Some people plan where every dollar of their budget goes. This method is called zero-based budgeting, and it involves allocating every dollar of income to your expenses, debts and savings. In other words, the goal of this method is that your monthly income and your expenditures are equal so that subtracting the latter from the former gives you zero. If you’re looking for a budgeting strategy that gives every cent you earn a “home” or you’ve been having trouble making a budget then here’s what zero-based budgeting is, how it differs from traditional budgeting and why it may work for you.

Do you have questions about financial planning? Speak with a financial advisor today.

What Is Zero-Based Budgeting (ZBB)?

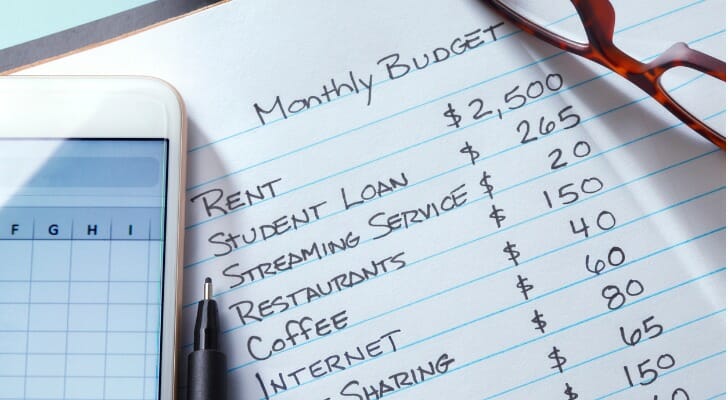

People who use zero-based budgeting start each month or pay period with a number. Typically, this number is their income and what’s available to spend. Then, they plan on how to spend every penny they make that month. Against the possibility that there is any extra income in a budgeting period, they pre-allocate those funds toward other line items, such as making extra debt payments or adding to their savings.

Rather than wait until the end of the month to see if there is money left over, people that use zero-based budgeting know at the beginning of the month where all their money will go.

This type of budgeting does not dictate how much of your income goes into which category (food, utilities, recreation, etc.). That is entirely up to you. What it does do, though, is require that once you have decided how much of your income goes into which categories then you must make sure that your monthly income is equal to your monthly expenses.

Examples of Zero-Based Budgeting

The best way to understand zero-based budgeting is to look at an example. Let’s say you earn $4,000 per month. You will have some fixed expenses such as a mortgage, car payment, insurance payments, student loan payments, etc. Say these fixed costs equal $2,000 per month. That leaves you with $2,000 to allocate toward food, savings, investments and entertainment.

Using the zero-based budgeting strategy, you would estimate how much your variable expenses are for that month. You might have to splurge for a plane ticket or other item, so knowing where your money is going ahead of time will help you cut back in other areas, such as dining out.

If you have money that has not yet been allocated at the end of your budgeting exercise, you decide at the beginning of the budgeting period where it will go. You might choose to make a large student loan payment or hold on to the money and put it into savings.

In another example, you might not have enough money left over at the end of the month. If this is the case, you can plan at the beginning of the following month to cut back in some areas to ensure that you have precisely enough money to cover all (and only all) monthly expenses.

Zero-Based Budgeting vs. Traditional Budgeting

Zero-based budgeting and traditional budgeting, sometimes called cost-based budgeting, have a few key differences. When someone adds new income to a standard budget, they will traditionally allocate a specific percentage to each line item. Therefore, if someone got a 5% raise, each line item would increase by 5%. However, zero-based budgeting focuses on dollar amounts rather than percentages, so a person would have to decide which line items will see their 5% raise.

In zero-based budgeting every item, whether it is for savings, investing or discretionary spending, must be justified as an expense. Therefore, a person can optimize his spending and not just evenly allocate his income. Zero-based budgeting is a more mindful approach, where every cost has a purpose, and you account for all income.

Pros and Cons of Zero-Based Budgeting

There are plenty of advantages to using a zero-based budget plan. A zero-based budget gives you:

- Accuracy and efficiency: When you know exactly how much you are earning and how much each line item requires, you will be better able to allocate money for savings and investing.

- Avoiding lifestyle creep: When you get a raise and do zero-based budgeting, you will have to allocate this increase in income to specific line items. Allocating funds to account for this increase helps prevent people from slowly increasing their spending in every area of their budget.

- Easy visibility: When you can see the exact dollar amount you have available to spend in a specific area, you have a better chance of sticking to it. This is in comparison to a percentage of their income, which might be more challenging to understand.

Of course, zero-based budgeting isn’t for everyone. Some things that people don’t enjoy about zero-based budgeting are that it is:

- Time-consuming: If your income fluctuates each month or pay period, you may have to make time to reflect your changing income in your budget.

- Cost-prohibitive: While a zero-based budget keeps people accountable, it does mean that there is only a set amount of money available for each line item that a person budgets for with no money leftover.

Bottom Line

Zero-based budgeting is time-consuming at first, but once you understand exactly where your money goes, you may appreciate the consistency of your budget. Zero-based budgeting helps you allocate your money to specific budget line items, therefore keeping you accountable to stick to your budget. If you are starting a budget, it may be helpful to speak with a financial advisor. He or she will help you understand how much money to allocate toward expenses, debts, savings and investments to reach your financial goals.

Tips for Creating a Budget

- When creating a budget for your family or your business, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Making a budget might feel intimidating at first, however it’s an important step towards maintaining your financial health. SmartAsset budget calculator can help make things easier for you. Plug in your income, location, family size and expenses to see how you’re doing.

Photo credit: ©iStock.com/AleksandarNakic, ©iStock.com/doockie, ©iStock.com/DNY59