The Census Bureau’s Small Business Pulse Survey shows that during the first week of December 2020, business expectations were depressed nationwide. While less than 2% of small businesses have closed during COVID-19, 52.9% of small businesses nationally expect they won’t return to normal levels of operation for at least six months or ever.

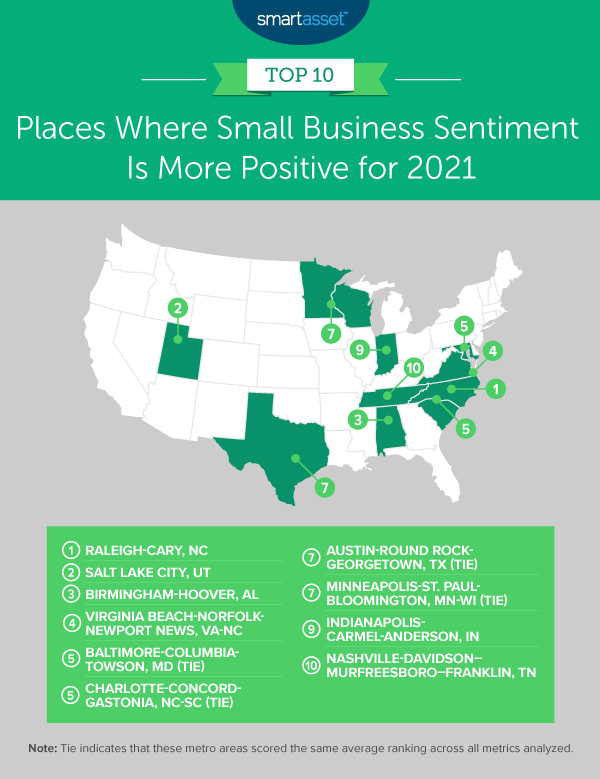

Though that outlook may seem a bit bleak, business sentiment remains stronger in some places compared to others. In this study, SmartAsset used data published in the Small Business Pulse Survey to determine the metro areas where small business sentiment is more positive heading into 2021. We compared the 50 largest U.S. metro areas across four metrics: percentage of small businesses that are operating at normal levels, percentage of small businesses that do not expect a return to normal levels of operations within six months or ever, percentage of small businesses looking to hire new employees and percentage of small businesses with three or more months of cash on hand.

Responses we considered were collected between November 30, 2020 and December 6, 2020. It is important to note that because the survey is experimental, sampling errors tend to be high relative to other Census-reported data. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- A strong showing from North Carolina. Three of the top 10 metro areas where small business sentiment is more positive heading into 2021 are at least partially located in North Carolina. They are Raleigh-Cary, North Carolina; Virginia Beach-Norfolk-Newport News, Virginia-North Carolina; and Charlotte-Concord-Gastonia, North Carolina-South Carolina. Though 52.9% of small businesses nationally do not expect a return to normal levels of operations within six months or ever, less than 45% of small businesses in all three of these metro areas report that expectation.

- Travel troubles. Metro areas that rely heavily on the tourism industry rank at the bottom of our list. The four places where small business sentiment is most negative for 2021 are Orlando, Florida; New York, New York; Las Vegas, Nevada; and Los Angeles, California, all of which attract many travelers throughout the typical calendar year.

- Just one in four small businesses has enough cash. On average across the 50 largest U.S. metro areas, only 26.0% of small businesses have at least three months of cash on hand, the minimum safety net generally recommended for a business.

1. Raleigh-Cary, NC

Around 37.5% of small businesses in Raleigh-Cary, North Carolina are operating at normal levels, the second-highest rate in our study. The Raleigh-Cary metro area finishes in the top 10 for two additional metrics: fifth-best for the percentage of small businesses that do not expect to return to normal levels of operation within six months or ever, at 44.9%, and eighth-best for the percentage of small businesses with at least three months of cash on hand, at 30.3%.

2. Salt Lake City, UT

In the Salt Lake City, Utah metro area, 33.2% of small businesses were operating at normal levels during the first week of December. This metro area is also a relatively good place to be if you are currently looking for a job, as 27.3% of small businesses are currently looking to hire new employees, the eighth-highest rate for this metric in the study. Finally, the Salt Lake City metro has the 11th-lowest percentage of small businesses that do not foresee themselves returning to normal levels of operation within six months or ever, at 49.0%.

3. Birmingham-Hoover, AL

In the Birmingham-Hoover, Alabama small business community, 32.2% of companies have at least three months of cash on hand, the highest percentage for this metric of all 50 metro areas. The Birmingham metro area also places third in terms of new small businesses looking to hire, at 33.4%. Furthermore, it ranks in the top 20 for the other two metrics, including 19th-lowest for its percentage of small businesses that don’t foresee returning to normal operating levels in six months or ever, at 51.4%.

4. Virginia Beach-Norfolk-Newport News, VA

Virginia Beach, Virginia and its surrounding metro area leads the study in terms of its percentage of small businesses looking to hire people, at 40.1%. It also places fourth for its relatively low percentage of small businesses that are not expecting a return to normal operation levels in six months or ever, at 43.2%. The metro area falls behind slightly in terms of the percentage of small businesses with at least three months of cash on hand, finishing in the bottom half of the study at 25.2%.

5. Baltimore-Columbia-Towson, MD (tie)

The Baltimore, Maryland metro area ranks seventh in this study for the percentage of businesses with fewer than 500 employees operating at a normal level, at 31.5%. Charm City and its surroundings also rank 10th-highest for the percentage of small businesses looking to hire new employees, at 25.4%, and 13th-lowest in terms of the percentage of small businesses that do not expect to return to normal operations within six months or ever, at 50.0%.

5. Charlotte-Concord-Gastonia, NC-SC (tie)

Charlotte, North Carolina’s metro area has just 39.6% of small businesses that don’t expect to return to normal operations within six months or ever, the smallest percentage we observed in the study for this metric. The Charlotte metro area also finishes fifth in terms of the percentage of small businesses currently operating at normal levels, at 32.3%. It finishes in the bottom half of the study in terms of small businesses with at least three months of cash on hand, at just 24.0%.

7. Austin-Round Rock-Georgetown, TX (tie)

The Austin, Texas metro area has the fifth-highest percentage in the study of small businesses looking to make new hires, at 32.5%. The Austin area sees 47.6% of small firms not expecting a return to normal levels of operations in six months or ever, the eighth-lowest percentage we observed. Austin does not fare as well, however, in terms of the percentage of small businesses currently operating at normal levels: It places 28th, in the bottom half of our study, at 24.0%.

7. Minneapolis-St. Paul-Bloomington MN-WI (tie)

The Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin metro area has 30.9% of small businesses with at least three months of cash on hand, the fifth-highest percentage we observed. Though that is the metro area’s only top-10 metric, it finishes in the top 20 for the other three, including placing 13th for its percentage of small businesses operating at normal levels, at 27.7%, and 15th for its percentage of small businesses looking to make new hires, at 24.6%.

9. Indianapolis-Carmel-Anderson, IN

The Indianapolis, Indiana metro area places third in terms of its percentage of small businesses operating at normal levels, at 35.3%. It also places sixth-lowest for the percentage of small businesses that don’t expect a return to normal levels of operation within six months or ever, at 46.3%. Indianapolis does not perform as well in terms of the percentage of small businesses with at least three months of cash on hand, finishing in the bottom half of the study at 25.9%.

10. Nashville-Davidson-Murfreesboro-Franklin, TN

The Nashville, Tennessee metro area places 10th for two different metrics: the percentage of small businesses operating at normal levels (29.4%) and the percentage of small businesses with at least three months of cash on hand (30.1%). That said, Nashville is closer to the middle of the pack, ranking 23rd-lowest, for the percentage of small businesses that do not expect to return to normal operations in the next six months or ever (52.2%).

Data and Methodology

To find the places where small business sentiment is more positive for 2021, we compared the 50 largest metro areas in the country across the following four metrics:

- Percentage of small businesses that are operating at normal levels.

- Percentage of small businesses that do not expect a return to normal levels of operations within six months or ever.

- Percentage of small businesses looking to hire new employees.

- Percentage of small businesses with at least three months of cash on hand.

All data comes from the Small Business Pulse Survey, conducted by the U.S. Census Bureau. Small businesses are defined as those with fewer than 500 employees. Small business responses were collected between November 30, 2020 and December 6, 2020.

To put our final rankings together, we ranked each metro area in every metric, giving a full weighting to all metrics. We then found each metro area’s average ranking and used this average to determine a final score. The metro area with the best average ranking received a score of 100. The metro area with the worst average ranking received a score of 0.

Please note that because the survey is experimental, sampling errors tend to be high relative to other Census-reported data.

Tips for Weathering a Tough Business Environment

- In a time as difficult as now, getting professional help can be a good idea. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Even in times when money is tight, it can’t hurt to think about the future. Use SmartAsset’s retirement calculator to see if you are on track for a solid retirement.

- Planning is key. If you’re having trouble keeping your money in order, the first step should be to make a budget – and then to stick to it.

Questions about our study? Contact press@smartasset.com.

Photo Credit: © iStock/Georgijevic