap rates suggest lower risk, but also the lower returns often found in more stable, high-demand markets.

- Cap rates can be used to evaluate market trends. You can observe cap rate trends over time to understand how the market is performing. For example, declining cap rates might indicate increasing property values or rental incomes, signaling a strong market. While rising cap rates could point to decreasing property values or increasing risks, indicating a cooling market.

How to Calculate Cap Rates

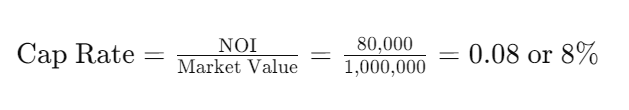

To calculate the cap rate, you’ll first determine the property’s net operating income. The NOI is calculated by subtracting all of the operating expenses from the total rental income. Operating expenses include costs such as property management fees, maintenance, insurance and property taxes. Mortgage payments and capital expenditures are excluded from this calculation. Once you have the NOI, it’s divided by the property’s current market value. This gives you the cap rate.

For example, if a property generates $120,000 in annual rental income and incurs $40,000 in operating expenses, the NOI would be $80,000. If the property’s current market value is $1,000,000, the cap rate would be calculated as follows:

This 8% cap rate is the estimated annual return you could expect to make from this property. This can help you decide whether it aligns with their investment goals and risk tolerance, so you can choose the properties that best meet your financial objectives.

Frequently Asked Questions About Cap Rates

What Is a Good Cap Rate?

A “good” cap rate depends entirely on your goals, risk tolerance, and the specific real estate market. Cap rates between 4% and 10% are generally considered attractive; higher rates are typically found in riskier or emerging markets, and lower rates are found in more stable, high-demand areas. For example, a 6% cap rate might be excellent in a well-established urban area, while a 10% cap rate could be normal for a property in a less developed location. As the investor, you’ll have to balance the potential returns against the associated risks to determine what constitutes a good cap rate for your particular situation and goals.

What Are the Differences Between the Cap Rate and the ROI?

Cap rate and return on investment (ROI) are both used to evaluate real estate investments, but they’re calculated differently and provide different information. Remember, the cap rate estimates the annual return relative to the property’s current market value. ROI, on the other hand, takes into account the total return on the investment, including income and capital appreciation, relative to the initial investment cost. ROI includes factors such as financing, purchase price, and any capital expenditures, providing a more comprehensive view of the investment’s overall profitability.

What Is the Impact of Interest Rates on Cap Rates?

Interest rates can have a significant impact on cap rates. Generally, when interest rates rise, borrowing costs increase, making it more expensive to finance real estate. This means investors might need to require a higher return to justify their investment. Which means they’ll want to see a higher cap rate. Alternatively, when interest rates fall, financing becomes cheaper. This often leads to an increased demand in the real estate market, as well as lower cap rates, as investors are willing to accept lower returns.

Interest rates also influence the broader economic environment, affecting property values and rental income. In a low-interest-rate environment, property values tend to rise, compressing cap rates as the market becomes more competitive. Meanwhile, high-interest-rate environments can depress property values and increase cap rates as demand for real estate investment decreases. Understanding the relationship between interest rates and cap rates can help investors make informed decisions in varying economic conditions.

Bottom Line

By determining the net operating income and market value of a property, real estate investors can calculate the cap rate for that property. This can help them assess the profitability and risk of potential of investment properties, and make informed decisions that align with their financial goals. While cap rates provide valuable insights and can help investors compare properties at a glance, they are not a standalone metric, and should be used as part of a more comprehensive investment strategy when purchasing a property. With a clear grasp of cap rates and their implications, you can be better equipped to begin exploring the real estate investment market.

Real Estate Investing Tips

- Investing in real estate is a big decision, and working with a financial advisor can help you make the best decision for your situation and goals. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re taking on a mortgage as part of your real estate investment, our free, easy-to-use mortgage calculator can make sure you understand how that factors in to all of your other rental expenses.

Photo credit: ©iStock.com/Perawit Boonchu, ©iStock.com/ChayTee, ©iStock.com/Natee Meepian