The first year of homeownership can often be the most expensive, especially when paying a sizable down payment and taking closing costs into account. More times than not, the most affordable places to buy homes are smaller and more rural. But how much does the first year of homeownership cost in America’s largest cities?

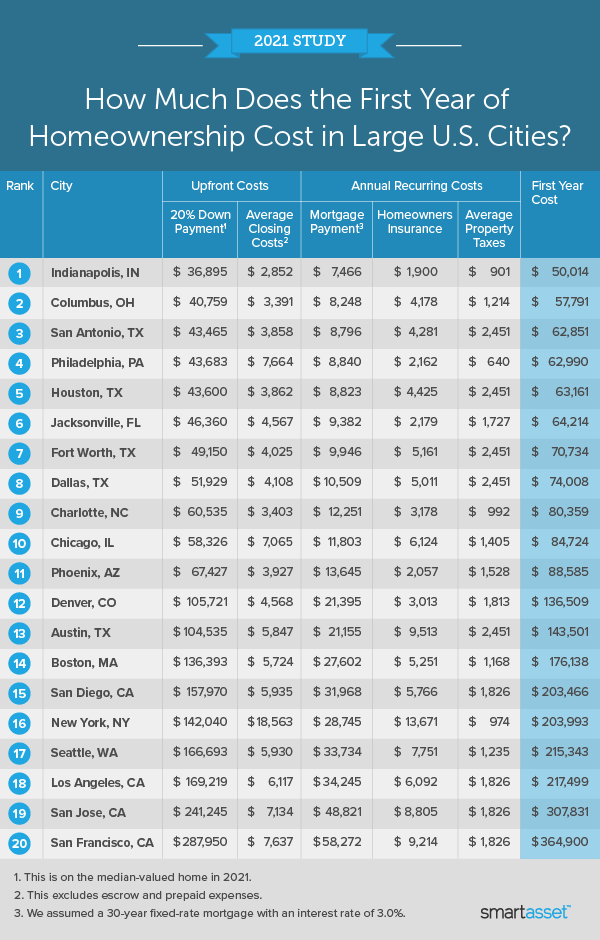

To answer this question, SmartAsset looked at data across 20 of the largest cities in the U.S. We calculated the cost of homeownership in the first year after a home is purchased, using six metrics: median home value, down payment, average closing costs, monthly mortgage payment, property taxes and homeowners insurance. For details on our sources and how we put all the information together to create our final rankings, read the Data and Methodology section below.

Key Findings

- First-year homeownership costs differ across the study by a factor seven. In Indianapolis, Indiana, you can expect to spend over $50,000 in your first year of homeownership, 7.3 times less than in San Francisco, California, where costs total $364,900.

- It takes twice as much to close in New York City. The median home value in New York City is $710,200. While that isn’t the highest median home value in the study, closing costs in the Big Apple are more than double what they are anywhere else, thanks in large part to a citywide transfer tax.

Where First-Year Homeownership Costs Are Most Affordable

1. Indianapolis, IN

The median home value in Indianapolis, Indiana is just $184,474, the lowest of all 20 cities in our study. Average closing costs, excluding escrow and prepaid expenses, are also lower than any other city at just $2,852. The average property tax bill in Indianapolis is just $1,900 per year, about a third of the average for all 20 cities. All of this amounts to the first year of homeownership costing just $50,014.

2. Columbus, OH

In Columbus, Ohio, homebuyers will pay a total of $57,791 in their first year of homeownership, making it the No. 2 most affordable big city for the first year of homeownership. The median home price in Ohio’s capital city is just $203,796, while average closing costs are $3,391, both second-lowest across our study. Columbus also has the seventh-lowest average property taxes ($4,178) of the 20 cities that we studied.

3. San Antonio, TX

At $62,851, San Antonio, Texas is the No. 3 most affordable large city for the first year of homeownership. Homebuyers in San Antonio pay $47,323 in upfront costs, as well as $15,528 in annual recurring costs. San Antonio benefits from its stock of affordable homes. The median value of a home in the city is just $217,326, third-lowest across our entire study.

4. Philadelphia, PA

No city on the East Coast is more affordable for homebuyers than Philadelphia, Pennsylvania. The first year of homeownership in the City of Brotherly Love requires $62,990, including $51,347 in upfront costs. At $218,417, the median home value in Philadelphia is fifth-lowest across our study. Philly also has the lowest average homeowners insurance ($640, according to Value Penguin data measured at the state level), and the third-lowest average property taxes ($2,162).

5. Houston, TX

The fourth-largest city in the country, Houston, Texas is another affordable place to purchase a home. Homebuyers will spend $63,161 in their first full year of homeownership, including $47,462 in upfront costs and $15,699 in annual recurring costs. Houston has the fourth-lowest median home value ($218,000) and the fifth-lowest average closing costs ($3,862).

Where First-Year Homeownership Costs Are Least Affordable

1. San Francisco, CA

It’s no surprise that San Francisco, California is the nation’s least affordable large city for first-year homeownership. Homebuyers in the City by the Bay will need a whopping $364,900 for their first year, thanks in large part to a median home value of $1,439,752. The average property tax bill in San Francisco is $9,214, the third-highest across our study.

2. San Jose, CA

This Silicon Valley tech hub is the No. 2 least affordable for first-year homeownership, as homebuyers will pay an average of $307,831 in their first year. San Jose, California, has the second-most expensive homes in our study, as the median home value is $1,206,225. The average property tax bill of $8,805 is the fourth-highest across our study, while average closing costs are $7,134, which also rank fourth-highest.

3. Los Angeles, CA

Though significantly more affordable than its Bay Area counterparts, Los Angeles, California is the No. 3 least affordable city for first-year homeowners. There, homebuyers will pay an average of $217,499 in their first year. The median home value in Los Angeles is $846,096, which ranks third-highest across our study. However, average closing costs are at least $1,000 less than in San Francisco and San Jose.

4. Seattle, WA

With an average first-year homeownership cost of $215,343, Seattle, Washington is slightly more affordable than Los Angeles. Homebuyers will need $172,623 in cash to cover upfront costs, which include average closing costs of $5,930, the eighth-highest across our study.

5. New York, NY

Buying a home in the Big Apple will cost you $203,993 in the first year of homeownership. The median home value in New York is $710,200, which makes homes there more affordable than the West Coast cities on this list. However, closing costs are by far the highest in New York, where a transfer tax pushes average closing costs over $18,000.

Data and Methodology

To find the most affordable populous cities for the first year of homeownership, SmartAsset examined data for 20 of the largest cities in the country with available data (Washington, D.C. was the only city missing this data). We considered the following metrics, grouped according to upfront costs and annual recurring costs:

Upfront Costs

- 20% down payment. This is on the median-valued home in 2021, according to data from Zillow. Although the National Association of Realtors reports that the median down payment in 2020 was 12% for all buyers, a recent realtor.com article states that down payments in larger metropolitan areas tend to be larger.

- Average closing costs. Data comes from SmartAsset’s closing costs calculator. It excludes escrow and pre-paid expenses such as homeowners insurance.

Annual Recurring Costs

- Mortgage payment. We assumed a 30-year fixed-rate mortgage with an interest rate of 3%. This aligns with recent rates as reported by Freddie Mac.

- Average property taxes. Data comes from SmartAsset’s property taxes calculator.

- Homeowners insurance. Data comes from Value Penguin, is from August 2021 and is measured at the state level.

First we calculated upfront costs and annual recurring costs in each city. Summing those together, we found the estimated first year cost of owning a home in each city. Cities were then ranked from most to least affordable.

Home Buying Tips

- Mind your monthly payment. People who spend more than 30% of their income on housing are considered to be “housing cost burdened” by the federal Department of Housing and Urban Development. Some experts recommend your monthly mortgage payment should be no more than 28% of your gross monthly income. Others, like Dave Ramsey, assert that your mortgage payment shouldn’t exceed 25% of your take home pay.

- Have a pro in your corner. A financial advisor can help you invest and save for a down payment, and advise you on how much to spend on a home purchase. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Sean Pavone