Americans are spending slightly less of their pre-tax income on utilities when compared with a decade ago. According to Bureau of Labor Statistics (BLS) data, the average American household spent 4.93% of income on utilities, which includes electricity, gas, telephone services, water and other public services such as waste pickup. This is down from 5.86% in 2010. However, some researchers expect an uptick in heating and cooling costs with rising energy prices. Inflation data from the BLS shows that the energy index rose 30% from October 2020 through October 2021 and the total consumer price index rose 6.2% over the same period.

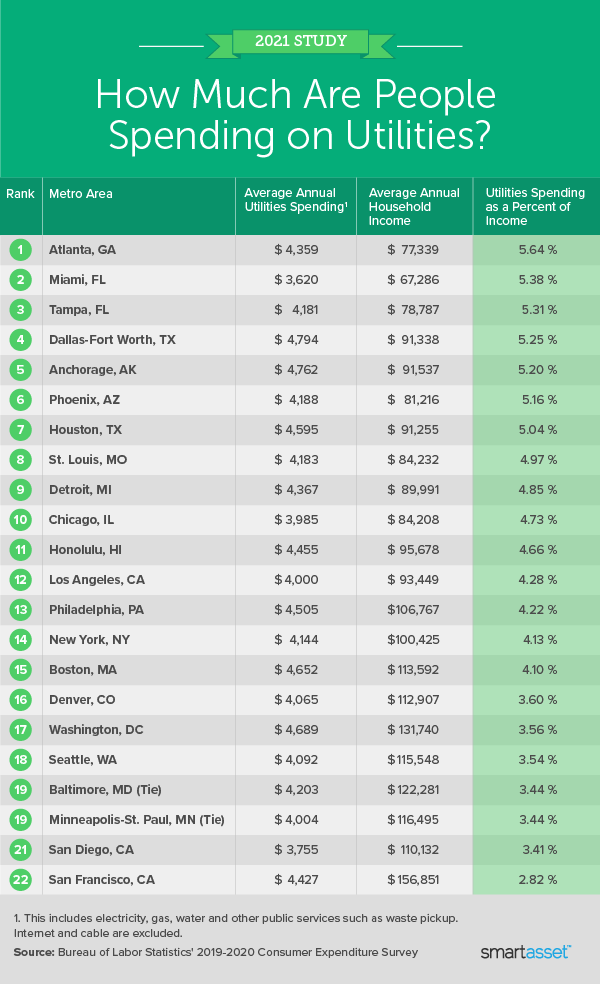

With potential increases in utilities spending on the horizon, SmartAsset took a closer look at the places where people spend the most on utilities already. To do this, we examined data for 22 metro areas from the Bureau of Labor Statistics’ 2019-2020 Consumer Expenditure Survey. We compared two metrics (average utilities spending per household and average household income) and ranked metro areas according to utilities spending as a percentage of household income. For more information on our data or how we put together our findings, read our Data and Methodology section below.

Key Findings

- Americans pay more for electricity and telephone services than other utilities. BLS data shows that in 2020, the average American household spent $4,158 on utilities. Across the different types of utilities, average spending was highest for electricity ($1,516) and telephone services ($1,441). Together, they account for more than 71% of total utilities spending.

- Western and Northeastern metro areas spend less on utilities than Midwestern and Southern areas. While residents in big Western and Northeastern metro areas typically face higher living costs, they tend to spend less of their income on utilities. Across the 22 metro areas we considered, Northeastern residents pay 4.7% of annual income before taxes on utilities and Western residents pay 4.5%. In Southern and Midwestern areas, those figures are higher – at 5.3% and 5.1%, respectively.

1. Atlanta, GA

Across the 22 metro areas in our study, average utilities spending is 10th-highest in Atlanta, Georgia at $4,359. However, residents in Atlanta spend the largest chunk of their income on utilities. The area’s average household income is $77,339, which means that average annual utilities spending makes up 5.64% of what residents earn.

2. Miami, FL

In the Miami, Florida area utilities spending makes up 5.38% of the average household income, the second-highest percentage of all 22 metro areas in our study. Specifically, average utilities spending is roughly $3,600 while the average household income is about $67,300.

3. Tampa, FL

Residents of greater Tampa, Florida average 5.31% of their household income on utilities each year, the third-most out of all 22 metro areas. Relative to total annual housing spending, utilities spending makes up roughly 20% on average.

4. Dallas-Fort Worth, TX

Gross average annual utilities spending is highest in Dallas-Fort Worth, Texas across all 22 metro areas ($4,794). Compared with average household income, Dallas-Fort Worth ranks fourth. Average utilities spending makes up 5.25% of average household income.

5. Anchorage, AK

The average household in the Anchorage, Alaska spends close to $4,800 annually on utilities, including electricity, gas, telephone services, water and other public services such as waste pickup. Using that figure and the median household income figure from the BLS, we found that the average household in Anchorage must allocate 5.2% of pre-tax income to utilities.

6. Phoenix, AZ

Residents of Phoenix, Arizona area spend the sixth-most on utilities. The average household income is the third-lowest in our top 10, at $81,216. However, average utilities spending ($4,188) makes up 5.16% of that income figure.

7. Houston, TX

The second Texas metro area to rank in our top 10, Houston is the seventh and last area where average annual utilities spending makes up more than 5% of the average household income. The average household in the Houston metro area spends $4,595 on utilities annually relative to the median household income of $91,255.

8. St. Louis, MO

Residents of the St. Louis, Missouri area spend $4,183 or 4.97% of their household income on utilities, which include electricity, gas, water and other public services such as waste pickup. While St. Louis’s average household income in 2019-2020 was $84,232, the typical household spent $20,493 on total housing spending.

9. Detroit, MI

Households in the Detroit, Michigan average nearly $4,400 on utilities annually. This represents about 4.85% of the metro area’s average household income ($89,991). Utilities spending comprises almost 22% of total household spending on rental and mortgage payments along with utilities.

10. Chicago, IL

Chicago, Illinois rounds out our list of the top 10 places where people spend the most on utilities. BLS data shows that the average household spends nearly $4,000 on utilities annually. This accounts for 4.73% of the average household income in the area.

Data and Methodology

To find the places where people spend the most on utilities, we looked at data for all 22 metro areas included in the Bureau of Labor Statistics’ 2019-2020 Consumer Expenditure Survey. Specifically, we examined data for the following metrics:

- Average utilities spending. This is the annual amount that the average household spends on utilities. This includes electricity, gas, telephone services, water and other public services such as waste pickup. Internet and cable are excluded.

- Average household income. This is the annual average household income.

For each metro area, we divided average utilities spending by the average household income. The result represents the average utilities spending as a percentage of total income. We ranked the places according to those percentages from highest to lowest.

Trouble Paying Your Utility Bill?

- See if you are eligible for help through the Low Income Home Energy Assistance Program. The Low Income Home Energy Assistance Program (LIHEAP) assists eligible low-income households with their heating and cooling costs along with other energy-related costs. If you need financial assistance to keep up with rising energy costs, be sure to contact your local LIHEAP office.

- Identify ways to save. Having a firm understanding of your income and expenses is the cornerstone of any successful budget. SmartAsset’s free budget calculator can help you get a clearer picture of how you spend your money and, potentially, where you can save.

- Seek out trusted personal finance advice. Need some extra help getting a grasp of your spending habits? Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/fizkes