Many homeowners were incentivized to refinance their homes after mortgage rates reached historic lows in 2020. And Freddie Mac data shows that this caused mortgage refinancing activity to hit its second-highest milestone since peaking in 2003. For a comparison, there were about $2.6 trillion in inflation-adjusted refinance originations for the year 2020, compared with $3.9 trillion in 2003.

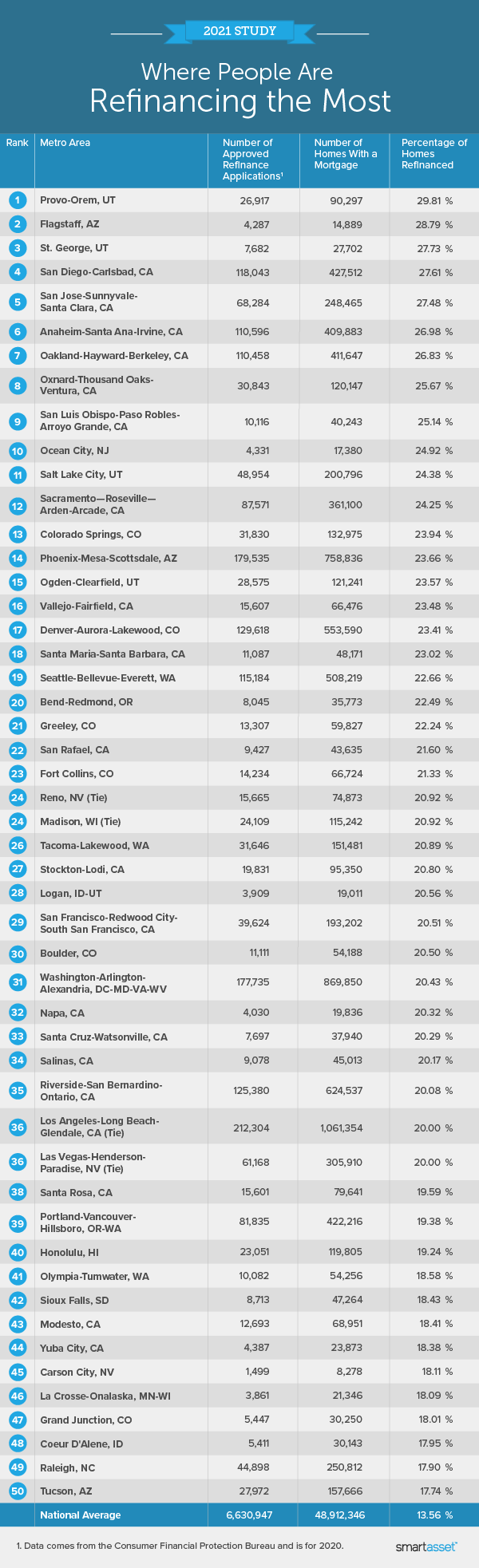

Though refinancing activity peaked nationally, it varied by location. In this study, SmartAsset examined the metro areas where people refinanced the most in 2020. We compared the number of approved refinanced applications to the number of homes with a mortgage. Specifically, we used data from the Consumer Financial Protection Bureau (CFPB) and Census Bureau to rank almost 400 metro areas according to the percentage of homes refinanced. For more information on our data or how we put together our findings, read our Data and Methodology section below.

Key Findings

- There is a wide range of refinancing activity across metro areas. In 2020, more than one in five homes with a mortgage were refinanced in 37 metro areas of the total 393 areas in our study. Meanwhile, the number of approved refinance applications divided by the number of homes with a mortgage is less than 10% in 148 metro areas. Between the metro area where people refinanced most (Provo-Orem, Utah) and the metro area where people refinanced least (Binghamton, New York) there is almost a 27-percentage point difference.

- Higher home values may mean higher potential refinance savings. With six of the top 10 metro areas where people are refinancing most in California, the average home value across the top 10 places in our study is $584,890. This is about 143% higher than the national median home value, $240,500. This trend of expensive areas seeing higher refinancing activity is perhaps unsurprising as interest adds up more on more expensive homes.

- There isn’t much refinancing activity in upstate New York. Six of the 10 metro areas where people are refinancing the least are located in upstate New York. They include Binghamton, Utica-Rome, Syracuse, Glen Falls, Ithaca and Buffalo-Cheektowaga-Niagara Falls. In all six places, less than 5% of homes with mortgages were refinanced in 2020.

1. Provo-Orem, UT

Close to one in three homeowners with mortgages in Provo-Orem, Utah refinanced their homes in 2020. The total number of approved refinance applications was roughly 26,900 and total number of homes with a mortgage was about 90,300.

2. Flagstaff, AZ

In 2020, almost 4,300 refinance applications were approved in Arizona’s Flagstaff metro area. This is a roughly 239% increase from the number of refinance applications approved in 2019 (1,263 according to CFPB data). Compared to the number of homes with mortgages in the area, the 2020 refinancing rate is 28.79%. That’s the second-highest in our study.

3. St. George, UT

The St. George metro area is located in southwestern Utah. In 2020, 27.73% of homeowners with mortgages applied and were approved to refinance their homes. In total, the number of approved refinanced applications was 7,682, according to data reported by the CFPB.

4. San Diego-Carlsbad, CA

Across the top 10 places where people are refinancing most, California’s San Diego-Carlsbad metro area has the highest total number of approved refinance applications in 2020, at 118,043. Compared to the number of homes with a mortgage in the area (about 427,500), we found that almost 28% of homeowners took advantage of low home loan rates last year.

5. San Jose-Sunnyvale-Santa Clara, CA

About 27.5% of homes with mortgages in San Jose-Sunnyvale-Santa Clara, California were refinanced in 2020. According to Census Bureau and CFPB data, the total number of homes with an existing mortgage is 248,465 and about 68,300 refinance applications were approved last year.

6. Anaheim-Santa Ana-Irvine, CA

In California’s Anaheim-Santa Ana-Irvine metro area, the total number of approved refinance applications in 2020 (110,596) is roughly 219% higher than the number approved in 2019 (34,695). Using the number of homes with a mortgage, we found that the percentage of homes refinanced is 26.98% – the sixth-highest across the 393 metro areas we considered.

7. Oakland-Hayward-Berkeley, CA

Like in the Anaheim-Santa Ana-Irvine metro area, more than 110,000 refinance applications were approved in Oakland-Hayward-Berkeley, California last year. Compared to the number of homes with mortgages, we found that 26.83% of Oakland-Hayward-Berkeley homeowners who are paying off a mortgage refinanced in 2020.

8. Oxnard-Thousand Oaks-Ventura, CA

Oxnard-Thousand Oaks-Ventura is the fifth of six California metro areas that rank in our top 10 places where people are refinancing most. CFPB data shows that in 2020, about 30,800 refinance applications were approved in the Oxnard-Thousand Oaks-Ventura metro area. Compared to the roughly 120,100 homes with mortgages in the area, this represents close to 26% of homeowners choosing to refinance.

9. San Luis Obispo-Paso Robles-Arroyo Grande, CA

About 25% of homes with mortgages in San Luis Obispo-Paso Robles-Arroyo Grande, California were refinanced in 2020. The total number of approved refinance applications in 2020 (10,116) is roughly 231.5% higher than the number approved in 2019 (3,052).

10. Ocean City, NJ

A popular second home location, New Jersey’s Ocean City rounds out our list of the top 10 places where people are refinancing most. Data from the CFPB shows that more than 4,300 refinance applications were approved in 2020. Relative to the roughly 17,400 homes with a mortgage in the area, this means that close to one in four homeowners decided to take advantage of low interest rates last year.

Data and Methodology

To find the places where people are refinancing the most, we considered 393 metro areas. For each area, we compared two metrics:

- Number of approved refinance applications. Data comes from the Consumer Financial Protection Bureau and is for 2020.

- Number of homes with a mortgage. Data comes from the Census Bureau’s 1-year American Community Survey.

For each metro area, we divided number of approved refinance applications by number of homes with a mortgage. The result represents the percentage of homes refinanced. We ranked the places according to those percentages from highest to lowest.

To note, Freddie Mac reports that repeat refinances – loans that were refinanced two or more times with a 12-month period – increased in 2020. Our study does not distinguish between ordinary refinances and repeat refinances. Thus, the total number of approved refinance applications may include applications from the same borrowers.

Tips for Saving Money on Your Mortgage

- See if refinancing is the right move. It may be hard to know on your own in refinancing makes sense. If you want help calculating your potential savings, take a look at our refinance calculator. Additionally, our comprehensive refinance guide has many other useful resources for homeowners considering a mortgage rate adjustment.

- Consider making extra payments. Paying more than your mortgage requires can benefit you in several different ways, including reducing the amount of interest you pay over time. If you want to make extra mortgage payments, here’s how to do it.

- Seek out trusted advice. No matter where you live, a financial advisor can help you get your financial life in order. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: iStock.com/courtneyk