The median household income is about $65,700, according to the most recent Census Bureau data. However, the top 20% of earners nationwide makes about twice this amount, potentially increasing their ability to save and invest for bigger financial goals like retirement. In 2019, the threshold to be in the 80th percentile of households according to annual income was $131,349.

Given significant differences in jobs and cost of living, the income threshold to be in the top 20% of earners varies significantly across U.S. cities, ranging from roughly $71,200 to more than $250,000. In this study, SmartAsset examined Census Bureau estimates of household income quintiles to determine the income needed to be in the 80th percentile of earners in the 100 largest cities. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s third annual study on the income needed to be a top earner in America’s largest cities. Check out the 2020 version of the study here.

Key Findings

- Some neighboring smaller cities rank above their principal cities. The income threshold is about 13% higher in Arlington ($229,000) than in Washington, D.C. ($202,353) and roughly 18% higher in Jersey City ($181,299) than in New York City ($153,841).

- The 80th percentile income threshold is less than $100,000 in 14 cities. Households must earn six figures to be in the top 20% of earners in the majority of the 100 largest U.S. cities. However, in 14 cities, this is not the case. Detroit, Michigan and Cleveland, Ohio have the lowest threshold to be a top earner, and an additional 12 cities have thresholds falling below six figures.

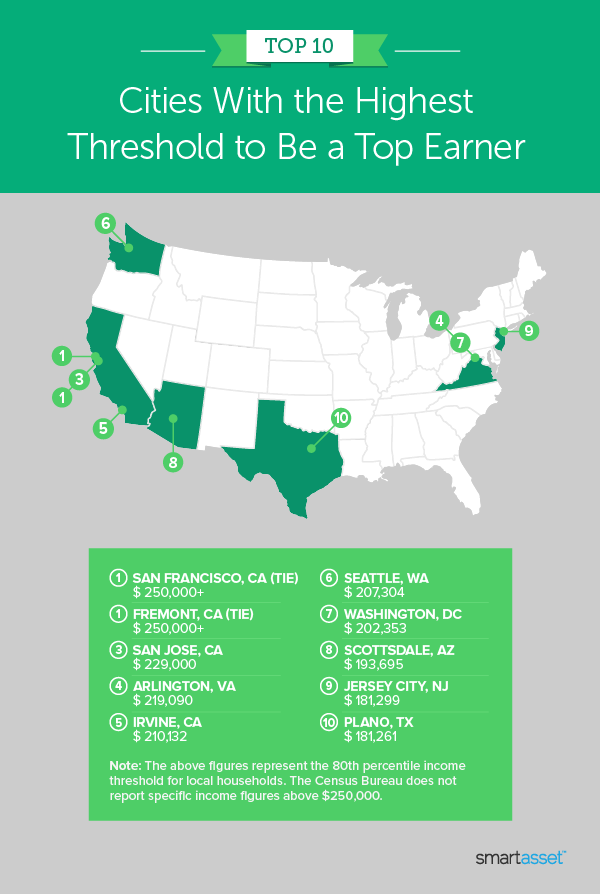

Top Cities With the Highest Threshold to Be a Top Earner

1. San Francisco, CA (tie)

The 2019 income needed to be in the 80th percentile of earners in San Francisco, California exceeds $250,000, a figure beyond which the Census Bureau does not report specific income details. The median household income in San Francisco is also high, at almost $123,900. This is about 89% higher than the national median household income ($65,712).

1. Fremont, CA (tie)

Like in San Francisco, the income needed to be a top earner in Fremont, California exceeds $250,000. Last year, Fremont also ranked second in our study, though the income needed to be in the 80th percentile of earners was $243,080.

3. San Jose, CA

The top 20% of earners in San Jose, California earn upwards of $229,000. This is five times more than the bottom 20% of earners, who make less than $45,830 annually. The median household income is about $115,900 – the fourth-highest across the 100 largest U.S. cities.

If you live in San Jose and are looking to make the most of your income and savings, check out our list of the best financial advisors in the area.

4. Arlington, VA

Arlington, Virginia ranks as the city with the fourth-highest threshold to be a top earner. According to 2019 Census Bureau data, households must earn at least $219,090 to be in the 80th percentile of earners.

5. Irvine, CA

South of Los Angeles, the California of Irvine ranks No. 5 on our list. The income needed to be in the top 20% of earners is roughly $210,100. This is over five times more than the 20th percentile of earners in the area (about $37,200).

Top Cities With the Lowest Threshold to Be a Top Earner

1. Detroit, MI

Like last year, Detroit, Michigan has the lowest income needed to be a top earner in the 100 largest U.S. cities. To be in the 80th percentile according to income, households must make at least $71,203 – about 46% less than the national 80th percentile threshold ($131,349).

2. Cleveland, OH

Cleveland, Ohio follows closely behind Detroit, Michigan for its low threshold to be a top earner. The 80th percentile for earners in Cleveland is less than $72,600. Though this figure is low relative to other large cities, it is more than double the city’s median household income ($32,053).

3. Toledo, OH

Staying in Ohio and roughly 115 miles west of Cleveland, Toledo also ranks in the top five cities with the lowest threshold to be a top earner. In 2019, the median household income was about $36,700. Top earners made about 108% more. The 80th percentile income threshold for earners was $76,380.

4. Newark, NJ

Although Jersey City, New Jersey ranks in the top 10 cities with the highest threshold to be a top earner ($181,300), less than 10 miles away, the city of Newark has a much lower threshold. In 2019, the 80th percentile for household income was about $81,800 in Newark.

5. Hialeah, FL

The median household income in Hialeah, Florida is roughly $40,700, the fifth-lowest across the 100 largest U.S. cities. Hialeah also has the fifth-lowest income needed to be a top earner. In 2019, the income needed to be in the 80th percentile of households was less than $84,800.

Data and Methodology

All data for this report comes from the Census Bureau’s 2019 1-year American Community Survey. We considered only the 100 largest cities and ranked them according to the household income needed to be in the 80th percentile of the income distribution.

Tips for Maximizing Your Savings

- Invest as early as possible. A great way to get the most out of your savings is by planning. By planning and investing early you can take advantage of compound interest. Check out our investment calculator to see how your money can grow over time.

- Contribute to a 401(k). A 401(k) is an employer-sponsored defined contribution plan in which you divert pre-tax portions of your monthly paycheck into a retirement account. Some employers will also match your 401(k) contributions up to a certain percentage of your salary, meaning that if you chose not to contribute, you are essentially leaving money on the table. Our 401(k) calculator can help you determine what you saved for retirement so far and how much more you may need. If you don’t have access to a 401(k), an IRA is another great option.

- Seek out trusted advice. No matter where you live, a financial advisor can help you get your financial life in order. SmartAsset’s free tool matches you with financial advisors in just five minutes. If you’re ready to be matched with advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/KIVILCIM PINAR