If you’re nearing retirement (or you’ve already retired), you might think that your credit score doesn’t matter all that much anymore. You might be surprised, however, to learn that your credit score can affect your financial life even if you’re no longer working a 9-to-5. Here are four good reasons to keep your credit score on track after deciding to leave the workforce for good.

Check out our retirement calculator.

1. You’re Considering a Reverse Mortgage

If you own a home, a reverse mortgage may allow you to generate a steady stream of income in retirement. With this kind of loan, you can ask your lender to pay you a set amount each month or give you a lump sum payout based on how much equity you’ve built in your home.

As part of the application process, reverse mortgage lenders are now required to conduct a financial assessment, which includes a credit check. Letting your credit score slide could keep you from qualifying for a reverse mortgage loan.

2. You Want to Get the Best Insurance Rates

In many cases, your credit score can affect your chances of getting the best insurance rates. If you’re trying to get a new car insured, for example, the insurance company will look at your past credit behavior as a means of assessing your risk level.

If you’ve always paid your bills on time and you’re not carrying a substantial amount of debt, that shows insurers that you’re financially responsible. On the other hand, if you’ve fallen behind on a payment or two in retirement or you’ve maxed out a credit card to cover an unexpected expense, that can leave you with higher insurance premiums.

Related Article: How Bad Credit Can Affect Life Insurance Premiums

3. You’re Planning to Start a Business

Retirement gives many seniors the chance to start their own businesses. If you’ve got a potentially lucrative idea, you’re probably going to need some cash to get it off the ground. Unless you’re comfortable tapping into your nest egg, you might need to consider taking out a small business loan or a personal loan to fund your launch.

To get the best deal on a loan, you’ll need a solid credit score. Getting approved for a personal loan when you have fair or poor credit may be easier than approaching a bank for a business loan, but it might cost you. Online lenders, for instance, feature APRs as high as 36%. Even if your business is profitable, the cost of paying back the loan can take a big chunk out of your bottom line.

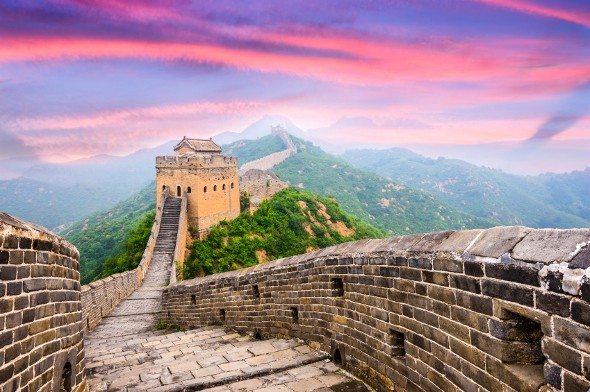

4. You Want to See the World

If starting a business isn’t your thing, you may decide that traveling is the best way to enjoy your golden years. Using a travel rewards credit card to book your trip can yield some generous savings if you’re earning miles, points or cash back on what you spend.

The only catch is that to earn premium rewards, you typically need a stellar credit score to qualify for the best cards. If a trip around the globe is on the agenda, it’s a good idea to make sure your credit is in tip-top shape before applying for a new card.

Find out now: Which rewards credit card is best for me?

Final Word

Maintaining good credit in your 60s and beyond is no different than doing it in your 20s or 30s. It’s important to always pay your bills on time, keep your credit utilization ratio low and avoid applying for multiple lines of new credit at one time. If you can do these things, your score will reap the benefits for years to come.

Photo credit: ©iStock.com/JackF, ©iStock.com/Minerva Studio, ©iStock.com/Sean Pavone