Not all couples can afford to buy a home and have the wedding of their dreams. Some must choose between the two or postpone one in favor of the other. The Netflix reality series “Marriage or Mortgage” explores this dynamic, as a couple decides between buying a home or having their dream wedding in each episode. Nationally, the average down payment (13%) on the median home sales price was $39,026 in 2020, close to double the average wedding cost, at $20,286. That means in most places, having a wedding takes far less cash than buying a home. But that isn’t the case everywhere.

In this study, SmartAsset identifies and ranks the places where it’s more expensive to have a wedding than purchase a home. We compare 150 of the largest metro areas in the U.S. across two metrics: the average wedding cost and a 13% down payment on the median-priced home. For more details on how we sourced and analyzed our data, check out our Data and Methodology section below.

Key Findings

- Homes tend to be less affordable than weddings. Of the 150 metro areas that we studied, there are only 20 in which buying a home is more affordable than having a wedding. These 20 metro areas are concentrated in eight states across the Midwest and Rust Belt. Five of those places are in western and central New York, and nine are in Ohio and Pennsylvania.

- High home prices sink two California metros. It’s no surprise that the pricey San Francisco Bay Area is home to the two metro areas where buying a home is wildly more expensive than having a wedding. The median home sales price in the San Jose-Sunnyvale-Santa Clara metro area is a whopping $1.38 million, meaning a typical down payment requires nearly 82% more cash than an average wedding ($33,142). Meanwhile, the median home in the nearby San Francisco-Oakland-Berkeley area sells for $1.1 million. That means a typical down payment there is 76% more expensive than what an average wedding ($33,697) costs.

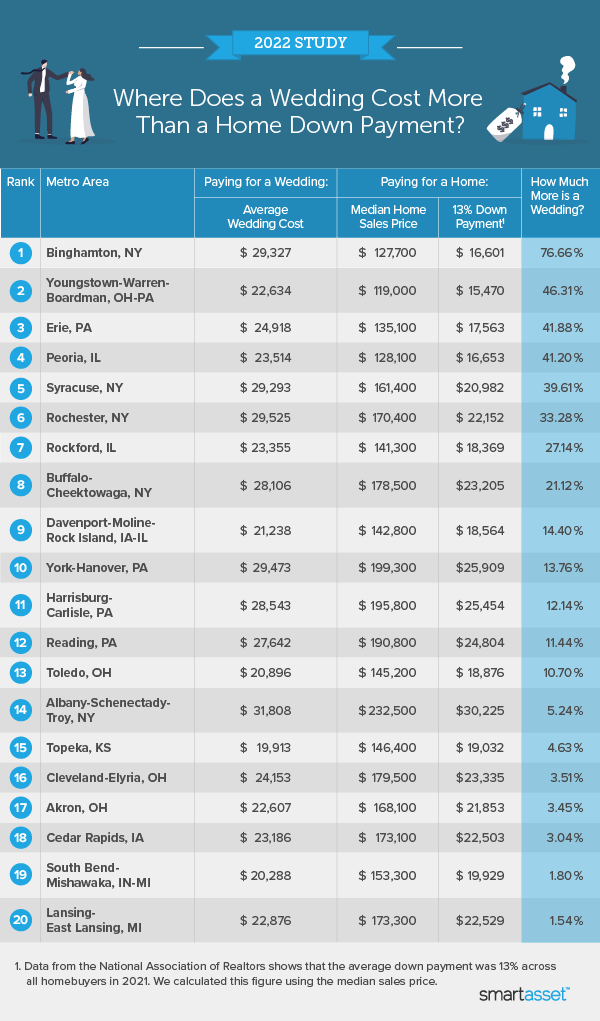

1. Binghamton, NY

Couples looking to have a wedding in Binghamton, New York, need nearly 77% more cash compared to buying a median-priced home. With the median sales price of a home in the area just $127,700 in 2020, a 13% down payment would require just $16,601. This is significantly less than the $29,327 that it would have taken to get married in the same area that year.

2. Youngstown-Warren-Boardman, OH-PA

The average price tag of a wedding in the Youngstown-Warren-Boardman metro area of Ohio and Pennsylvania was $22,634 in 2020. That’s 46.31% more than a typical down payment needed to buy a home of median sales price. The Youngstown-Warren-Boardman area had the lowest median home price ($119,000) of all 150 metro areas we examined. Homebuyers in this metro area, which straddles the border between eastern Ohio and western Pennsylvania, needed only $15,470 on hand to make a 13% down payment in 2020.

3. Erie, PA

A down payment of 13% on a median-priced home in Erie, Pennsylvania required $17,563 in cash on hand in 2020. The average cost of a wedding in Erie that same year was $24,918, nearly 42% more money than what was needed for a typical down payment.

4. Peoria, IL

On average, weddings in the Peoria metro area of Illinois cost $23,514 in 2020. That’s 41.20% more than a typical 13% down payment for a home purchase there. The median sales price of homes in the area was just $128,100 in 2020, meaning homebuyers needed just $16,653 for a 13% down payment.

5. Syracuse, NY

At $29,293, an average wedding in Syracuse, New York, in 2020 cost 39.61% more than a typical down payment on a home. The median sales price of a home in Syracuse was $161,400 in 2020, meaning homebuyers would need $20,982 for a 13% down payment.

6. Rochester, NY

At $29,525, the average cost of a wedding in Rochester, New York, was higher in 2020 than any other metro area in the top 10. In 2020, the average wedding was 33.28% more expensive than a 13% down payment on a home of median sales price ($170,400).

7. Rockford, IL

Located in northern Illinois, the Rockford metro area had a median home sales price of $141,300 in 2020. The average cost of a wedding in the area was $23,355, making the average wedding 27.14% more expensive than the typical down payment on a home ($18,369).

8. Buffalo-Cheektowaga, NY

Making a 13% down payment on a median-priced home in the Buffalo-Cheektowaga metro area required $23,205 in 2020. Meanwhile, the average wedding cost was $28,106 or 21.12% more than the typical down payment on a home purchase.

9. Davenport-Moline-Rock Island, IA-IL

At $21,238, the average wedding in the Davenport-Moline-Rock Island metro area of Iowa and Illinois cost 14.40% more than a typical down payment in 2020. The area’s median home sales price in 2020 was just $142,800, meaning homebuyers needed only $18,564 for a down payment.

10. York-Hanover, PA

Couples looking to have a wedding in the York-Hanover metro area of Pennsylvania needed 13.76% more cash than if they put a 13% down payment on a median-priced home instead. The median home sales price in the area was $199,300 in 2020, meaning a 13% down payment would require $25,909. Meanwhile, an average wedding cost $29,473 in 2020.

Data and Methodology

To find the places where average wedding costs are more than the typical down payment associated with a home mortgage, we analyzed data for 150 of the largest metro areas in the country. For each area, we considered three metrics:

- Average wedding cost. Data comes from theweddingreport.com and is for 2020.

- Median home sales price. Data comes from the National Association of Realtors and is for 2020.

- 13% down payment. The typical down payment for all buyers is 13%, according to the National Association of Realtors. We calculated this simply by taking 13% of the median home sales price in each metro area.

For each metro area, we divided the down payment figure by the average cost of a wedding there. We then ranked the metro areas based on how much more an average wedding costs compared to a 13% down payment on a median-priced home.

Tips for First-Time Homebuyers

- You don’t need 20% for a down payment. While buyers have traditionally been encouraged to put 20% down on a home purchase, you can buy a home with far less up front. A loan from the Federal Housing Administration allows you to put as little as 3.5% down, although you’ll need to pay mortgage insurance. Some lenders may even permit buyers to put just 3% down.

- Run the numbers. SmartAsset has a number of tools that can help first-time homebuyers with the process. Our rate comparison tool can help you evaluate different lenders based on the interest rates they’re currently offering. Our mortgage calculator, meanwhile, can help you determine how much your monthly payments will be.

- Work with a professional. A real estate agent isn’t the only professional who can help you buy a home. A financial advisor can help you save for a down payment and set a budget for your house hunt. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Sargis Zubov