The low interest environment during the COVID-19 pandemic has been a boon for the vacation real estate market. While millions of Americans took advantage of low interest rates and bought their first homes, others capitalized on the cheap money and purchased vacation homes.

Figures from the Home Mortgage Disclosure Act Database show that vacation homes comprised a larger percentage of home purchases in 2020 than in 2019, despite the COVID-19 pandemic. But with the Federal Reserve set to hike interest rates for the first time since the pandemic began, the vacation home market may evolve in the coming months.

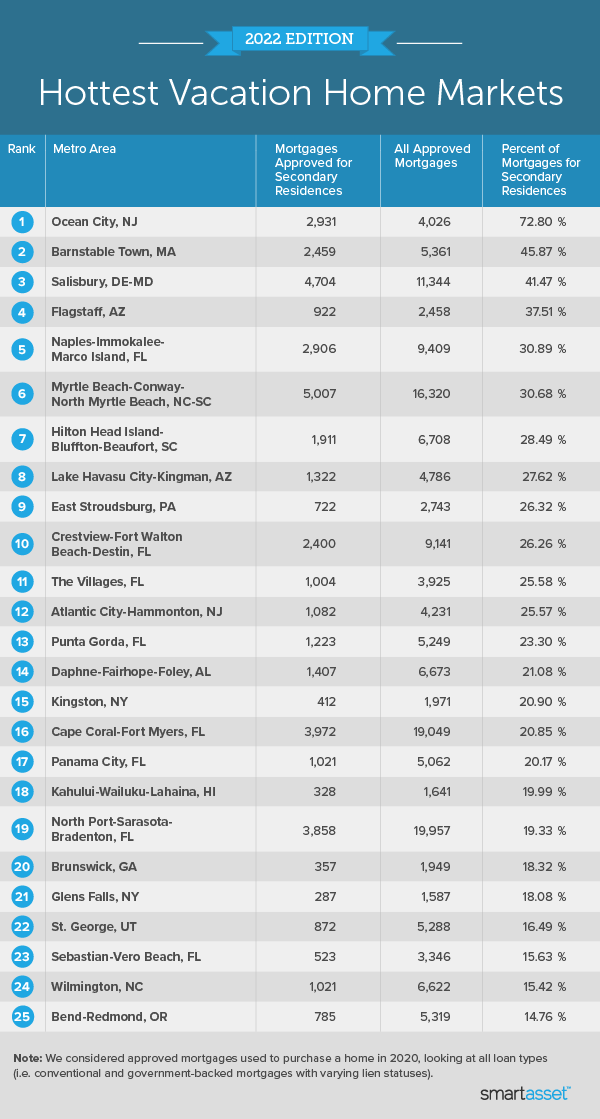

To find the hottest markets for vacation homes, we compiled the number of mortgages issued for secondary homes in 2020 in nearly 400 metro areas across the country. We then divided this by the total number of mortgages issued to calculate the percentage of the market made up of second homes. For details on our data sources and how we put all the information together to create our final rankings, read the Data and Methodology section below.

This is SmartAsset’s fifth study on the hottest vacation home markets in the country. Check out the 2021 version here.

Key Findings

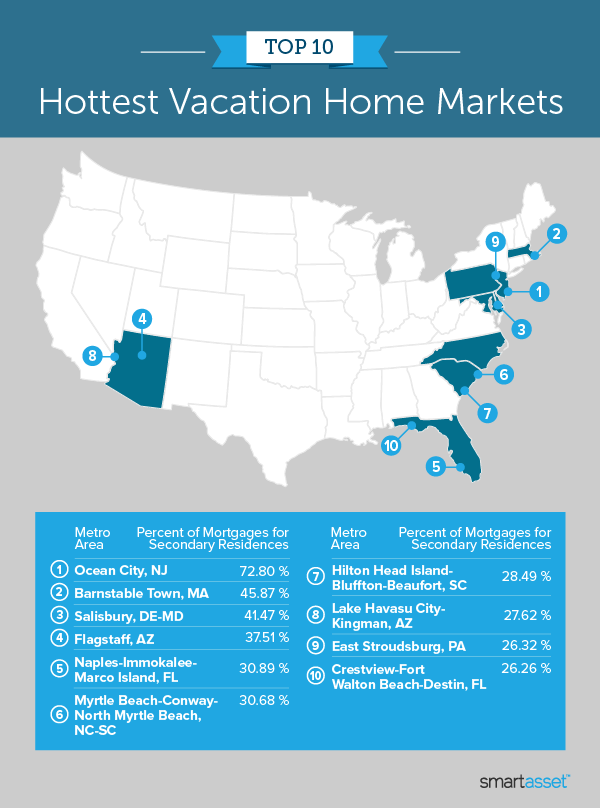

- East Coast beach destinations dominate. It’s no surprise that coastal metro areas figure prominently in our rankings, but East Coast beach locales fare especially well. Seven of the top 10 metro areas for vacation homes are beach destinations along the East Coast, including No. 1: Ocean City, New Jersey.

- Secondary homes surged in 2020. The total number of second home purchases in 2020 ticked up relative to the previous year. While just 51,708 mortgages were taken out for secondary residences in 2019, that number more than tripled in 2020, reaching 160,158. In the 395 metro areas that we considered, 4.12% of approved mortgages were for second homes in 2020 compared to 3.24% of approved mortgages in 2019.

1. Ocean City, NJ

In Ocean City, New Jersey, 72.80% of new mortgages were taken out for secondary homes, making this Jersey Shore beach town the hottest vacation home destination in the country, according to our metrics. Secondary mortgages comprised 2,931 of the 4,026 total new mortgages taken out in Ocean City.

2. Barnstable Town, MA

Barnstable Town, Massachusetts, has the second-highest percentage of mortgages for secondary homes across our study, 45.87%. Located on Cape Cod, 2,459 of the new mortgages taken out in this beach town in 2020 were for secondary homes, while 2,902 were for primary residences.

3. Salisbury, DE-MD

The Salisbury metro area of Delaware and Maryland has the third-highest percentage of mortgages for secondary homes (41.47%). More precisely, 4,704 of the 11,344 new mortgages in the Salisbury area were for secondary residences in 2020.

4. Flagstaff, AZ

Located in the mountains of northern Arizona, Flagstaff has the fourth-highest percentage of mortgages (37.51%) that are used to purchase vacation homes. One of only three non-coastal metro areas in the top 10, Flagstaff saw a total of 2,458 new mortgages taken out in 2020, 922 of which were for vacation homes.

5. Naples-Immokalee-Marco Island, FL

Mortgages for second homes accounted for 30.89% of the new mortgages that were taken out in the Naples-Immokalee-Marco Island area of Florida in 2020. Of the 9,409 new mortgages issued in the area, 2,906 were for second homes.

6. Myrtle Beach-Conway-North Myrtle Beach, NC-SC

The Myrtle Beach-Conway-North Myrtle Beach metro area, which stretches across both South Carolina and North Carolina, had 16,320 new mortgages taken out in 2020. Of those new home loans in this hub for golf and beach vacations, 5,007 or 30.68% were for second homes.

7. Hilton Head Island-Bluffton-Beaufort, SC

A total of 6,708 new mortgages were taken out in the Hilton Head Island-Bluffton-Beaufort metro area of South Carolina in 2020. Secondary home mortgages (1,911) accounted for 28.49% of the new home loans issued, the seventh-highest percentage across our study.

8. Lake Havasu City-Kingman, AZ

Located on the eastern banks of the Colorado River, the Lake Havasu-Kingman metro area of Arizona has the eighth-highest percentage of secondary home mortgages, 27.62%. Of the 4,786 new mortgages taken out in the Lake Havasu-Kingman area in 2020, 1,322 were for second homes.

9. East Stroudsburg, PA

Tucked in the Poconos region of eastern Pennsylvania, East Stroudsburg had a total of 2,743 new mortgages taken out in 2020, including 722 for second homes. That means home loans used to purchase vacation homes accounted for 26.32% of all mortgages issued in 2020.

10. Crestview-Fort Walton Beach-Destin, FL

Located on the Florida Panhandle, the Crestview-Fort Walton Beach-Destin metro area ranks as the 10th-hottest vacation housing market in the U.S., according to our metrics. That’s because 26.26% of the 9,141 new mortgages taken out in 2020 were for secondary homes (2,400).

Data and Methodology

To find the hottest vacation home markets in the U.S., we examined data for 395 metro areas across these two metrics:

- Number of mortgages approved for secondary residences in 2020.

- Total number of mortgages approved in 2020.

We divided the number of mortgages approved for secondary residences by the total number of mortgages approved for each metro area. The metro area with the highest number of non-primary residence mortgages as a percentage of all approved mortgages ranked highest. The place with the lowest percentage ranked lowest.

Data for both metrics comes from the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act Database.

Tips for Buying a Home

- Get help setting a budget. A financial advisor can help you determine how much house you can afford and stick to your budget. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Think strategically about your down payment. Making a 20% down payment isn’t always the best option. We ran the numbers and found a scenario in which putting 10% down may make more sense for your long-term financial health.

- Don’t forget closing costs. These extra fees and expenses typically run anyway from 2% to 5% of the loan amount. SmartAsset’s closing cost calculator can help you estimate how much they might be for you.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/JohnnyGreig