Back in 1989, the average American could expect to live until 75. Roughly 27 years later, the average life expectancy in the U.S. has crept up to nearly 79 years. But while the increased life expectancy is certainly good news, it is also a double-edged sword for Americans when it comes to financial planning. Given that they are living longer, Americans need to be more prepared than ever for retirement, whether that’s in building their own savings in tax-advantaged accounts or investing with a professional financial advisor. The Bureau of Labor Statistics estimates that the average retired household spends nearly $49,000 per year. Living an extra four years means adding the equivalent of nearly $200,000 to the average retiree’s lifetime expenses.

Below, we examine data on retirement accounts like 401(k)s and IRAs to see how Americans are adapting to these changes. More than just living longer, Americans young and old need to contend with the rising costs of living and a recent recession.

In order to track retirement savings and retirement account usage, we analyzed data from the Federal Reserve’s SCF (Survey of Consumer Finances) and specifically looked at data from 1989 to 2016. We ultimately broke the data out by race, age and income percentile to find important trends. Check out our data and methodology below to see where we got our data and how we put it together.

Key Findings

- The gap between the haves and have-nots is growing – Across the three demographic cleaves we analyzed, the distance between those at the top and those at the bottom is growing: The richest families have 14 times more saved for retirement than the poorest families, older families who are still working age have 11.5 times more saved for retirement than younger families and white families have 3.5 times as much saved up for retirement as black families. For each of these demographics, the gap between the best-off and the worst-off grew between 50% and 224% from 1989 to 2016.

- Most American families are not ready for retirement – The average American family with a retirement account has $228,900 saved up. That is no small amount. Referring back to the BLS expenditure figures, $228,900 would cover nearly five years’ worth of retirement living. However, only 52% of American families have any assets in retirement accounts at all, according to the SCF.

Retirement and Income

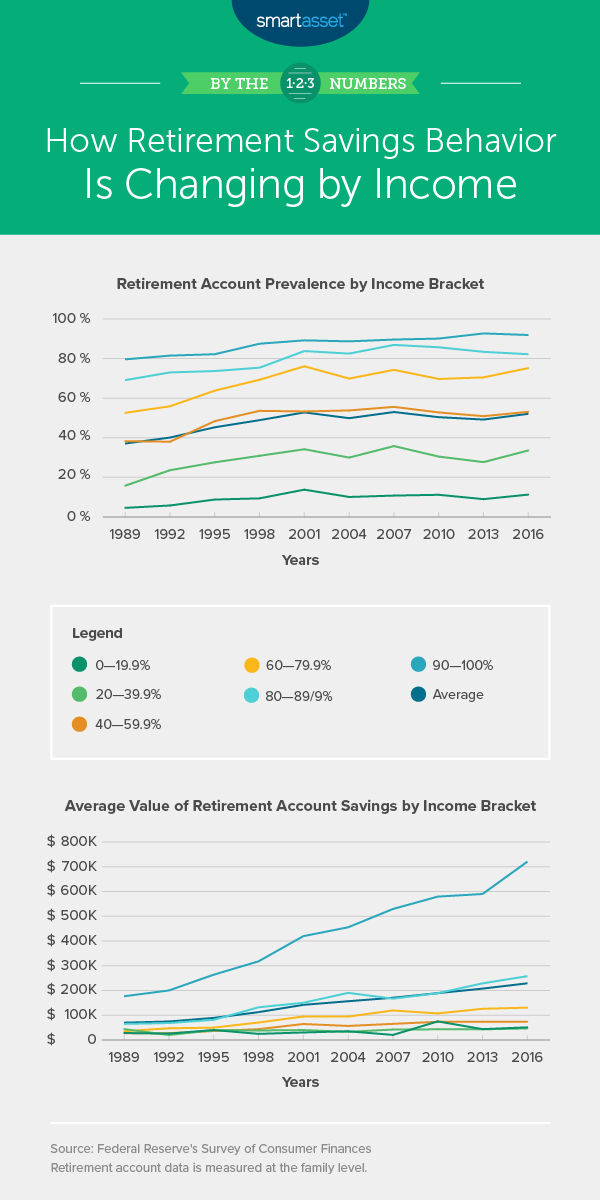

Back in 1989, finding families who used retirement accounts to fund their retirement was a fairly rare occurrence. Only 37% of families had any assets in a retirement account, according to the SCF. Fortunately for the average American’s retirement prospects, that behavior is changing. Americans are more likely to use retirement accounts than ever before. Survey data from 2016 shows that 52% of families had assets in a retirement account.

Along with a rise in the utilization of retirement accounts, the value of the average retirement account is also growing. From 1989 to 2016, the average American family with savings in a retirement account increased its retirement account assets from $69,900 to $228,900, according to SCF.

What those statistics hide, however, is that income was a fairly good indicator of whether or not a family would have assets in a retirement account, and not all Americans are equally prepared for retirement. As early as 1989, retirement accounts were already popular among wealthy families. Nearly four out of every five families in the top decile of family income had assets in a retirement account. By comparison, only 4.6% families in the bottom 20th percentile of income held assets in retirement accounts.

Over time, the distance between the rich in poor in their use of retirement accounts shrunk, but not by much. The latest data shows that a family from the top 10th percentile of income is eight times as likely to use a retirement account as those in the bottom 20 percentile of income. As of 2016, about 11% of families in the bottom 20th percentile of income use retirement accounts compared to 92% in the top 10th percentile of income.

More than just a gap in retirement account usage, though, there is also a very large, widening growing gap between how much the poor and rich save for retirement. This is to be expected, of course. Rich families can afford to save more money.

In 1989, the average family in the bottom 20% of earners with assets in a retirement account had about $28,100 saved up, according to the SCF. The average family in the top decile, meanwhile, had just under $177,000. That is a difference of just over six times. Over time, that gap between the retirement savings of the poor and rich has reached a difference of 14.1 times. A gap of 14.1 times is certainly large, but it is by no means the largest gap in the dataset. In 2007, as the economy was crumbling, SCF data shows that the retirement savings of poor families took a serious hit relative to retirement savings of rich families. In that year, the richest families had 25 times as much saved for retirement as the poorest families. The average family in the bottom 20% of earners had about $20,000, while the average family in the top decile had $529,000.

Retirement and Age

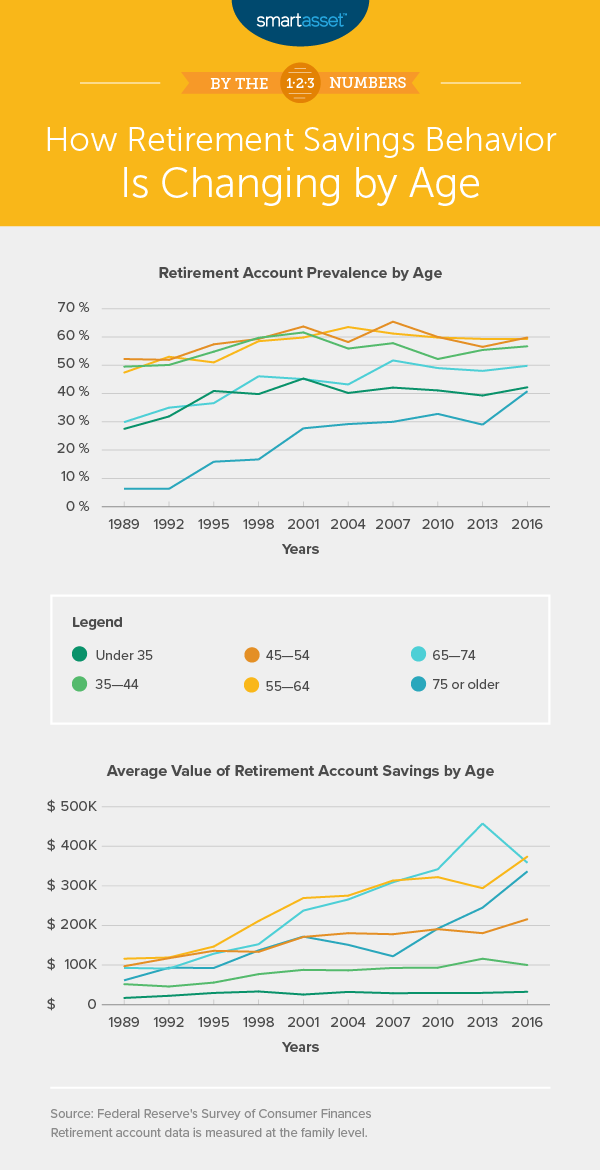

Millennials are the best-educated generation in American history. But the cost of that education has been severe. In total Americans, owe nearly $1.4 trillion in student loan debt, the vast majority of which is held by Americans under the age of 40. Americans under the age of 30 owe just under $384 billion, while Americans between the ages of 30 and 39 owe $461 billion. Between those two age groups, there are 29.1 million Americans with student loan debt.

The student loan debt burden on millennials has prevented them from reaching financial milestones like buying a house and saving for retirement. According to the latest Census Bureau figures, under-35 households have a homeownership rate of 37%, half that of households 65 years or older. Over-65 households have always had higher homeownership rates, but the under-35 figure sits six percentage points below its peak in 2004. Of course, the real blow to this demographic is the inability to put adequate money away for retirement.

According to our data, only 42.2% of families under the age of 35 use retirement accounts. And although, as we mentioned earlier, the average American is doing a better job of saving for retirement, much of that retirement account value has accrued to older households. The average under-35 household with retirement savings in 2016 has only $32,500 saved up. That is up by only $15,000 compared to 1989. The average family between the ages of 55 and 64 with retirement accounts, meanwhile, has accumulated an average retirement account value of $374,000. This means the average under-35 family has enough retirement savings to last for less than one year of retirement.

Retirement and Race

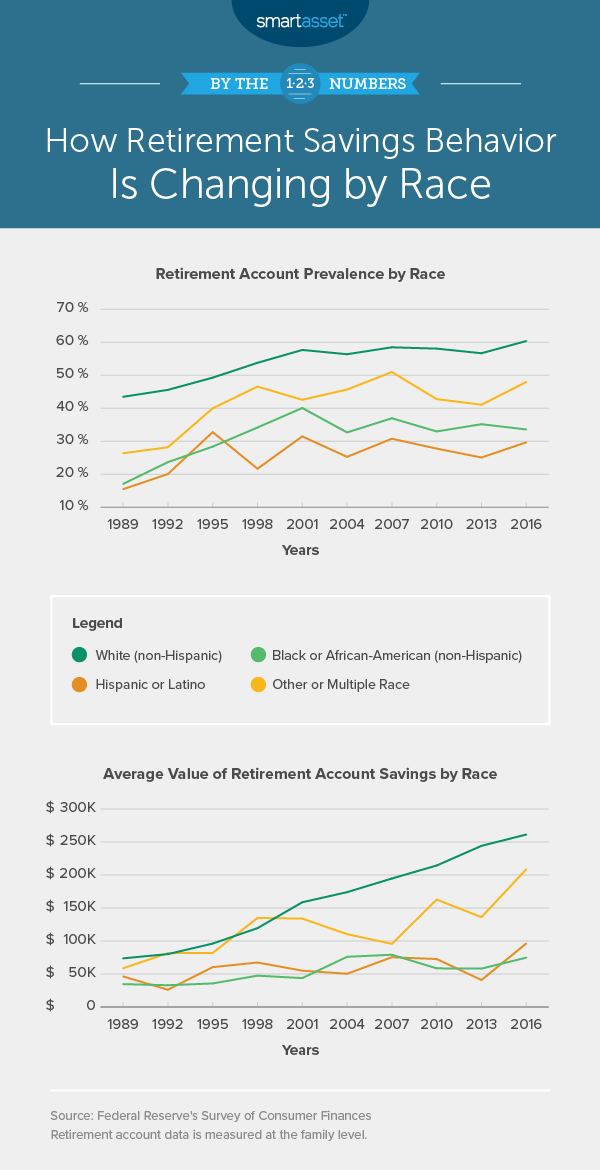

When it comes financial security, white households are not only more likely to have higher incomes and to own their homes, but they also on average have much more saved up for retirement compared to other races. In 2016, the average white family had about 3.5 times as much saved for retirement as the average black family. When it comes to retirement savings, the distance between white families and Latinos is slightly smaller. White families and families categorized as other have near parity in their retirement savings.

A major concern for the retirement prospects of minorities is their low usage of retirement accounts. Only one-third of black families have any assets in retirement accounts while fewer than 30% of Latino families have retirement accounts.

The retirement savings gap between white families and non-white families is also expanding for the most part. The average white family had 2.1 times more retirement assets than black families in 1989. As mentioned earlier, that figure as of 2016 was 3.5. The relationship between white and Latino savings is similar. In 1989, the average white family had 1.6 times more retirement assets as the average Latino family. Jumping forward to 2016 and the average white family has more than 2.7 times more retirement assets than the average Latino family.

Data and Methodology

In order to track how retirement savings behavior is changing, we looked at data for two factors across 27 years, specifically pulling out data for three demographic types: age, race and income percentile. Data for all metrics come from the Federal Reserve’s Survey of Consumer Finances (SCF).

Tips for Maximizing Your Retirement Savings

- Saving for retirement can be complicated, and a financial advisor can help. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Every dollar you save today is another two or three dollars you won’t need to save in the future, depending on how aggressively you invest. If you hook up with a financial advisor and manage to squeeze 10% returns out of your investments every dollar you invested would double in seven years. While securing 10% returns is bullish, averaging returns above 5% is probably not.

Questions about the study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/monkeybusinessimages